By Samir Al Khoury,

The USD/CAD price continues its downward trend for the fifth consecutive day, reaching 1.3635 today, but it is still up approximately 3% year-to-date.

Recent Canadian economic data indicate that the Canadian economy is resilient:

• The Ivey Purchasing Managers’ Index (PMI) rose to 63.0 points, surpassing expectations (58.1) and the previous reading (57.5). This marks its highest level since June 2022.

• The rate of change in employment increased, with 90.4K new jobs added, exceeding expectations (20.9K) and the previous reading (-2.2K).

• The unemployment rate stood at 6.1%, lower than expectations (6.2%) but consistent with the previous reading.

The consumer price index in Canada rose by 2.9% annually in March, suggesting the possibility of the Bank of Canada maintaining interest rates at their current level of 5.00% to control inflation, which remains above the target rate of 2%.

It’s worth noting that an important factor that could boost the US dollar against the Canadian dollar is the strength and flexibility of the US economy, along with the decrease in market expectations regarding the timing of a US interest rate cut, which supports the US dollar against major currencies.

Analysts are closely watching today’s release of the headline and core consumer price indices, as well as retail sales data in the United States. Caution is advised, as any readings higher than expectations for the consumer price indices and retail sales could have a positive impact on the US dollar and a negative impact on foreign currencies and other financial instruments.

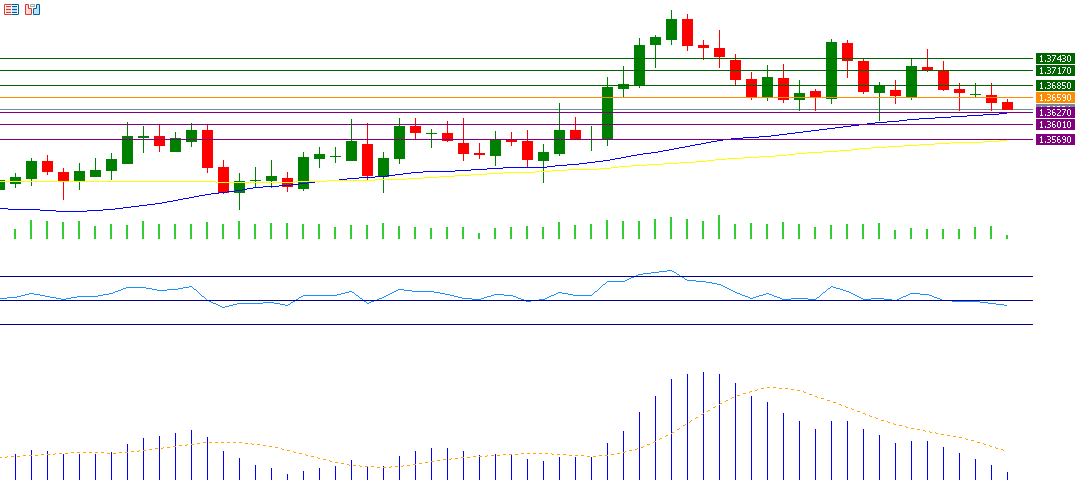

Regarding technical analysis, if the USD/CAD breaks below the pivot point of 1.3659, it may target support levels at 1.3627, 1.3601, and 1.3569. Conversely, if it surpasses the pivot point, it is likely to target resistance levels at 1.3685, 1.3717, and 1.3743. The Relative Strength Index (RSI), currently at 45 points, suggests negative momentum for the USD/CAD pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.