By Camilo Botia,

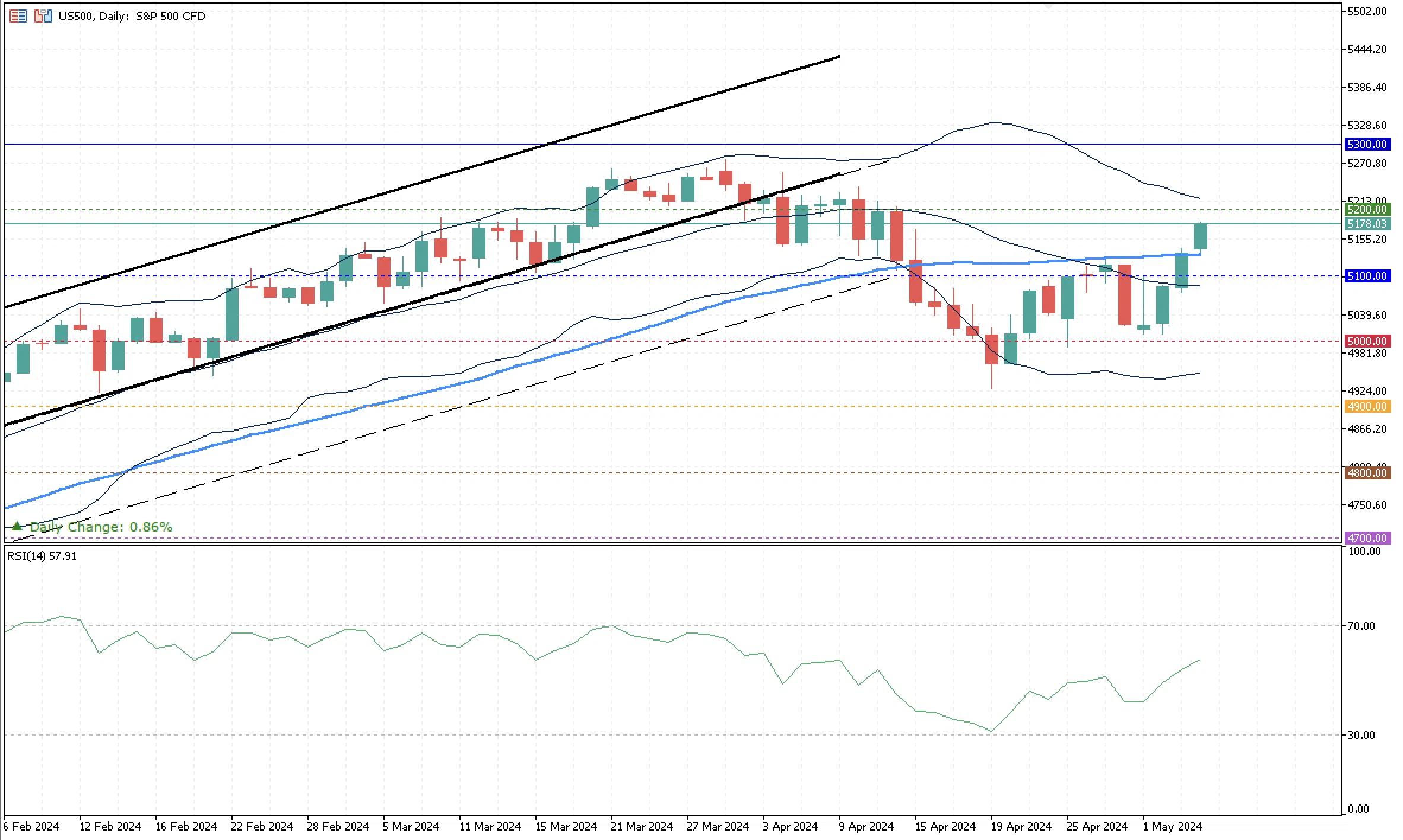

Stocks experienced their best three-day rally since November, driven by rising expectations that the Federal Reserve will cut interest rates this year. The S&P 500 rose 1%, topping its average price over the past 50 days – a technically significant indicator for maintaining positive sentiment. The stronger-than-expected earnings season also buoyed the market, with some sectors regaining their appeal to investors following a recent pullback. While lower trading volumes raise questions about the rally’s long-term strength, most industries posted gains.

This week is light on high-profile economic data but heavy on the implications of Fed Chair Jerome Powell’s recent remarks for future interest rate policy. Comments from other Fed officials this week, including Richmond Fed President Thomas Barkin and New York Fed President John Williams, will be closely analyzed for clues about the central bank’s direction.

Megacap companies like Nvidia Corp. and Tesla Inc. saw notable gains, while Apple Inc. fell after Warren Buffett announced a reduction in his stake in the tech giant. Treasury 10-year yields edged downward.

Earnings Season Drives Optimism

A robust earnings season has helped solidify high stock valuations despite the continued pressure of elevated interest rates. With over 80% of S&P 500 companies reporting results, profit growth has significantly outpaced expectations.

Several companies reporting earnings this week will provide further insights into the market’s health. Arm Holdings Plc may showcase the benefits of rising demand for AI, while gig economy companies like Airbnb Inc. could see slower growth. Uber Technologies Inc. is expected to report favourably, driven by expanding its user base. Fresh off its proxy battle victory, Walt Disney Co. is poised to impress investors with cost-cutting measures and gains in its streaming and theme park businesses.

The S&P 500 has surpassed its 50-day moving average, and market sentiment has become a little more positive in the last few days due to expectations about future interest rate cuts. The RSI oscillator showed growing bullish sentiment, edging higher and getting closer to 70. The index is up 3% during the month and will face 5,200 as its closest resistance if the bullish momentum persists. As support, the 50-day moving average is now the most significant floor to the price at 5,129.29.