The French CAC40 index declined, despite its strong performance since the beginning of the year. This drop is attributed to the political crisis in France, following the resignation of the French Prime Minister just hours after a new government was announced. This has plunged France into a dark tunnel amid a deep rift between French political parties, further complicating the mission of President Emmanuel Macron — especially as more voices are now calling for his resignation.

In contrast, we witnessed a surge in French government bond yields. The 10-year yield rose to 3.60% yesterday, and the spread with German government bonds widened, with the German 10-year yield currently at 2.71%. Markets view the growing political risks in France as weighing heavily on French assets, particularly given the already weak economic conditions.

After reaching a level of 8,097 points — its highest since March 26, 2025 — the CAC40 index fell back below 8,000 marks, recording 7,975 points yesterday. The index is still up about 8% year-to-date as of yesterday’s close, but it lags the German DAX (up around 22%), the UK’s FTSE 100 (up around 16%), and the European STOXX 600 (up around 12%).

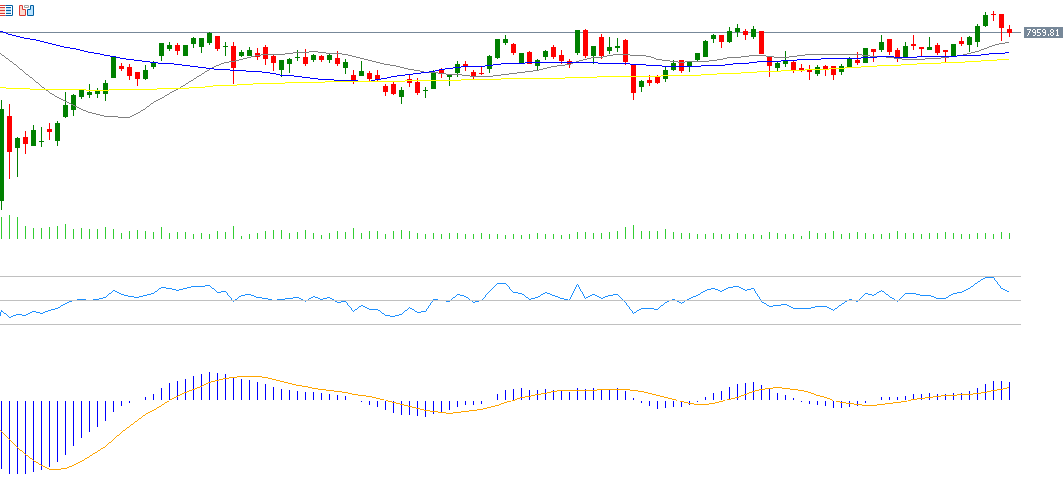

From a technical perspective, the 20-day, 50-day, and 200-day moving averages remain in a bullish alignment. The 20-day moving average is above 50-day, and the 50-day is above 200-day.

There appears to be a strategic support level at the 20-day moving average (in grey) around 7,882 points, followed by a second support level at the 50-day moving average (in blue) at 7,813 points. Any bearish crossover between them could signal the beginning of a downward trend in the CAC40 index.

As for the Relative Strength Index (RSI), it stands at 58 points, indicating continued positive momentum for the CAC40 index

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.