The Reserve Bank of New Zealand lowered interest rates yesterday by 50 basis points, from 5.25% to 4.75%, aligning with market expectations. This reduction marks the second consecutive cut this year, following an initial decrease of 25 basis points.

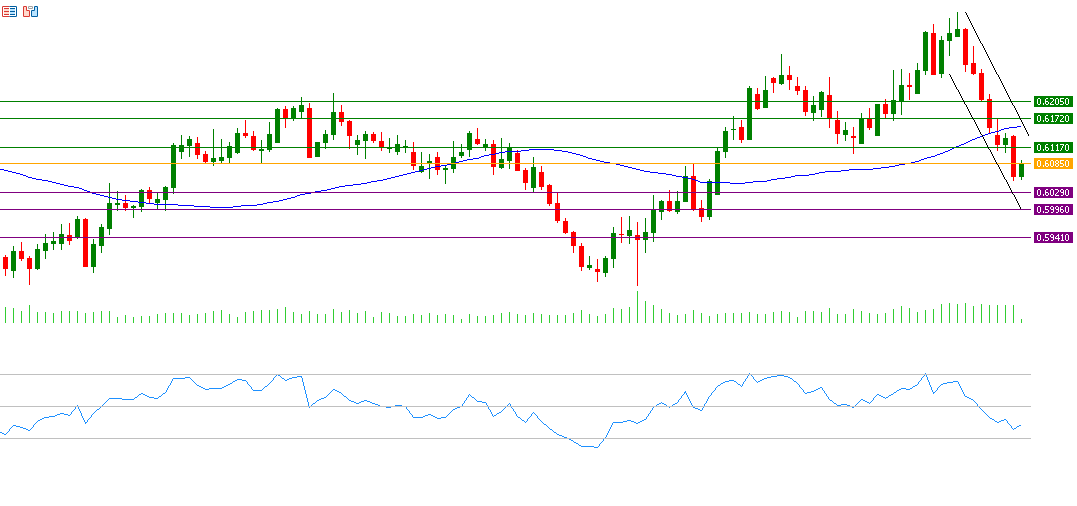

The downward trend of the New Zealand dollar against the US dollar seems to be prevailing in the upcoming phase, having declined by about 5% from the peak of 0.6378 recorded on September 30, 2024, down to a low of 0.6051 on October 9. It has also decreased by approximately 4% since the beginning of the year. Currently, it hovers around the 0.6100 levels.

Recent economic data from New Zealand indicates that the economy is facing weakness, as evidenced by:

- A monthly trade balance deficit of 2.203 million New Zealand dollars, which is worse than expectations (-155 million) and the previous reading (-1.016 million).

- A monthly decline in the building permits index, showing a contraction of 5.3%, which is worse than the previous reading (26.4%).

- A year-on-year contraction in GDP of 0.5% in the second quarter of this year, a decline compared to the previous reading (0.5%).

It is worth noting that a significant factor pressuring the New Zealand dollar against the US dollar is the strength and resilience of the US labor market, along with a reduced likelihood of a 50 basis point rate cut. Currently, the markets price in a 80% chance of a 25 basis point cut and a 20% chance of keeping rates unchanged at the upcoming Federal Reserve meeting scheduled for November 7.

Consumer Price Index (CPI) data for both headline and core inflation in the US is expected to be released today. Predictions suggest that the headline CPI will record 2.3%, which is lower than the previous reading (2.5%). For the core CPI, which excludes food and energy, forecasts indicate it will register 3.2%, matching the August reading.

Accordingly, caution is advised, as any reading exceeding expectations for the CPI could have negative repercussions on the New Zealand dollar against the US dollar.

From a technical perspective, if the pivot point at 0.6085 for the New Zealand dollar against the US dollar is breached, it is likely to target support levels at 0.6029, 0.5996, and 0.5941. Conversely, if the pivot point is surpassed, it may aim for resistance levels at 0.6117, 0.6172, and 0.6205. The Relative Strength Index (RSI), currently around 39 points, indicates negative momentum for the New Zealand dollar against the US dollar.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.