The USD/JPY pair rose yesterday, reaching a level of 148.92, its highest since September 3, 2025, and is currently trading near the 149.00 mark. The pair has gained 2% since the low recorded on September 17, 2025, at 145.48, up to yesterday’s peak of 148.92. However, it remains down about 5% year-to-date.

Factors Pressuring the Japanese Yen:

- Political Uncertainty in Japan:

Markets are closely watching to see who will succeed Japan’s resigned Prime Minister, Ishiba. Among the leading candidates is Sanae Takaichi, known for her support of accommodative monetary and fiscal policies. She stated yesterday that raising interest rates could negatively impact mortgage loans and corporate investments. - U.S. Monetary Policy:

Federal Reserve Chair Jerome Powell adopted a cautious tone, warning about inflation risks and noting that prices may rise due to tariffs, in addition to ongoing labor market pressures. This prompted the Fed to cut interest rates by 25 basis points last week. However, Powell also indicated that the Fed will monitor economic data before making any further decisions. This comes despite the dot plot projections pointing to two additional rate cuts this year, which gave a positive boost to the U.S. dollar against most foreign currencies.

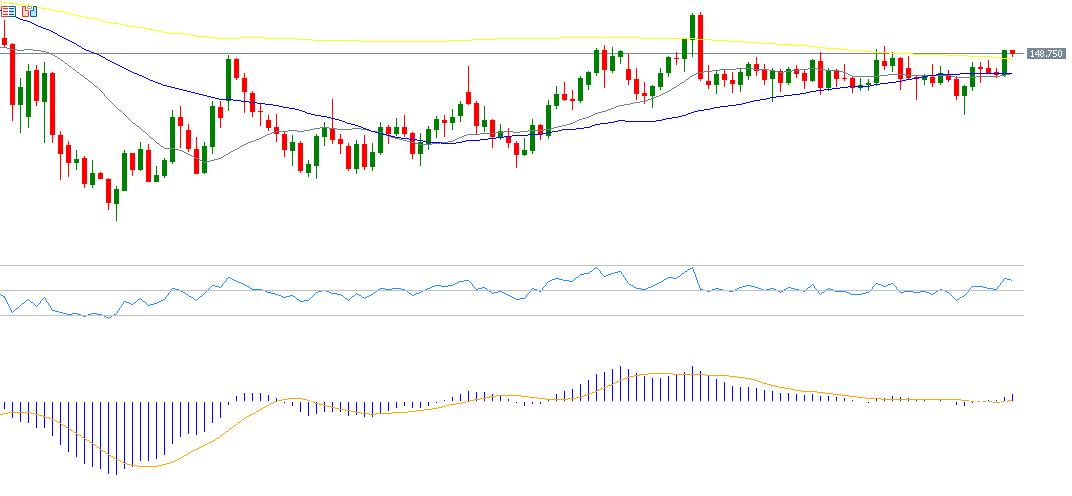

Technical Analysis of the USD/JPY Pair:

Technical indicators show that the upward trend remains dominant for the USD/JPY pair in the near term. If the price breaks below the pivot point at 148.40, the following support levels may be targeted:

- 147.88

- 146.99

- 146.47

However, if the pair breaks above the pivot point, it may aim for the following resistance levels:

- 149.29

- 149.81

- 150.70

As for momentum indicators, the Relative Strength Index (RSI) currently stands at 59, indicating moderate bullish momentum. Additionally, the MACD (blue line) has formed a positive crossover with the signal line (orange line), reinforcing expectations for continued upward momentum in the pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.