The UK’s FTSE 100 index rose to 8,887 points yesterday, marking its highest level since March 3, 2025. The index has gained approximately 18% from the April 7, 2025 low of 7,533 points to the recent peak. It has also risen about 9% year-to-date, outperforming U.S. indices such as the S&P 500 and Nasdaq 100. However, it still lags behind other European benchmarks like Germany’s DAX and the STOXX Europe 600.

The FTSE 100’s recent rally is attributed to several key factors:

- Wage Growth and Labor Market Data: Total earnings including bonuses fell to 5.3%, below expectations (5.5%) and the previous reading (5.6%). Unemployment rose slightly to 4.6%, in line with expectations but higher than the prior 4.5%, suggesting a higher likelihood of monetary easing (rate cuts) from the Bank of England.

- Optimism Around US-China Trade Talks: Ongoing negotiations in London between the U.S. and China have boosted market sentiment.

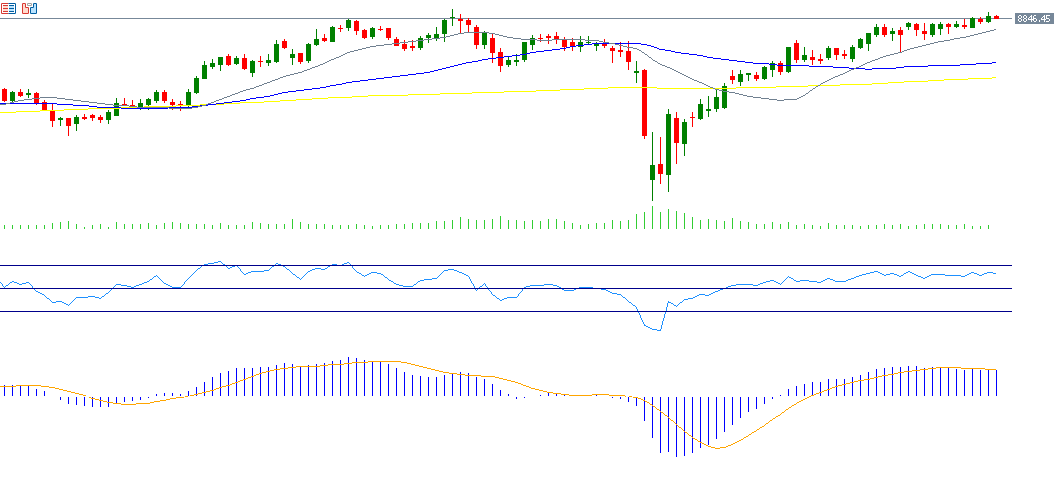

On the technical side, indicators support continued bullish momentum for the FTSE 100:

- The 20-, 50-, and 200-day moving averages are trending upward, with the 20-day above the 50-day, and the 50-day above the 200-day average — a classic bullish alignment.

- The Relative Strength Index (RSI) currently stands at 62, reflecting positive momentum.

- The MACD indicator shows a bullish crossover, with the MACD line moving above the signal line, further supporting the upside outlook.

The main challenge now lies in breaking the record high of 8,909 points set on March 3, 2025.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.