The Bank of Thailand unexpectedly cut interest rates by 25 basis points for the first time this year during its latest meeting held on October 16, 2024, reducing the rate from 2.50% to 2.25%.

Recent Thai economic data reveals a mixed picture. The country’s GDP grew by 3.0% year-on-year in the third quarter of this year, surpassing expectations (2.6%) and the previous reading (2.2%). In contrast, the industrial production index contracted by 3.51% year-on-year, below the forecast (-0.30%) and the previous reading (-1.91%).

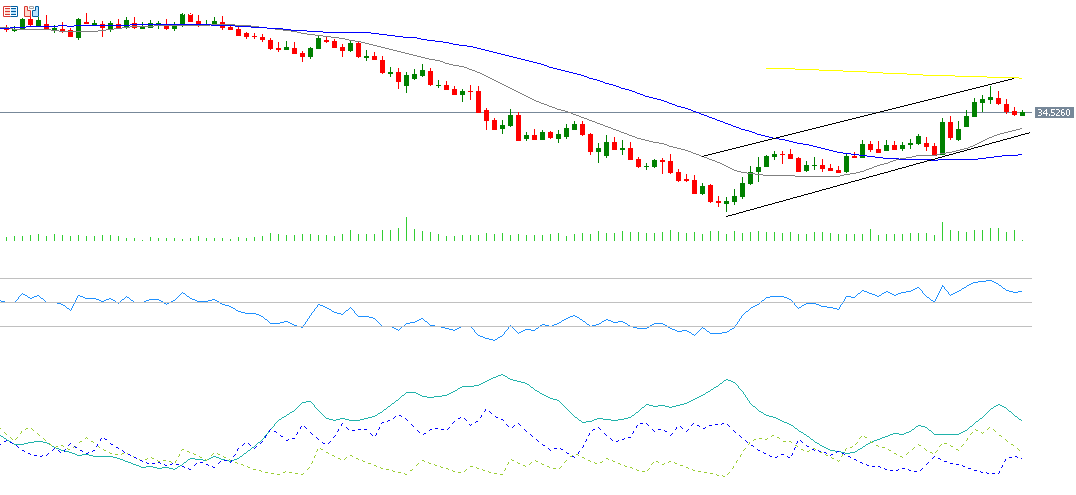

The US dollar continues its upward trend against the Thai baht, reaching 35.17 last week, its highest level since August 15, 2024. It is currently trading near the 34.60 level. The USD/THB pair has risen by about 9% since the low of September 30, 2024, when it hit 32.14, to the high recorded last week at 35.17. Additionally, the pair has gained around 1% since the beginning of the year.

An important factor driving the upward momentum of the USD/THB pair is the strength of the US dollar, particularly with Donald Trump’s return to the presidency, along with the resilience of the US economy and the outperformance of most US economic data compared to analysts’ expectations.

Technical indicators also suggest continued upward momentum for the USD/THB pair in the near term for several reasons:

- Moving Averages: A Golden Cross occurred between the 20-day moving average (in gray) and the 50-day moving average (in blue) on October 30, 2024, providing positive momentum for the USD/THB pair.

- Relative Strength Index (RSI): The RSI currently stands at 60, reflecting bullish momentum for the USD/THB pair.

- Directional Movement Indicators (DMI): The Positive Directional Indicator (DMI+) is at around 29 points, while the Negative Directional Indicator (DMI-) is around 12 points. The large gap between these indicators suggests strong buying pressure on the USD/THB pair. Moreover, the Average Directional Index (ADX) is at 34 points, above the 25-point threshold, indicating that the upward trend is strong.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.