After silver prices hit a record high of $54.50 per ounce on Friday, October 17, they fell significantly to $45.56 yesterday — a drop of about 16% from peak to trough. This sharp decline is mainly attributed to profit-taking by investors, which is quite natural after such strong gains, as silver has risen more than 85% since the start of the year. Silver prices are currently trading at nearly $48 per ounce. The decline in gold prices has also contributed to silver’s drop, given the positive correlation between the two metals.

Despite the pullback, forecasts suggest that silver will likely resume its upward trend in the coming period, especially given its broad industrial applications. For instance, the manufacturing PMI in the United States, the Eurozone, and the United Kingdom all exceeded expectations last week. Additionally, industrial company profits in China grew at the fastest pace since 2023, indicating a recovery in global industrial activity that could boost silver demand going forward.

Market expectations also point to an interest rate cut of 25 basis points, which is almost certain to be announced at today’s Federal Reserve meeting, with another 25-basis point cut anticipated in December. This would support silver as a non-yielding asset.

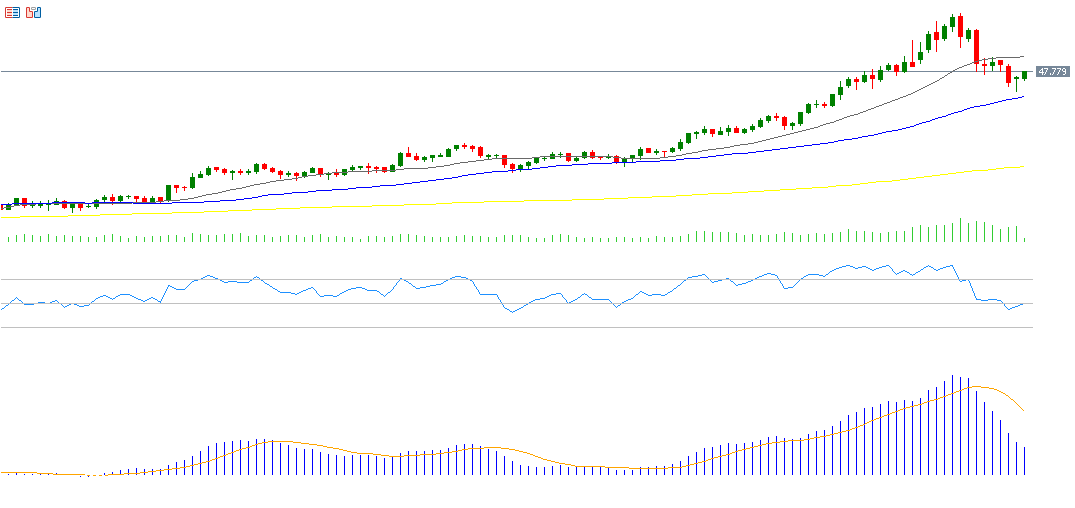

From a technical standpoint, silver prices have broken below the first key support level at $49.57, representing the 20-day moving average, but have not yet reached the second support at $45.01, corresponding to the 50-day moving average.

The MACD (blue line) is below the signal line (orange line), indicating negative momentum for silver. Meanwhile, the RSI is currently at 49, reflecting continued bearish momentum for the metal.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.