Last week featured a range of important global economic developments. The minutes from the U.S. Federal Reserve meeting revealed that the majority of members expect two additional interest rate cuts this year. Meanwhile, U.S. crude oil inventories rose more than expected, and the University of Michigan Consumer Sentiment Index showed mixed results, with a slight improvement in long-term inflation expectations. In the UK, the construction sector continued to contract despite a slight improvement in the Purchasing Managers’ Index (PMI). Canada’s data was notably strong, with employment rising, unemployment falling, and a significant improvement in the Ivey PMI. In New Zealand, the central bank surprised markets by cutting interest rates by 50 basis points instead of the expected 25, signaling a more accommodative stance. Japan saw monthly household spending grow more than expected, although it remained below the previous reading, reflecting ongoing economic fluctuations.

Market Analysis

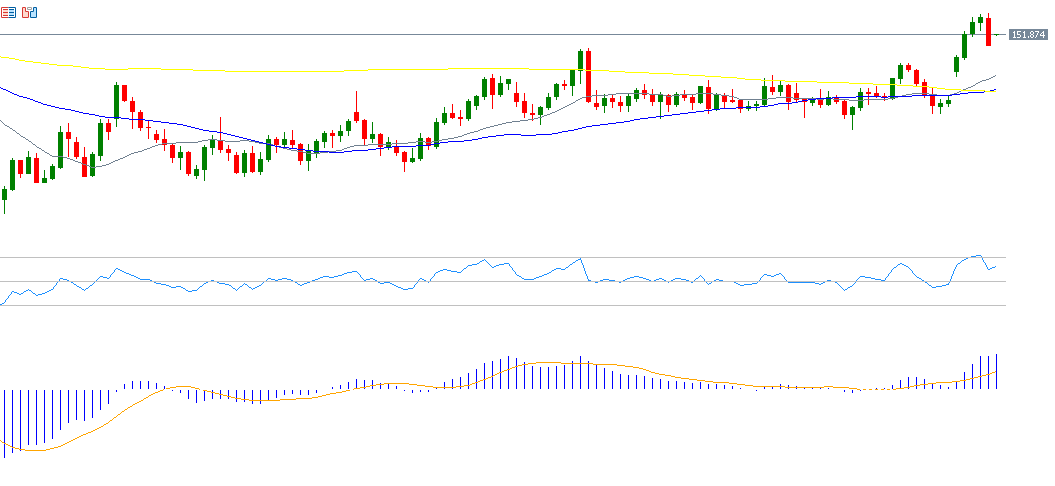

USD/JPY Currency Pair

The USD/JPY pair rose on Friday, reaching 153.27—the highest since February 13, 2025—before pulling back to close at 151.12. Despite this, the pair remains down about 4% year-to-date. The yen’s decline is largely attributed to the election of Sanae Takaichi as leader of the Liberal Democratic Party, known for supporting accommodative monetary and fiscal policies, including high government spending and easy borrowing to stimulate the sluggish economy. This complicates the Bank of Japan’s task of controlling inflation without raising interest rates. The Relative Strength Index (RSI) currently stands at 60, indicating positive momentum for the USD/JPY pair. Additionally, the MACD shows a bullish crossover between the blue line and the orange signal line, supporting the continuation of upward momentum.

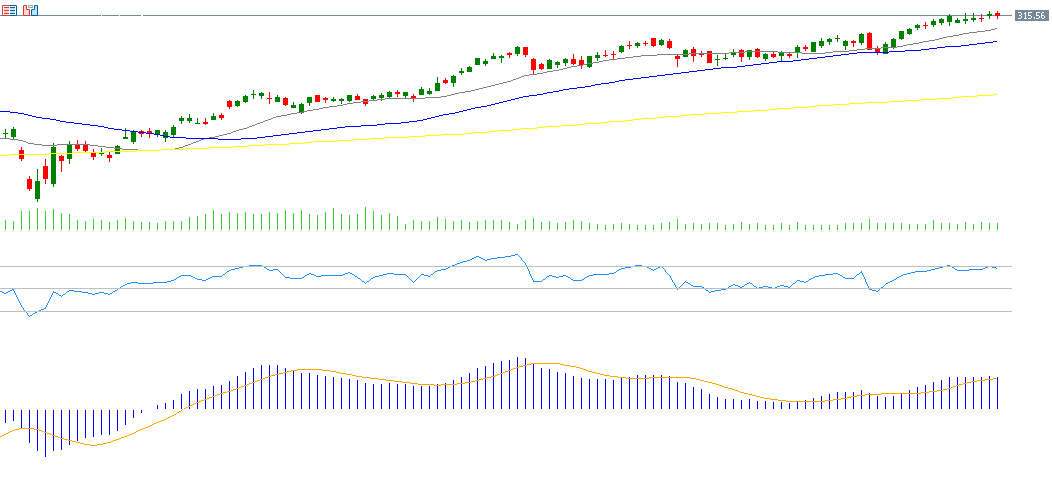

JP Morgan Chase

JP Morgan Chase’s stock has gained roughly 26% since the start of the year. Markets are awaiting the company’s earnings report on Tuesday, October 14, 2025. Analysts expect earnings of $4.66 per share, up from $4.37 in the previous quarter. Revenue is forecasted at $44.45 billion, compared to $43.32 billion previously. The RSI currently reads 40, indicating negative momentum, while the MACD shows a bearish crossover, suggesting downward pressure on the stock.

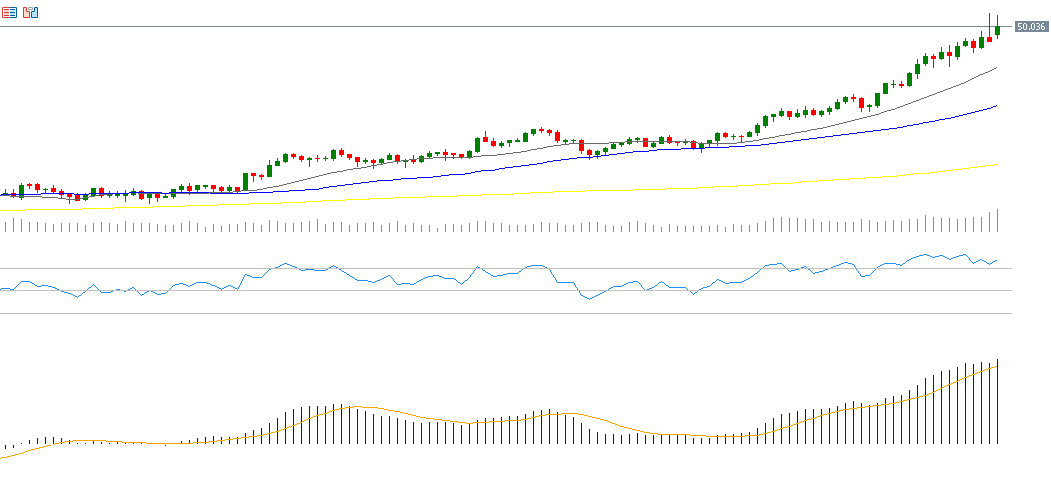

Silver

Silver continues its strong upward trend, hitting an all-time high of $51.24 on Thursday, surpassing the previous record from April 2011 at $49.76. It closed on Friday at $50. Year-to-date, silver has surged about 73%, outperforming high-risk assets like Bitcoin and major global stock indices—including those in the U.S., Europe, China, and Japan—as well as gold, which rose 53%. The bullish outlook for silver is supported by several factors:

- A generally positive correlation with gold prices, with investors who cannot afford gold turning to silver as an alternative.

- Although not traditionally a safe haven, silver is currently playing that role, driving strong buying momentum and a faster rise than gold.

- Strong industrial demand, particularly in medical supplies, electronics, and electric vehicles. The growth of artificial intelligence infrastructure, reliant on silver-based electronic components, further boosts demand.

- A persistent supply deficit, where annual demand exceeds available supply, putting upward pressure on prices.

The RSI stands at 81, indicating the market is in an overbought condition but still showing strong bullish momentum. The MACD also exhibits a bullish crossover, reinforcing silver’s positive momentum.

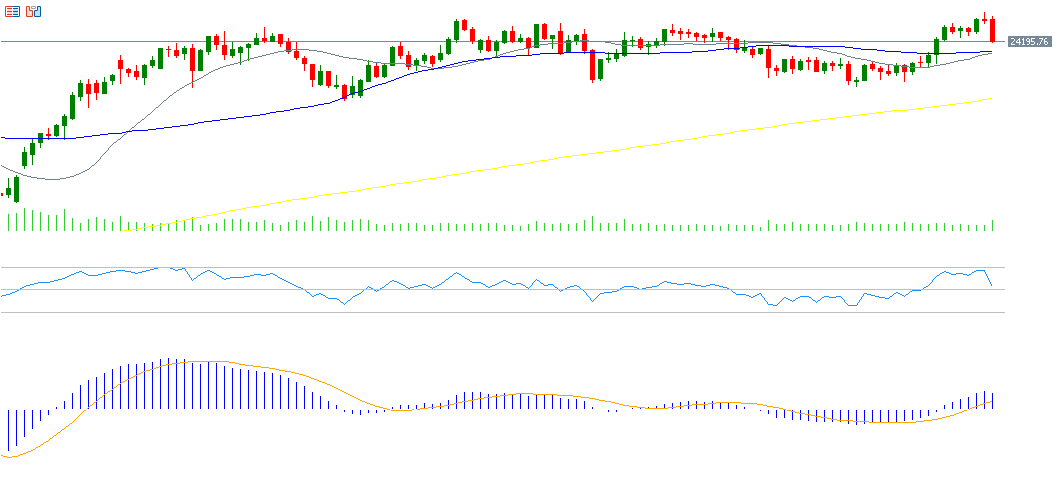

German DAX Index

The DAX index continues its upward trajectory, reaching a record high of 20,771 points on Thursday, October 9, and closing at 24,242 points. It has gained approximately 22% year-to-date, outperforming other European and U.S. stock indices. The RSI is around 73, placing the index in the overbought territory and signaling positive momentum.

Key Events to Watch This Week

Markets will focus on several important economic indicators and events this week:

- Monday: China’s export and import data, and U.S. construction spending.

- Tuesday: UK unemployment and income data including bonuses, plus a speech by Federal Reserve Chair Jerome Powell.

- Wednesday: China’s consumer and producer price indices, industrial production in Japan and the Eurozone, New York Empire State Manufacturing Index, and U.S. crude oil inventories.

- Thursday: Australia’s employment change and unemployment rate, UK GDP and industrial production, U.S. producer price index, initial jobless claims, and Philadelphia Fed manufacturing index.

- Friday: Eurozone consumer price index, U.S. non-farm payrolls, unemployment rate, average hourly earnings, and U.S. industrial production.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.