Last week saw the release of several significant global economic data points. In the United States, inflation showed a slight slowdown, while both manufacturing and services activity improved. However, consumer confidence declined, and long-term inflation expectations rose. In contrast, the Eurozone and the United Kingdom recorded improvements in Purchasing Managers’ Index (PMI) readings, with UK inflation continuing to ease, reinforcing expectations of potential monetary easing. In Canada, inflation rose above expectations, while Australia showed a slowdown in manufacturing and recovery in services. In Japan, prices continued to rise above forecasts despite weaker manufacturing and services activity. Meanwhile, China reported steady economic growth despite slower consumption and investment, along with a continued decline in the real estate market—indicating ongoing challenges to a full economic recovery.

Market Analysis

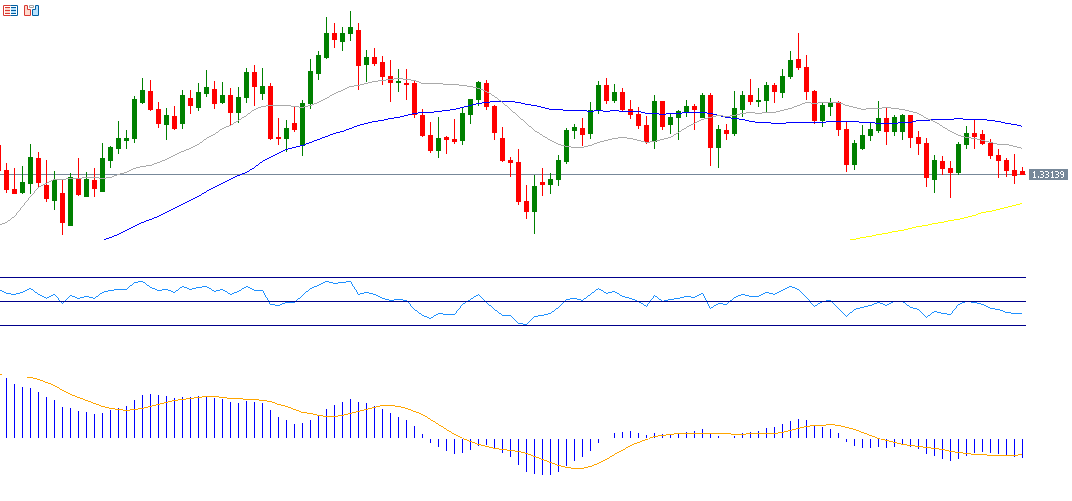

GBP/USD

The GBP/USD pair recorded a level of 1.3287 on Friday, October 24, its lowest since October 14, 2025. Despite this, the pair remains up about 6% year-to-date. The UK’s annual Consumer Price Index (CPI) for September showed growth of 3.8%, below expectations of 4.0%. The core CPI, which excludes food and energy, rose by 3.5%, also below forecasts (3.7%) and the previous reading (3.6%). This decline in inflation supports expectations that the Bank of England may move toward cutting interest rates, which weighed on the British pound. The Relative Strength Index (RSI) currently stands around 40, indicating bearish momentum for the GBP/USD pair. Additionally, a bearish crossover between the MACD line and the signal line further reinforces the likelihood of continued downward momentum.

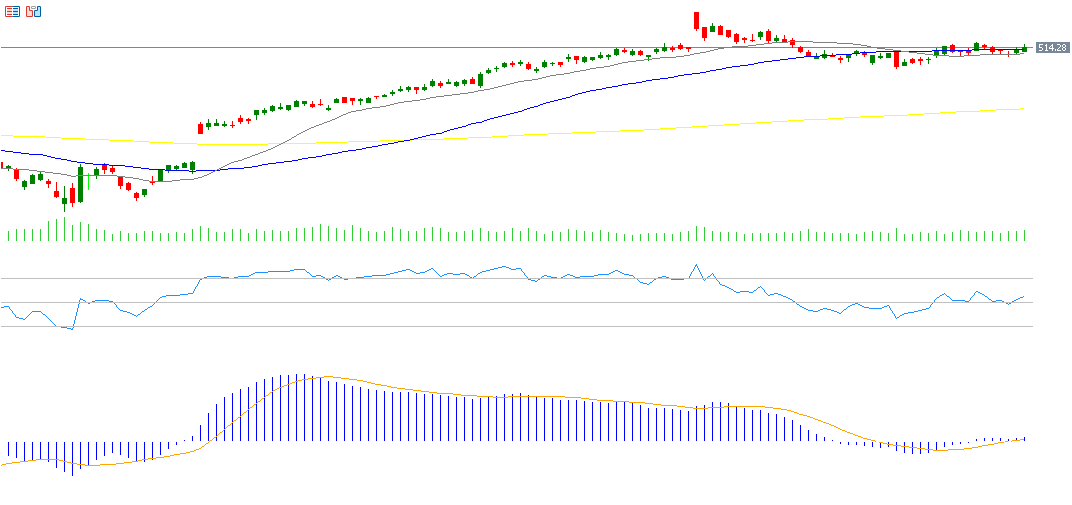

Microsoft

Microsoft’s stock has risen about 24% since the start of the year. Markets are awaiting the company’s financial results, scheduled for Wednesday, October 29, 2025. Analysts expect earnings of $3.65 per share, up from the previous $3.30, while revenue is projected at $75.35 billion compared to $65.59 billion previously. The RSI currently reads 60, placing it in the overbought zone, which reflects positive momentum for the stock. The MACD indicator shows a bullish crossover between the MACD line (blue) and the signal line (orange), further supporting upward momentum.

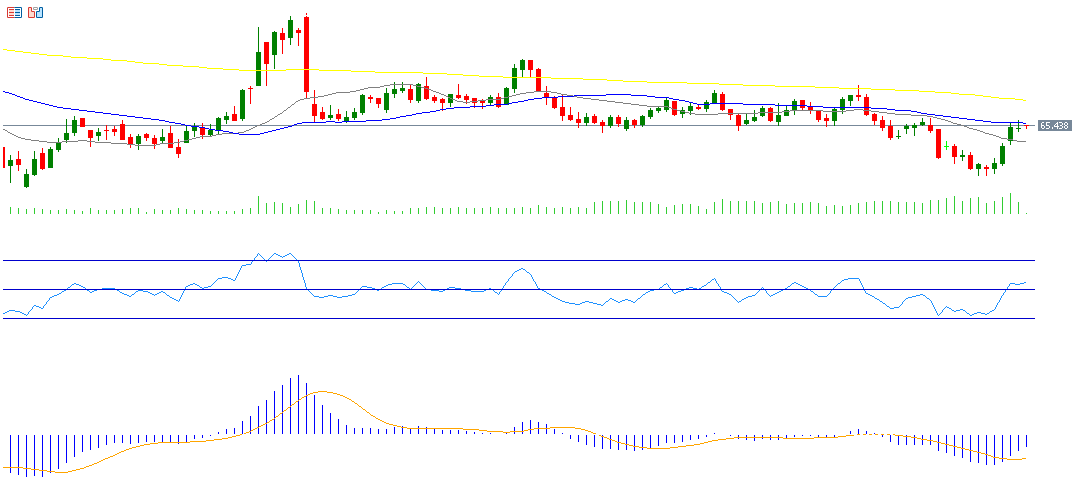

Crude Oil

Oil prices rose about 7% over the past week and are up roughly 11% from the October 20 low of $60.07 to the recent peak of $66.78. However, prices remain at about 12% year-to-date. Positive drivers for oil at this stage include new U.S. sanctions on Russian oil giants Rosneft and Lukoil—Russia’s two largest producers, accounting for half its crude exports—in an effort to pressure Moscow toward peace negotiations with Ukraine. Additionally, markets anticipate two more Federal Reserve rate cuts this year, which could boost oil demand. Hopes of a U.S.-India trade deal, potentially including India’s gradual reduction of Russian oil imports (currently about one-third of its total), also support prices. The U.S. Department of Energy’s announcement to purchase one million barrels to refill the Strategic Petroleum Reserve, ongoing geopolitical tensions between Russia and Ukraine, and a smaller-than-expected U.S. crude inventory drawdown of 0.961 million barrels (versus expectations of 2.2 million) all contributed to bullish sentiment. The RSI currently reads 55, indicating positive momentum, and the MACD shows a bullish crossover, signaling further upside potential for crude oil prices.

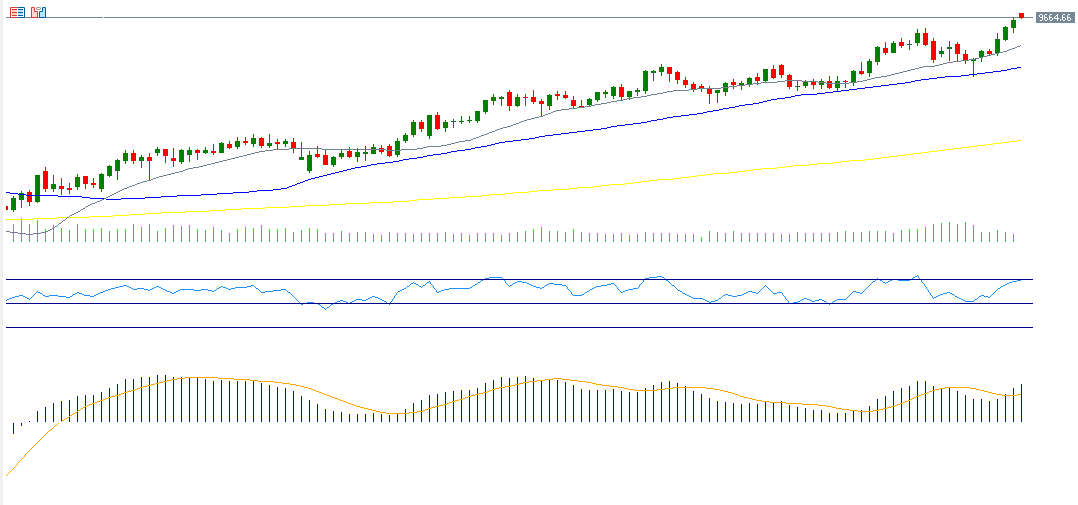

FTSE 100

The UK’s FTSE 100 index continues to climb, reaching 9,657 points on Friday, October 24, 2025—its highest level on record. The index has risen roughly 28% from its April 7, 2025, low of 7,533 points to the current peak, and about 18% year-to-date. The RSI currently stands at 68, suggesting the index is in overbought territory but maintaining strong bullish momentum. The MACD also shows a bullish crossover, reinforcing the positive trend.

Key Events This Week

Markets are awaiting several important economic indicators and central bank decisions this week.

Monday: Release of China’s year-to-date industrial profit data and U.S. durable goods orders.

Tuesday: The British Retail Consortium (BRC) shop price index and U.S. consumer confidence figures.

Wednesday: The Bank of Canada’s interest rate decision, with expectations for a 25-basis-point cut to 2.75%, and the Federal Reserve’s rate decision, with markets anticipating a 25-basis-point cut to a range of 3.75%–4.00%. Investors will closely monitor Chair Jerome Powell’s remarks for clues about the Fed’s future policy path. Other releases include Australia’s CPI, U.S. existing home sales, goods trade balance, and crude oil inventories.

Thursday: Interest rate decisions from the Bank of Japan (expected to hold at 0.50%) and the European Central Bank (expected to hold at 2.00%), along with GDP and unemployment data from the Eurozone and GDP figures from the U.S.

Friday: Releases include Tokyo CPI, China’s manufacturing and non-manufacturing PMIs, Eurozone CPI, the U.S. Core PCE Price Index (the Fed’s preferred inflation gauge), the University of Michigan consumer sentiment index, and Canada’s GDP data.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.