The price of the dollar against the Turkish lira reached 35.3235 two days ago, marking its highest level ever. The price is currently hovering around 35.0500 lira per dollar. The dollar has risen approximately 19% against the Turkish lira since the beginning of the year.

Recent Turkish economic data shows that the Turkish economy is struggling, as:

- The Manufacturing Confidence Index in December fell to 99.1 points, which is lower than the previous reading (100.4).

- Monthly retail sales grew by only 0.2%, which is lower than the previous reading (2.5%).

- The Industrial Production Index on a yearly basis contracted by 3.1%, which is lower than the previous reading (-2.3%).

- The unemployment rate increased to 8.8%, which is higher than the previous reading (8.7%).

The weak economic figures mentioned above suggest that the Central Bank of Turkey may begin to reduce interest rates in the upcoming period to support the economy. Interest rates have remained at 50% for eight consecutive months.

Markets are waiting for the Central Bank of Turkey’s interest rate decision today at 15:00 UAE time, with expectations of a rate cut of 150 basis points from 50% to 48.50%.

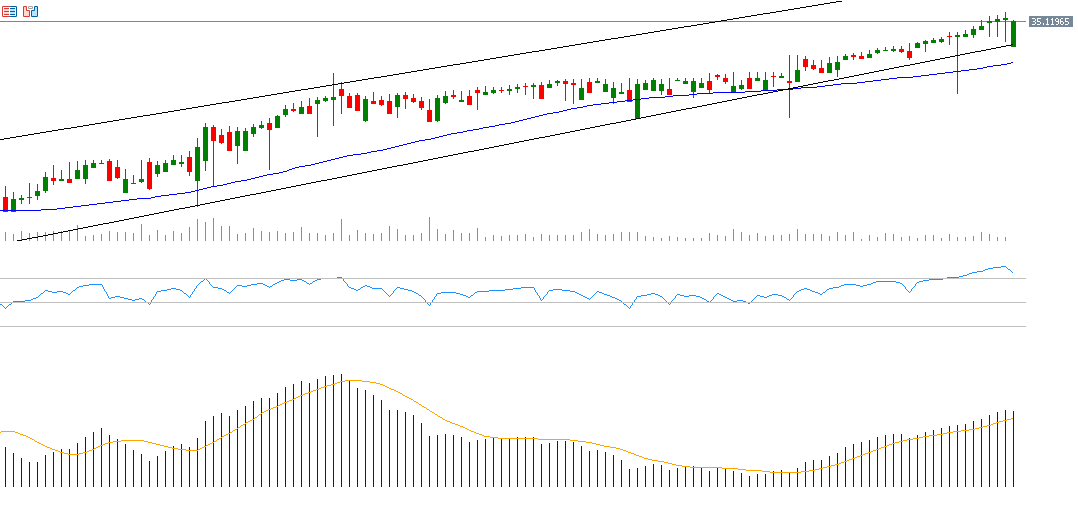

From a technical perspective, the upward trend for the USD/TRY pair seems to be prevailing in the coming period, especially with the continued positive momentum for this pair, as the Relative Strength Index (RSI) is at 64.

Additionally, the MACD (in blue) has crossed above the Signal Line (in orange), indicating bullish momentum for the USD/TRY pair.

Furthermore, there is alignment in the 20-day, 50-day, and 200-day moving averages, all showing an upward trend, with the 20-day average surpassing the 50-day average, and the 50-day average surpassing the 200-day average.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.