The price of the dollar against the Turkish lira recorded 34.3559 yesterday, the highest level since August 28, 2024. The next challenge lies in reaching the record level set on August 28, which was 34.3827. The price is currently hovering around 34.3400 lira per dollar. The dollar has risen against the Turkish lira by about 17% since the beginning of the year to date.

Recent Turkish economic data show that the Turkish economy has started to improve somewhat, as:

- The Purchasing Managers’ Index (PMI) for the manufacturing sector in October recorded a contraction of 45.80 points, which is higher than the previous reading (44.30).

- Retail sales increased on a monthly basis, recording a growth of 2.2%, which is higher than the previous reading (0.9%).

- The consumer confidence index in October rose to 80.6 points, which is higher than the previous reading (78.2) and the highest level since June 2023.

- Exports increased to record 23.60 billion Turkish lira in October, which is higher than expectations and the previous reading (22.00 billion Turkish lira).

- The year-on-year Consumer Price Index (CPI) in Turkey slowed to 48.58% in October, a rate that exceeded expectations (48.30%) but was lower than the previous reading (49.38%).

Interest rates remain unchanged at 50% from the Central Bank of Turkey for seven consecutive months. Markets are awaiting the interest rate decision from the Central Bank of Turkey on Thursday, November 21, 2024.

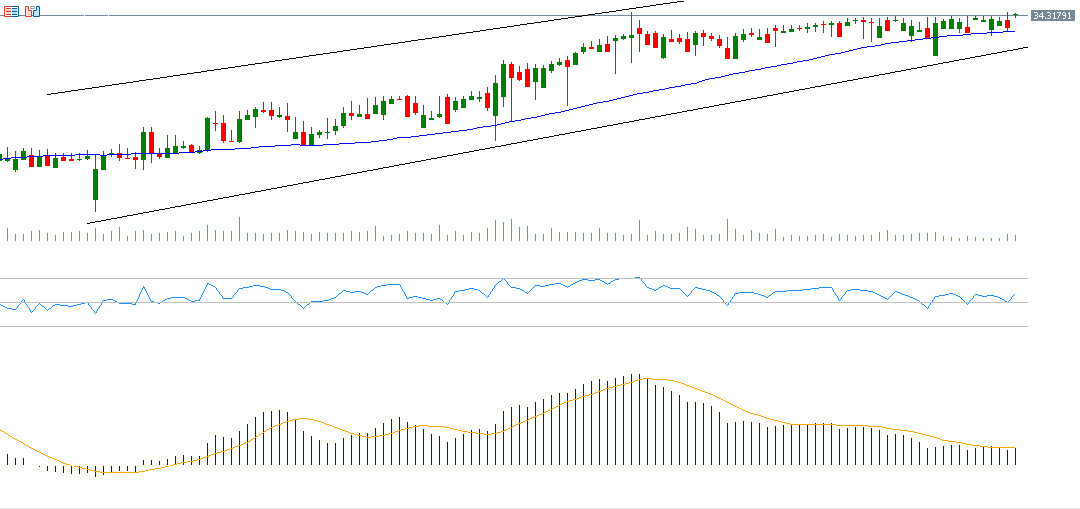

From a technical perspective, the upward trend for the dollar against the Turkish lira seems to prevail in the coming phase, especially with the continued positive momentum for this pair, as the Relative Strength Index (RSI) records 60 points.

Additionally, there is a regularity in the 20-day, 50-day, and 200-day moving averages, all trending upwards, as the 20-day average surpasses the 50-day average, and the 50-day average exceeds the 200-day average. A bullish crossover also occurred yesterday between the MACD indicator (in blue) and the Signal Line (in orange), indicating the upward momentum for the dollar against the Turkish lira.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.