Recent economic data from Germany continues to show that the German economy is struggling. Specifically:

- The German Consumer Price Index (CPI) recorded an annual growth of 1.9% in August, which met expectations but was lower than the previous reading of 2.3%. It is also below the European Central Bank’s target rate of 2%, indicating weak consumption within the German economy. The Industrial Production Index declined month-on-month, recording a contraction of 2.4%, which is below expectations (-0.4%) and the previous reading (1.7%).

- The German ZEW Index for current economic expectations in September registered a contraction of 84.5, which is below expectations (-80.0) and the previous reading (-77.3), marking the lowest level since May 2020.

- The German ZEW Index for economic sentiment in September recorded a growth of 3.6, which is below expectations (17.1) and the previous reading (19.2), representing the lowest level since November 2023.

- The Purchasing Managers’ Index (PMI) for manufacturing declined to 40.3 points, which is lower than both expectations and the previous reading (42.4), marking the lowest level since September 2023.

- The Purchasing Managers’ Index for services registered a growth of 50.6 points, which is lower than expectations (51.1) and the previous reading (51.2).

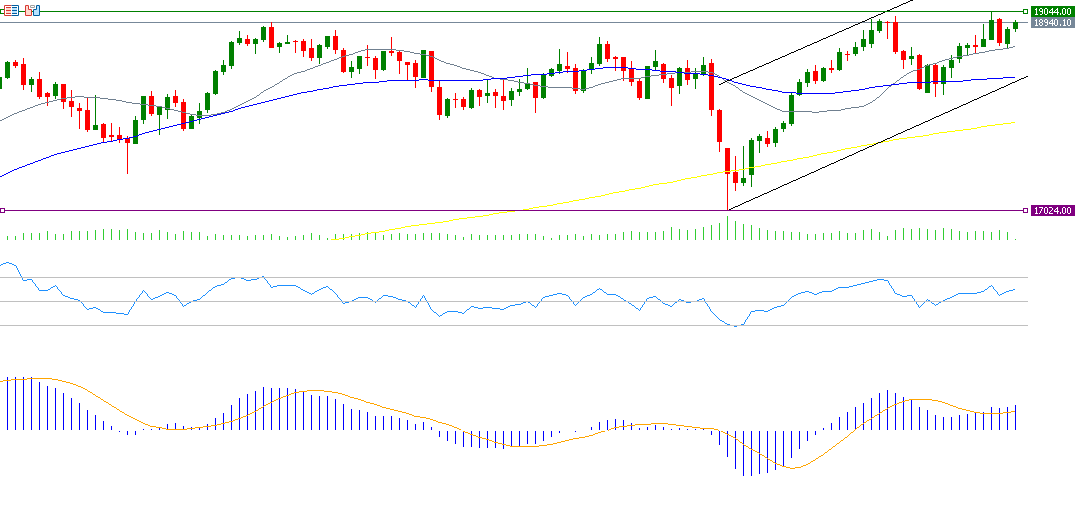

However, it is noteworthy that despite this economic contraction in Germany and the negative factors surrounding the internal situation, the picture is completely contrary for German stocks. The DAX index continues its upward trend, reaching 19,044 points on Thursday, September 19, 2024, the highest level ever recorded. It has risen by approximately 12% since the low of August 5, 2024, when it was at 17,024 points, reaching the peak recorded on Thursday at 19,044 points. It has also increased by about 12% since the beginning of the year, which is surprising and completely contrary to the direction of the economy. It closed yesterday at 18,846 points.

From a technical perspective, the upward trend appears to dominate the DAX index, as a golden cross occurred between the 20-day moving average (in gray) at 18,666 points and the 50-day moving average (in blue) at 18,369 points on September 3, 2024. The Relative Strength Index (RSI) recorded about 58 points, indicating positive momentum for the DAX.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.