Platinum prices continue their upward trend, reaching $1,548 today—the highest level since 2008—and currently trading above $1,500. Platinum has increased by approximately 70% since the beginning of the year until today, outperforming most other assets such as Bitcoin, global stock indices, gold (which rose by 43%), and silver (which increased by about 55%). Forecasts indicate the continuation of platinum’s bullish trend in the near future.

Factors Supporting the Rise in Platinum Prices:

Platinum currently benefits from several key factors, including:

- Ongoing Supply Deficit: Demand for platinum exceeds the available supply, exerting upward pressure on prices.

- Strong Industrial and Investment Demand: Especially from the automotive sector, notably increased demand for catalytic converters which primarily use platinum.

- Accommodative Monetary Policy Environment: Represented by the Federal Reserve’s interest rate cuts, enhancing the appeal of non-yielding assets like precious metals.

- Investor Inflows into Platinum ETFs: Increasing interest and liquidity in the metal.

Technical Analysis of Platinum Prices:

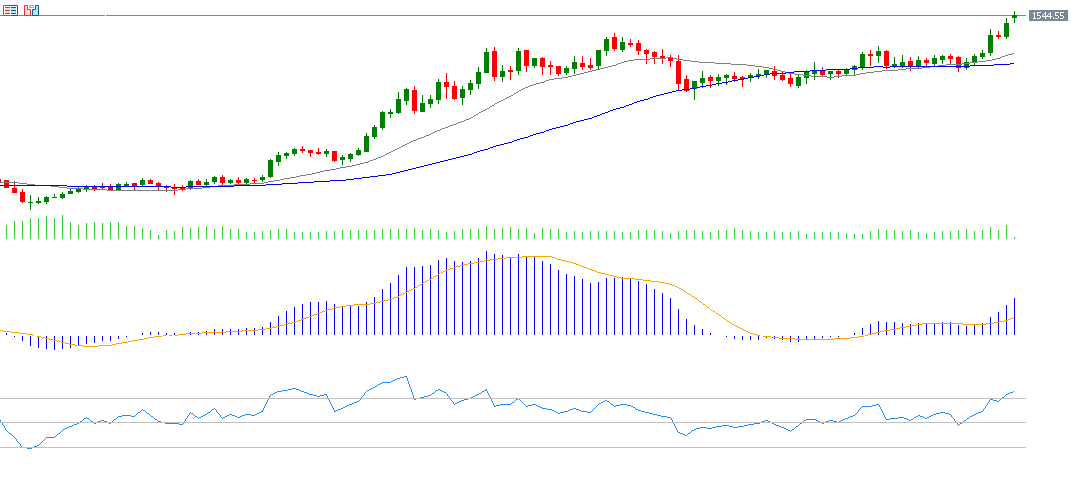

Technical indicators suggest that the bullish trend remains dominant for platinum prices in the upcoming period, based on the following observations:

- The 20-, 50-, and 200-day moving averages are aligned in a bullish formation, with the 20-day moving average above the 50-day, which in turn is above the 200-day moving average, indicating a strong upward technical structure.

- The Relative Strength Index (RSI) currently stands at 75 points, indicating that the market has entered an overbought zone, reflecting strong momentum.

- A bullish crossover has occurred in the MACD indicator, with the blue MACD line crossing above the orange Signal line, reinforcing expectations of continued positive momentum for platinum.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.