The Central Bank of Turkey unexpectedly raised interest rates by 350 basis points yesterday, increasing the policy rate from 42.50% to 46.00%.

The USD/TRY exchange rate hit 38.1529 on Friday, its highest level since March 19, 2025, when it reached around 41.00, following political turmoil in Turkey and the imprisonment of Istanbul Mayor Ekrem İmamoğlu on charges related to corruption and supporting terrorist organizations. The pair is currently hovering around 38.00 lira per dollar.

The USD/TRY has risen by approximately 8% year-to-date, and forecasts indicate continued weakness for the Turkish lira in the coming period.

Recent economic data suggests that the Turkish economy is showing signs of a slowdown:

- The annual Consumer Price Index (CPI) slowed to 38.10% in March, below both expectations (38.90%) and the previous reading (39.05%).

- The annual Producer Price Index (PPI) declined to 23.50% in March, lower than the previous reading (25.21%).

- The Manufacturing Purchasing Managers’ Index (PMI) contracted to 47.30 in March, down from the previous reading of 48.30.

- Total foreign exchange reserves fell to $77.84 billion, down from the previous level of $80.61 billion.

- Retail sales growth on a monthly basis slowed to 1.1%, down from the previous reading of 2.0%.

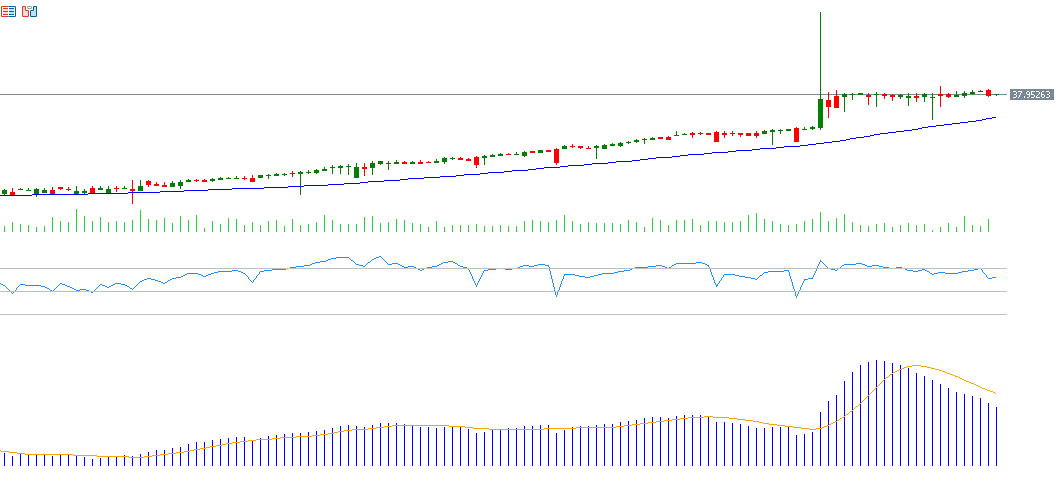

Technical Analysis:

The upward trend for USD/TRY appears to be dominant in the coming phase, especially with ongoing bullish momentum. The Relative Strength Index (RSI) is currently at 72, indicating that the pair is in overbought territory.

In addition, there is a clear upward trend in the 20-, 50-, and 200-day moving averages. The 20-day average is above the 50-day, and the 50-day is above the 200-day average.

A bullish crossover has also occurred between the MACD (blue line) and the Signal Line (orange line), supporting the continuation of the upward momentum for the USD/TRY pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.