Gold prices continue their upward trajectory, recording a new all-time high of $4,640 today, up by around 7% since the beginning of the year to date.

Both fundamental and technical indicators continue to support gold prices in the period ahead, as the factors that previously underpinned gold remain in place, alongside additional emerging drivers strengthening this trend. The most notable factors include:

- Ongoing political pressure from the Trump administration on the US Federal Reserve and its Chair, Jerome Powell, particularly following a memorandum sent by the US Department of Justice to Powell regarding the cost of repairing or rehabilitating the Federal Reserve building last year. Powell responded by stating that these were merely pretexts, and that the real motive lies in the administration’s desire for a more accommodative monetary policy and faster interest rate cuts. Furthermore, following the release of inflation data yesterday, which came in line with the previous reading, Trump stated that Powell is “far too late” in cutting interest rates and should reduce them aggressively, claiming that the strong inflation and growth data are the result of tariffs.

- Escalating geopolitical tensions between the United States and Iran, with cautious anticipation of a potential US strike inside Iran amid continued widespread domestic protests. The US administration has warned that it would intervene to protect Iranian citizens if the regime continues to suppress and kill its people.

- Ongoing geopolitical tensions between Russia and Ukraine despite negotiations aimed at ending the war, in addition to rising tensions between China and Taiwan. China has been conducting military drills at sea, while markets closely monitor the risk of any potential Chinese strike against Taiwan.

- An accommodative monetary policy environment, as markets expect at least two US interest rate cuts or more. It is also worth noting that Jerome Powell’s term ends in May next year, increasing the likelihood of appointing a Trump-aligned Fed Chair. This could lead to substantial rate cuts, potentially bringing interest rates down to levels between 1% and 2%. Such a scenario would naturally boost demand for gold, as it is a non-yielding asset.

- Continued gold purchases by global central banks, led by the People’s Bank of China, as they increase their gold reserves, thereby strengthening demand and supporting prices.

- Investors’ exit from long-term government bonds, including US, UK, French, German, and Japanese bonds, which are experiencing selling pressure and a notable rise in yields. This reflects declining investor confidence in public finances and widening fiscal deficits, pushing investors toward gold as a traditional safe haven.

- Inflation risks remain elevated, as US inflation is still above the 2% target level, with expectations of renewed upward pressures, reinforcing gold’s role as an inflation hedge.

From a technical perspective:

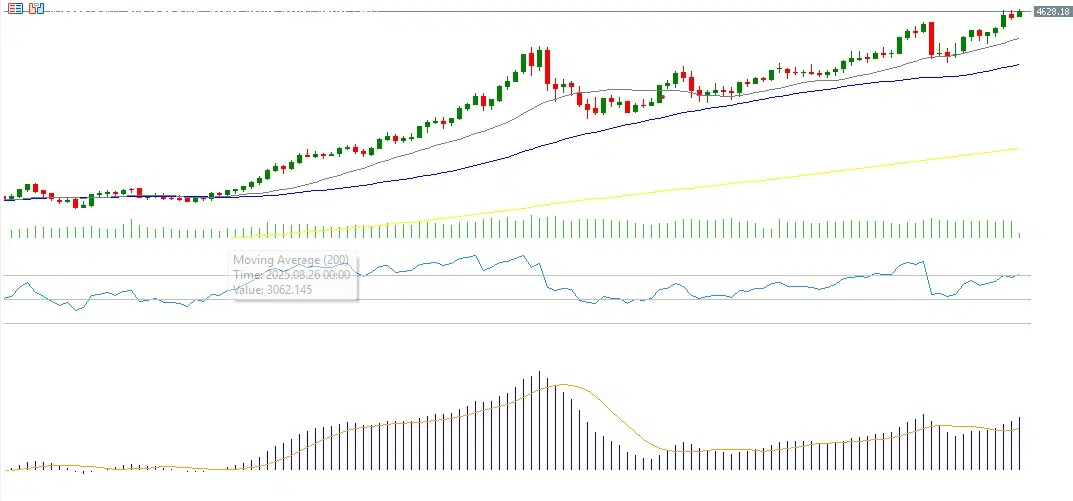

- There is a clear bullish alignment of the 20-day, 50-day, and 200-day moving averages, with the 20-day average above the 50-day, and the 50-day above the 200-day.

- The Relative Strength Index (RSI) currently stands at around 71, placing it in overbought territory and reflecting strong upward momentum in gold prices.

Outlook suggests that gold prices could reach the $5,000 level, or potentially even higher, given the multitude of supportive factors outlined above.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.