By Camilo Botia.

Wall Street kicked off a shortened trading week on a slightly downbeat note. Investors took a pause after a strong rally that pushed major indexes to all-time highs.

The Dow Jones Industrial Average dipped 0.41%, closing at 39,320.92. The S&P 500 and Nasdaq Composite also saw modest declines, finishing at 5,218.19 and 16,384.47, respectively. The market’s pullback comes despite being on track for its fifth consecutive month of gains. Last week, all three major indexes reached new closing highs, fueled by the Federal Reserve’s dovish stance on interest rates and continued investor enthusiasm for technology stocks.

However, some experts warn that the market might be due for a correction. The S&P 500 is trading at a premium compared to its historical average, suggesting potential overvaluation. Additionally, concerns linger about the long-term impact of inflation and rising interest rates. This week, investors will be looking toward the release of the February Personal Consumption Expenditures (PCE) price index, a key inflation measure for the Fed. However, some analysts predict a muted response from the market, given that recent CPI and PPI readings have already been factored in.

Overall, while the short-term outlook remains optimistic, investors should be aware of potential risks that could lead to a market pullback.

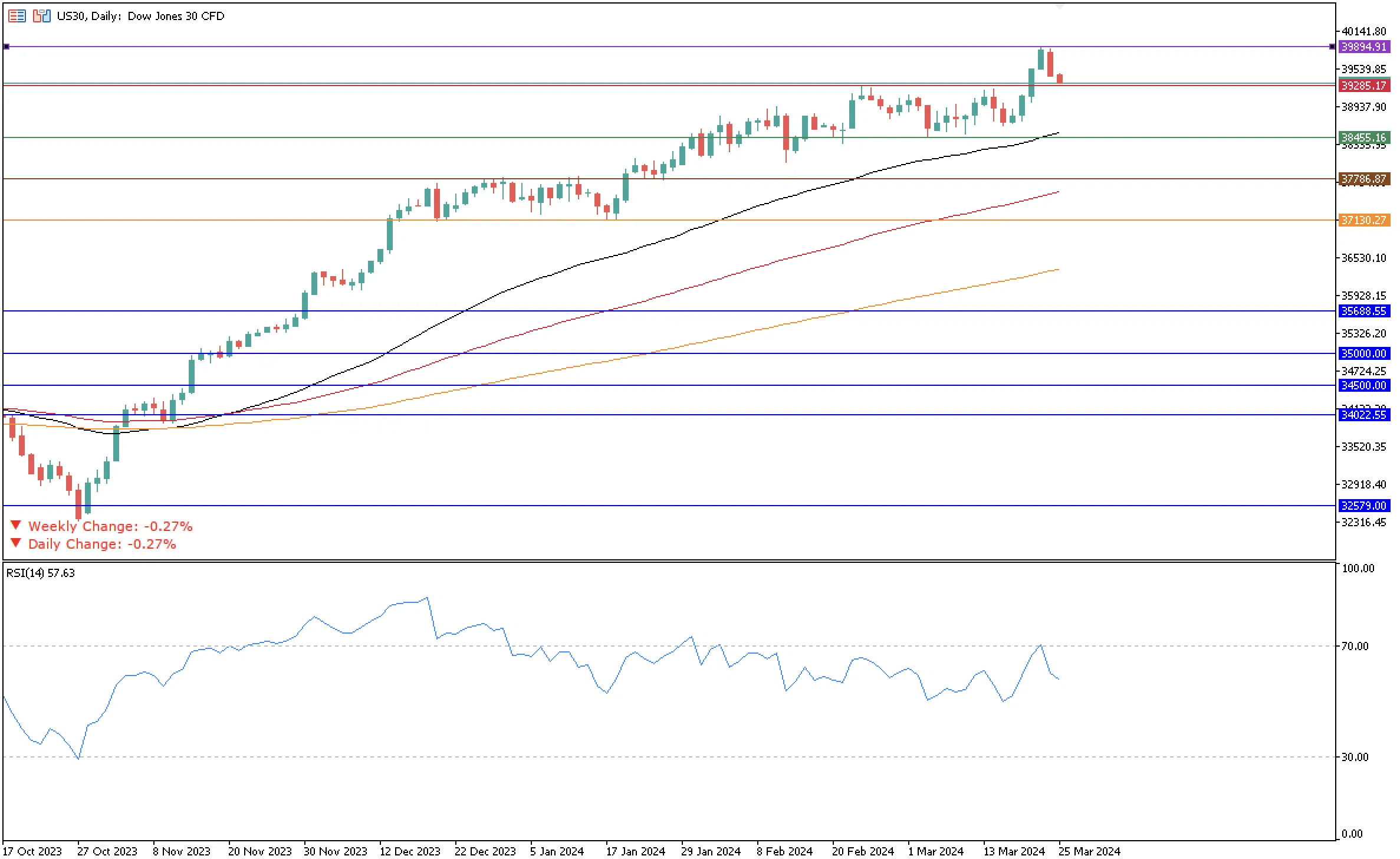

If the pullback continues, the DJIA will have to break its closest support at 39,285.17, pushing the index inside its previous sideways channel between this level and the 38,455.16 support, which last traded around mid-March. The 50-day moving average now sits at 38,316.125, and the RSI indicator shows no significant upward momentum for the index after it was overbought last when it reached an all-time high of 39,894.91, which is also its closest resistance.

This week will be shorter as the markets will be closed on Friday in the US and several other countries. The PCE data is due this Friday, so the impact of the news will not be reflected until next week.