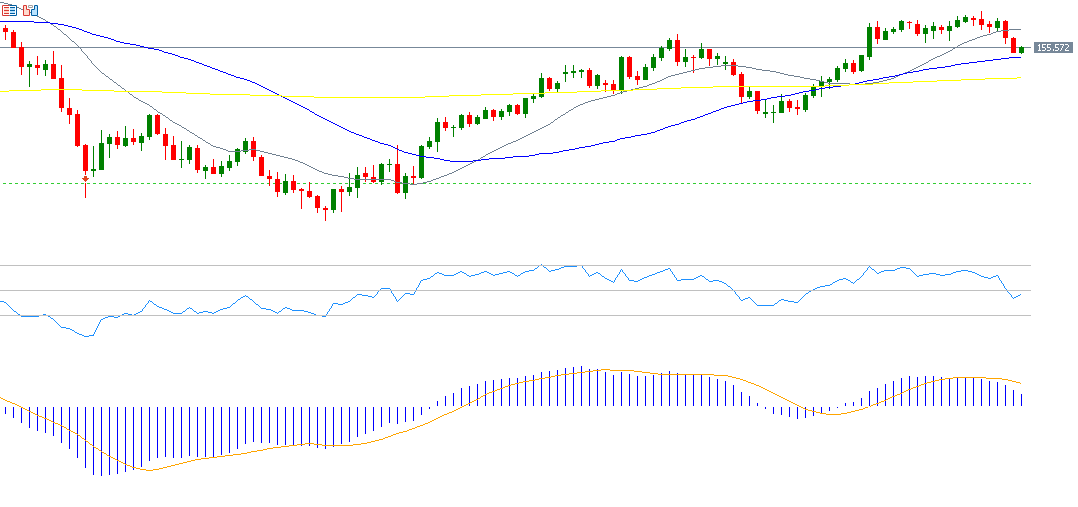

The USD/JPY pair continues its downward trend, recording 155.20 yesterday, its lowest level since December 19, 2024. It is currently stabilizing near the 155.50 level. The pair has dropped by 2% since the peak on January 10, 2025, when it reached 158.87, down to the low achieved yesterday.

As for the factors supporting the Japanese yen, they include:

- Narrowing the gap between Japanese and U.S. government bond yields: For example, the yield on 10-year Japanese government bonds is about 1.197%, while the yield on 10-year U.S. Treasury bonds is around 4.615%. This means the gap between them is approximately 3.418%. Although this gap remains large, it encourages carry trade activity.

- Slight weakness in the U.S. dollar: U.S. inflation data fell short of analysts’ expectations, such as the core consumer price index (which excludes food and energy), which recorded 3.2%, lower than the expected 3.3% and the previous reading of 3.3%.

- Statements from Bank of Japan Governor Kazuo Ueda: He hinted at the possibility of raising interest rates in the next central bank meeting on Friday, January 24, 2024, as markets are pricing in a rate cut of 25 basis points.

From a technical perspective, the bearish momentum for the USD/JPY pair seems dominant in the upcoming phase. The biggest challenge will be breaking the strategic support level, which is the 50-day moving average at 154.65, followed by the 200-day moving average at 152.75.

If the pivot point of 155.67 for the yen against the dollar is broken, the pair could target support levels at 154.80, 154.23, and 153.36. Should the pivot point be surpassed, it is likely to target resistance levels at 156.24, 157.11, and 157.68. The Relative Strength Index (RSI) currently stands at 47, indicating the bearish momentum for the USD/JPY pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.