The Swiss National Bank cut interest rates by 25 basis points in its meeting held on Thursday, September 26, 2024, from 1.25% to 1.00%, marking the third consecutive cut this year.

The price of the US dollar against the Swiss franc continues its upward trend, reaching 0.8607 on Friday, October 4, 2024, the highest level since August 20, 2024. It is currently hovering around the 0.8550 levels. The US dollar has risen by about 3% since hitting a low of 0.8374 on September 6, 2024, to the peak recorded last week at 0.8609.

The annual Consumer Price Index (CPI) in September 2024 showed a growth of 0.8%, which is below expectations and the previous reading of 1.1%, marking the lowest level since July 2021. This may prompt the Swiss National Bank to continue lowering interest rates in the coming period, placing pressure on the Swiss franc.

Notably, a key factor providing positive momentum to the US dollar against the Swiss franc is the strength and resilience of the US labor market. US labor market data has surpassed analysts’ expectations, as seen in the non-farm payrolls report, unemployment rate, and average hourly wages, indicating that the US economy is likely to avoid entering a recession. Thus, the prospect of a soft landing seems most probable at this time.

Analysts are closely watching the release of the US Consumer Price Index on Thursday, so caution is warranted. Any reading that exceeds expectations for this index would significantly likely reflect positively on the USD/CHF pair.

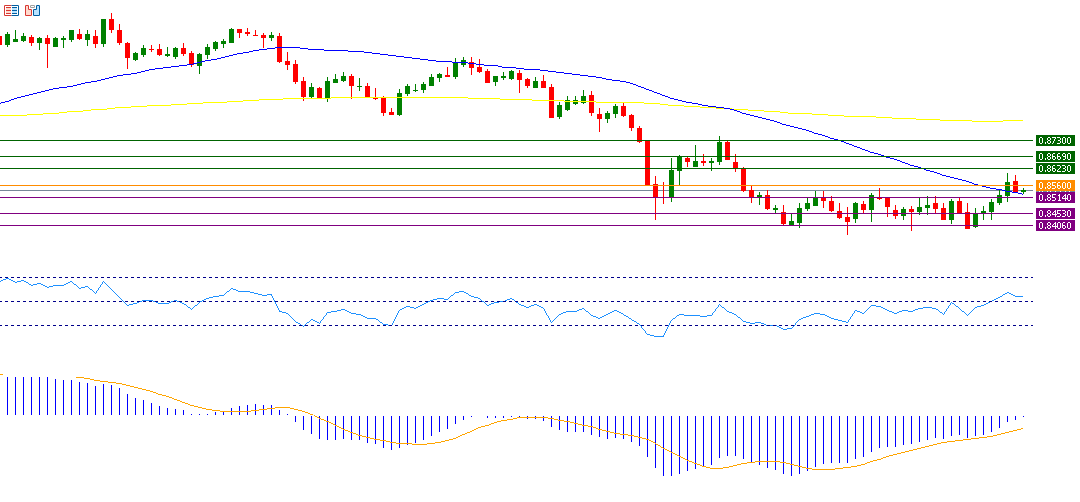

Regarding the technical side, if the pivot point of 0.8560 for the US dollar against the Swiss franc is broken, there is a possibility of targeting support levels at 0.8514, 0.8453, and 0.8406. If the pivot point is surpassed, it is likely to target resistance levels at 0.8623, 0.8669, and 0.8730. The Relative Strength Index (RSI), currently at 54 points, indicates positive momentum for the USD/CHF pair.

As for the MACD indicator, shown in blue, it is crossing above the signal line (in orange), indicating bullish momentum for the USD/CHF pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.