By Camilo Botia

On Thursday, the S&P 500 index reached the 5,000 level for the first time in history but failed to close above it as investors weighed earnings results and the outlook for interest rates. The benchmark index closed the day at 4,995.42 after hitting an intraday record of 5,001.19 in the final minutes of trading.

The S&P 500 has risen more than 7% this year from January lows, driven by strong corporate earnings. Among the notable earnings reports on Thursday, Disney surged 11.5% after beating analysts’ expectations and raising its guidance for its streaming service. Chipmaker and designer Arm soared 47.9% after posting solid results and a bullish outlook. However, some analysts have warned that the rally may be losing steam as it might not be sustainable in the long term.

One of the main factors that could derail the market’s momentum is the timing and pace of interest rate hikes by the Federal Reserve. The head of the Richmond Fed, Thomas Barkin, said the decision-makers could wait and see how things unfold before lowering interest rates. Additionally, a report on unemployment benefits showed that the economy was still creating jobs and supported the careful tone of monetary authorities. Next week’s CPI numbers are the next crucial economic event on the economic calendar.

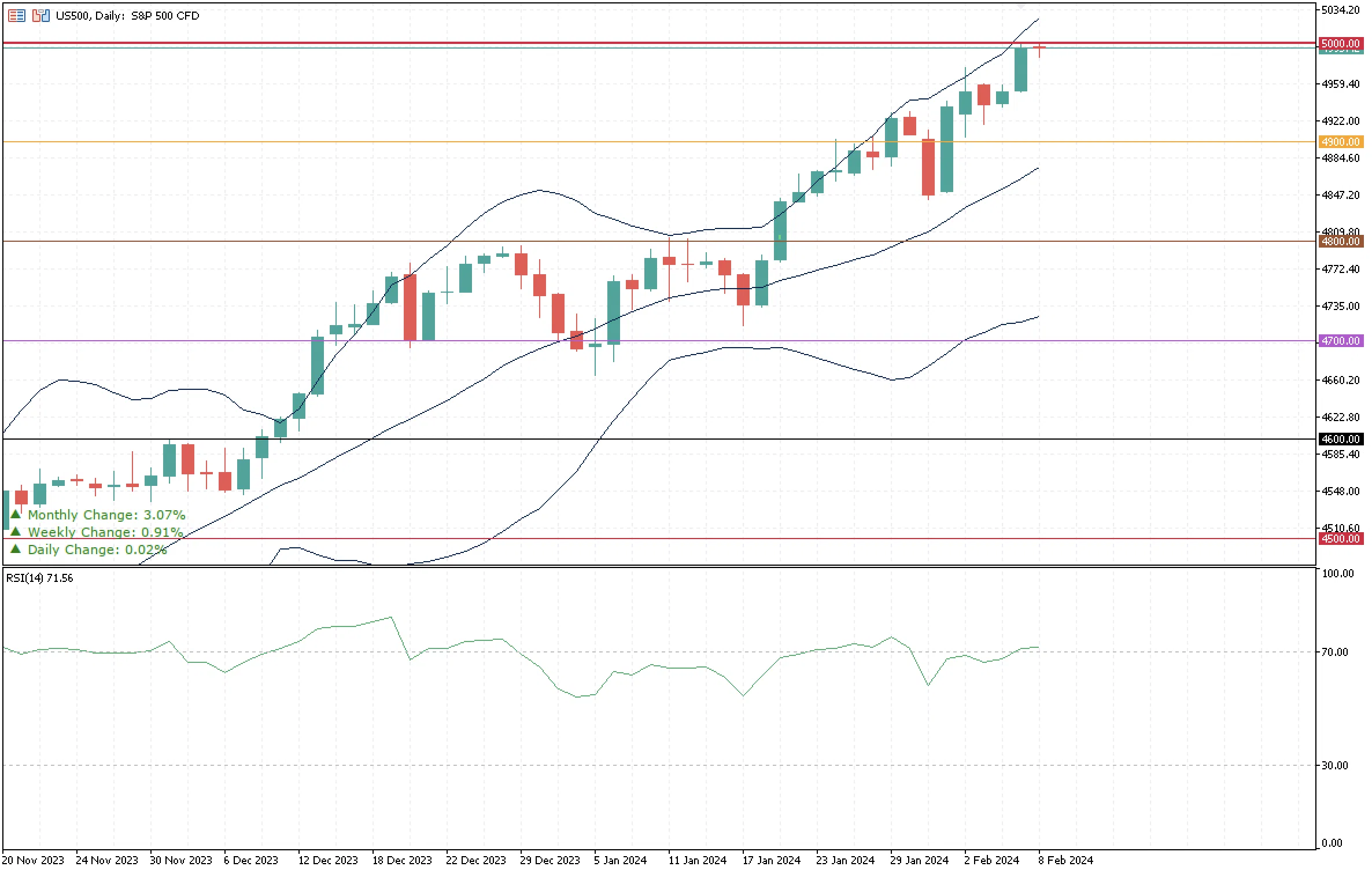

The S&P500 is now trading at around the 5,000 psychological barrier, with increasing volatility, as shown in the Bollinger Bands. As mentioned in this newsletter before, the S&P500 has been moving in waves around every 100 points. With the recent corporate results and some companies’ positive outlook on their current quarter, the S&P could reach new record highs and eventually get 5,100. However, the market is an overbought condition, as shown by the RSi indicator. With this signal coinciding with the 5,000 level, the S&P could trade along this resistance in the upcoming days, with its next support at 4,957.02.