The euro against the pound is facing selling pressure, having recorded 0.8317 yesterday, the lowest level since April 22, 2022, indicating a decline of about 4% since the beginning of the year. It is currently trading near the 0.8340 level.

It seems that the negative momentum for this pair will dominate in the upcoming period. Regarding the fundamental and technical factors that may exert pressure on this pair, we note the following:

- Continued weakness in economic data within the Eurozone, especially in Germany and France, the two largest economies in the region. The manufacturing and services Purchasing Managers’ Indexes (PMIs) have notably declined in the Eurozone, Germany, and France in September, especially since the manufacturing PMI remains in contraction territory.

- The Consumer Price Index (CPI) recorded an annual growth of 2.2% in the Eurozone, which is in line with expectations but lower than the previous reading of 2.6%. Additionally, the core Consumer Price Index (excluding food and energy) recorded an annual growth of 2.8%, also meeting expectations but lower than the previous reading of 2.9%, indicating a slowdown in consumption within Europe and coming closer to the European Central Bank’s target rate of 2%, which encourages the central bank to continue lowering interest rates in the near future.

- Despite the decline in the manufacturing and services PMIs in Britain, these indexes remain in the growth territory, unlike the situation in the Eurozone. Furthermore, retail sales in Britain rose in August, indicating strong consumer spending in the UK.

- The Bank of England decided to keep interest rates at 5.00% last week, in line with expectations, unlike the European Central Bank, which lowered rates by 25 basis points to 3.50%.

- The Consumer Price Index (CPI) recorded an annual growth of 2.2% in Britain, matching both expectations and the previous reading. The core Consumer Price Index (excluding food and energy) recorded an annual growth of 3.6%, in line with expectations but higher than the previous reading of 3.3%. This recent reading indicates that the core CPI is still far from the Bank of England’s target rate of 2%, suggesting that the central bank is not in a hurry to cut interest rates.

- The ongoing gap between British and German government bond yields continues to exert pressure on the euro against the pound. For example, the yield on British 10-year government bonds is around 3.95%, while the yield on German 10-year bonds is approximately 2.14%. This means the gap between them is about 1.81%, which encourages carry trade.

- Additionally, technical indicators seem poised to exert pressure on the euro against the pound in the upcoming period for several reasons:

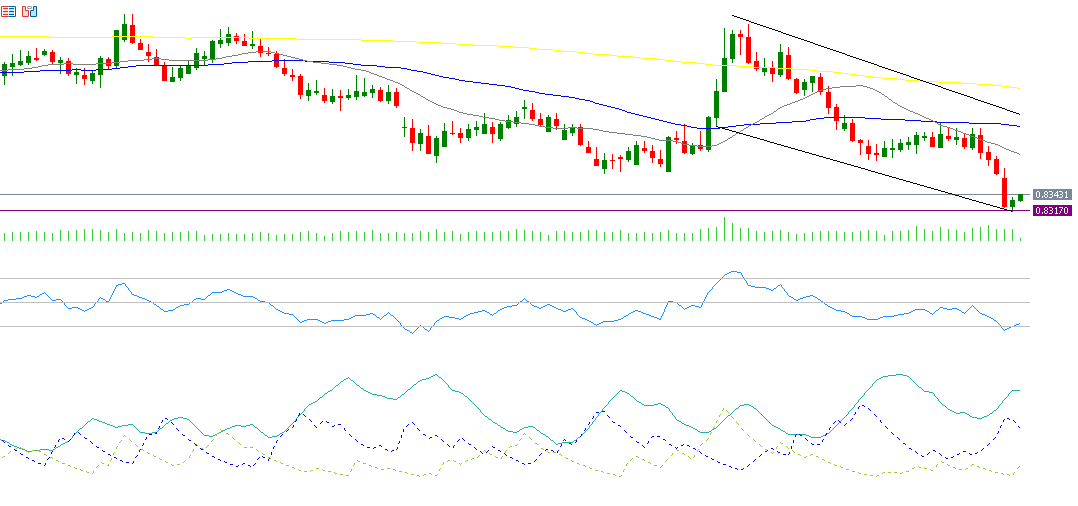

First: a downward crossover or “death cross” has occurred between the 20-day moving average (in gray) at 0.8411 and the 50-day moving average (in blue) at 0.8459 on September 10, 2024.

Second: the Relative Strength Index (RSI) currently registers at 32 points, which suggests bearish momentum for the pair.

Third: the positive Directional Movement Index (DMI+) records about 10 points compared to the negative Directional Movement Index (DMI-) at around 30 points. The significant gap between these two indicators indicates that selling pressures on the euro-pound pair are ongoing. Importantly, the Average Directional Index (ADX) registers around 29 points, exceeding 25 points, indicating that the momentum of this downward trend is strong.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.