By Camilo Botia,

Stocks experienced a positive Monday, propelled by Tesla’s upward momentum, as market participants anticipate a significant week packed with corporate earnings reports and a Federal Reserve meeting.

• The S&P 500 saw a 0.32% increase, ending at 5,115.34.

• The Nasdaq Composite experienced a 0.35% growth, closing at 17,785.55.

• The Dow Jones Industrial Average added 146.43 points (0.38%) to conclude at 38,374.29.

Tesla stock soared by over 15%, bolstering the broader market after successfully navigating a significant regulatory obstacle for its full self-driving technology rollout in China. Apple also witnessed a considerable climb of around 2.5% following an optimistic upgrade by the investment firm Bernstein. However, some moderation occurred due to losses experienced by Big Tech names like Microsoft, Alphabet, and Meta.

Domino’s Pizza surged by over 5% after delivering earnings that surpassed analysts’ projections on Monday morning. Investors await quarterly financials from significant players such as Apple, McDonald’s, Coca-Cola, and Amazon this week. These releases arrive amidst a robust earnings season, with roughly 80% of the S&P 500 companies announcing results beating expectations.

Despite Monday’s positive movement, the Dow faces a potential decline of over 3.5% by the end of April. Similarly, the S&P 500 and Nasdaq Composite could see a monthly drop of more than 2% as trading concludes on Tuesday.

Some analysts believe we are still in the pullback phase but don’t expect a change to a bearish market. On Wednesday, all eyes will be on the Federal Reserve’s latest interest rate announcement. While no change in borrowing costs is broadly expected, investors will attentively follow Chair Jerome Powell’s post-announcement press conference.

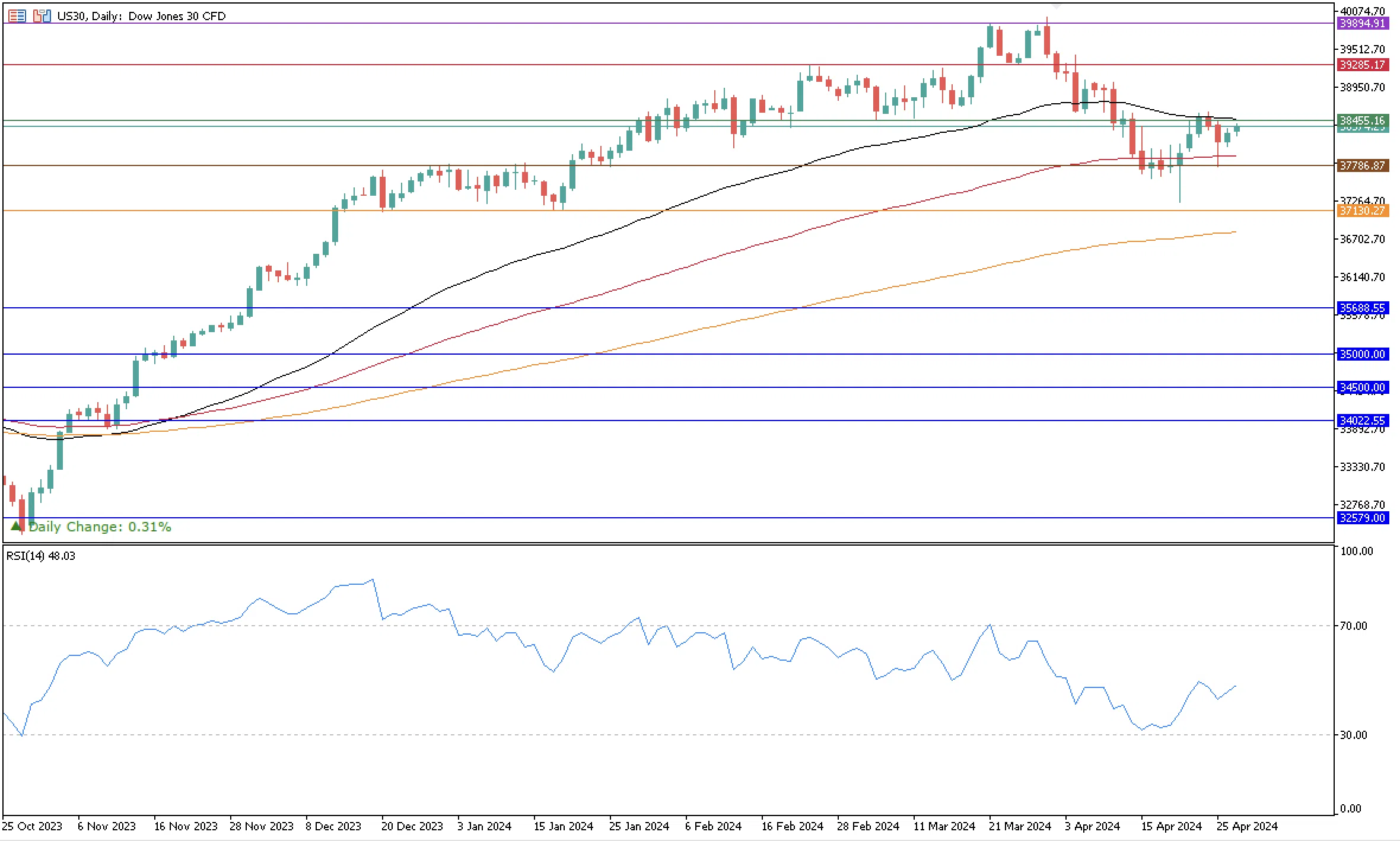

The Dow is trading close to the weekly resistance of 38,455.16, which coincides with its 50-day moving average. The index has been in a sideways phase since April 11 between this resistance and the 37,786.87 support (next to its 100-day moving average). The RSI indicator confirms the sideways movement. The next significant resistance for the index is at 39,285.17, and the next support is at the 100-day moving average of 37.786.87.