The Bank of Canada (BoC) held interest rates steady at 2.75% yesterday, in line with market expectations. This marks the fourth consecutive hold by the central bank.

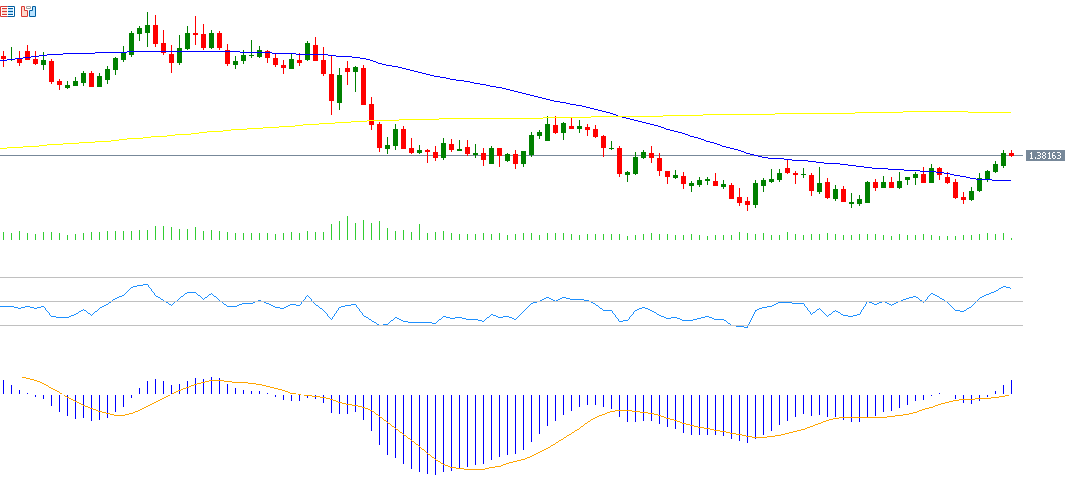

Meanwhile, the U.S. dollar continues to strengthen against the Canadian dollar. USD/CAD reached 1.3845 on Tuesday — its highest level since May 29, 2025 — and is currently hovering near the 1.3800 mark. The pair has gained approximately 2% since its recent low of 1.3575 on July 23. However, it remains down about 4% year-to-date.

Key Drivers of USD Strength:

- Robust U.S. Economic Data:

U.S. economic resilience remains a major driver. Both the GDP and ADP non-farm private employment data released yesterday came in stronger than expected, boosting the U.S. dollar index to 99.98 — its highest level since May 29. - Easing Trade Tensions:

Reduced trade friction between the U.S. and major partners like Japan, China, and the Eurozone, alongside ongoing uncertainty regarding tariffs with other countries — especially Canada — have also fueled demand for the greenback.

Technical Outlook:

- Support Levels:

A break below the pivot point at 1.3810 may open the door for further downside towards 1.3774, 1.3722, and 1.3686 - Resistance Levels:

If USD/CAD holds above the pivot, it may test resistance at 1.3862, 1.3898, and 1.3950.

Technical Indicators:

- RSI (Relative Strength Index): Currently at 61, indicating bullish momentum.

- DMI (Directional Movement Index): +DMI is at 29 vs. -DMI at 14 — a significant spread favoring the bulls.

- MACD (Moving Average Convergence Divergence): A bullish crossover with the signal line suggests continued upward momentum for USD/CAD.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.