The GBP/USD currency pair reached a level of 1.3444 on April 28, 2025, marking its highest point since February 24, 2022. It has gained approximately 11% from the low recorded on January 13, 2025, at 1.2100 to the peak reached on April 28 at 1.3444. The pair is currently trading near the 1.3300 level and is up about 6% year-to-date.

Recent UK economic data shows that the British economy remains resilient, including the following highlights:

- The British Retail Consortium (BRC) retail sales report showed a 6.8% increase, well above expectations (2.4%) and the previous reading (0.9%).

- Quarterly GDP rose by 0.7%, exceeding expectations (0.6%) and the previous figure (0.1%).

- Average earnings including bonuses rose by 5.5%, higher than market expectations.

- The Manufacturing PMI came in at 45.1, slightly higher than expectations (44.0) and the previous reading (44.9), though still indicating contraction.

- The Services PMI registered 49.0, above expectations (48.9), but also in contraction territory.

- The Construction PMI recorded 46.6, also better than expectations (46.0) and the previous reading (46.4).

A key factor that has contributed to the bullish momentum in GBP/USD is the weakness in the US Dollar Index.

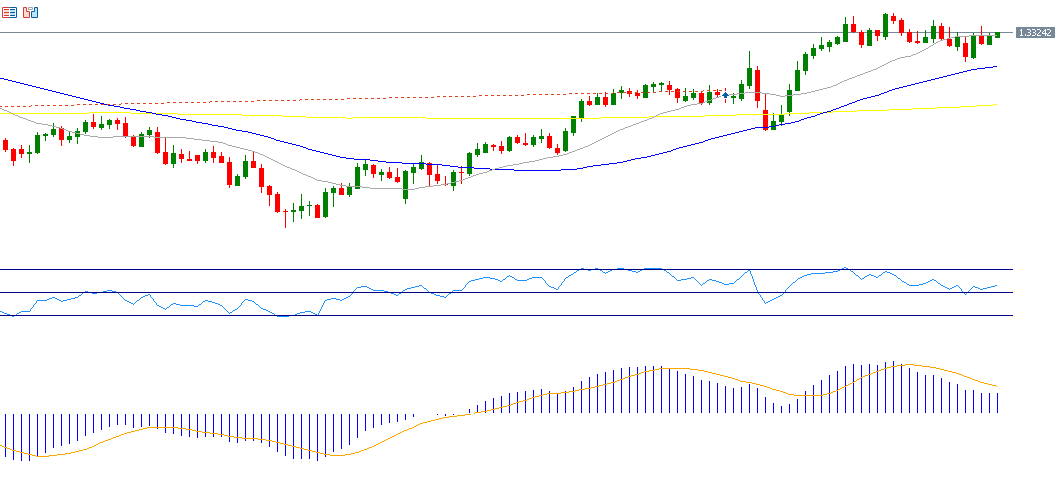

From a technical perspective, if the pivot level at 1.3294 is broken to the downside, the pair may target support levels at 1.3267, 1.3230, and 1.3203. However, if the pivot is breached to the upside, resistance levels may be seen at 1.3331, 1.3358, and 1.3395.

The Relative Strength Index (RSI) is currently around 56, indicating continued bullish momentum. Additionally, the MACD shows the blue MACD line above the orange Signal Line, further supporting the case for ongoing upward momentum in GBP/USD.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.