United States of America

- The Consumer Confidence Index rose to 103.3, surpassing expectations of 100.9 and the previous reading of 101.9.

- The Core Durable Goods Orders Index decreased by 0.2% month-over-month, below expectations of 0.0% and the previous reading of 0.1%. Meanwhile, the overall Durable Goods Orders Index grew by 9.9% month-over-month, exceeding expectations of 4.0% and the previous reading of -6.9%.

- The Pending Home Sales Index fell by 5.5% month-over-month, underperforming expectations of 0.2% and the previous reading of 4.8%.

- Initial Jobless Claims dropped to 231,000, below expectations of 232,000 and the previous reading of 233,000.

- U.S. crude oil inventories decreased by 846,000 barrels, significantly less than expectations of -2.7 million and the previous reading of -4.649 million.

- The Gross Domestic Product (GDP) increased by 3.0% quarter-over-quarter in Q2, beating expectations of 2.8% and the previous reading of 1.4%.

- The Core Personal Consumption Expenditures (PCE) Price Index recorded an annual rate of 2.6%, slightly lower than expectations of 2.7% but consistent with the previous reading.

- The Michigan Consumer Sentiment Index rose to 67.9, slightly exceeding expectations of 67.8 and the previous reading of 66.4.

Eurozone

The headline Consumer Price Index (CPI) recorded an annual rate of 2.2%, matching expectations but lower than the previous reading of 2.6%. The core CPI, excluding food and energy, recorded an annual rate of 2.8%, also aligning with expectations but slightly lower than the previous reading of 2.9%.

Canada

The Gross Domestic Product (GDP) rose by 2.1% quarter-over-quarter in Q2, outperforming expectations of 1.6% and the previous reading of 1.8%.

Japan

The Consumer Price Index (CPI) in Tokyo rose by 2.4% year-over-year, exceeding both expectations and the previous reading of 2.2%.

China

- The Non-Manufacturing Purchasing Managers’ Index (PMI) increased to 50.3, surpassing expectations of 50.0 and the previous reading of 50.2.

- The Manufacturing PMI declined to 49.1, below expectations of 49.5 and the previous reading of 49.4.

Looking Ahead: Upcoming Economic Indicators

- Today: The Manufacturing PMI will be released for Japan, Australia, the Eurozone, the United Kingdom, and the United States, along with the Caixin Manufacturing PMI for China.

- Tuesday: Focus will be on the Consumer Price Index (CPI) and Gross Domestic Product (GDP) in Switzerland, as well as the ISM Manufacturing PMI, Construction Spending, and Manufacturing PMI in the United States.

- Wednesday: Markets are anticipating an interest rate decision from the Bank of Canada, with expectations of a 25 basis point cut from 4.50% to 4.25%. Additionally, the Services PMI will be released for Japan, the Eurozone, the United Kingdom, and the United States, along with the Caixin Services PMI in China, GDP in Australia, the Producer Price Index (PPI) in the Eurozone, and JOLTS job openings, factory orders, and crude oil inventories in the United States.

- Thursday: Key releases include the unemployment rate in Switzerland, the Construction PMI in the United Kingdom, retail sales in the Eurozone, the ADP Non-Farm Employment Change, initial jobless claims, the Services PMI, and the ISM Non-Manufacturing PMI in the United States.

- Friday: The Non-Farm Payrolls (NFP) report, unemployment rate, and average hourly earnings in the United States will be closely watched, alongside GDP in the Eurozone, as well as employment change, the unemployment rate, and the Ivey PMI in Canada.

Technical Analysis

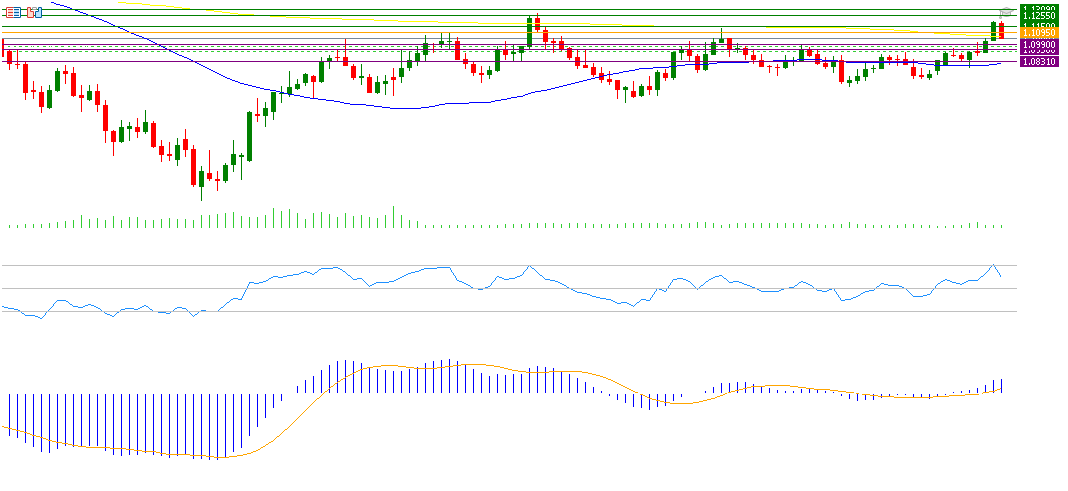

EUR/USD

If the pivot point at 1.1095 for the Euro against the Dollar is broken, the pair may target support levels at 1.0990, 1.0936, and 1.0831. Conversely, if the pivot point is surpassed, the pair may aim for resistance levels at 1.1150, 1.1255, and 1.1309.

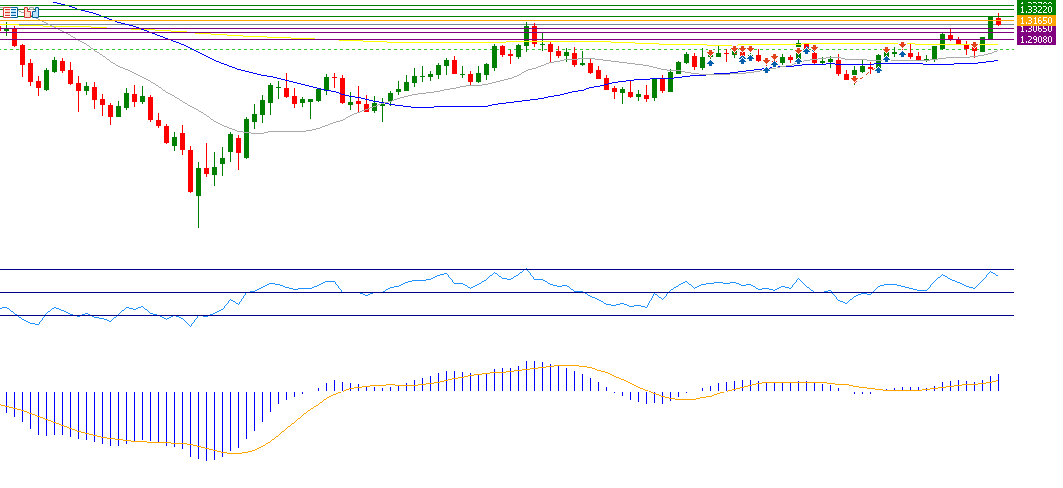

GBP/USD

If the pivot point at 1.3165 for the Pound Sterling against the Dollar is broken, the pair may target support levels at 1.3065, 1.3008, and 1.2908. However, if the pivot point is surpassed, it could target resistance levels at 1.3222, 1.3322, and 1.3379.

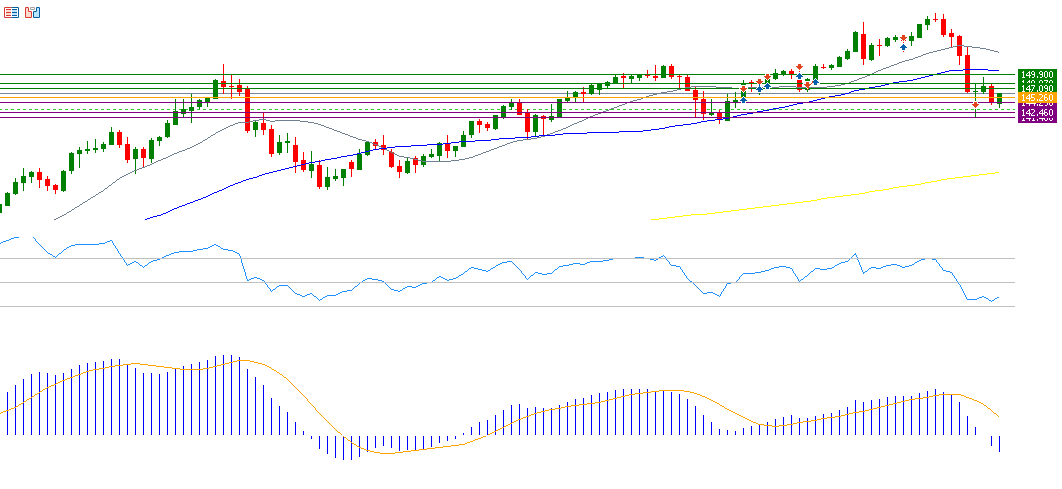

USD/JPY

If the pivot point at 145.26 for the Yen against the Dollar is broken, the pair may target support levels at 144.29, 142.46, and 141.48. Conversely, if the pivot point is surpassed, the pair may aim for resistance levels at 147.09, 148.07, and 149.90.

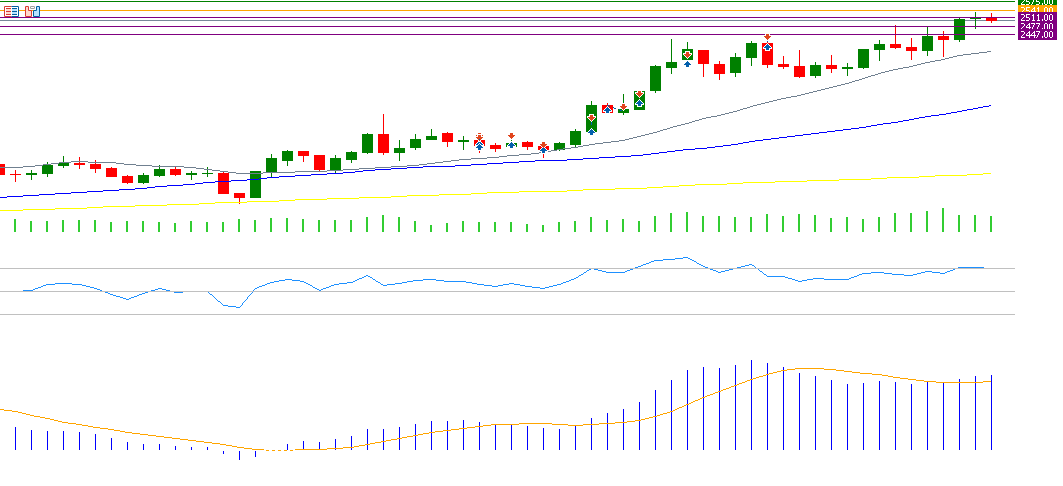

Gold (XAU)

If the pivot point at 2541 for gold is broken, it could target support levels at 2511, 2477, and 2447. However, if the pivot point is surpassed, it might target resistance levels at 2575, 2605, and 2639.

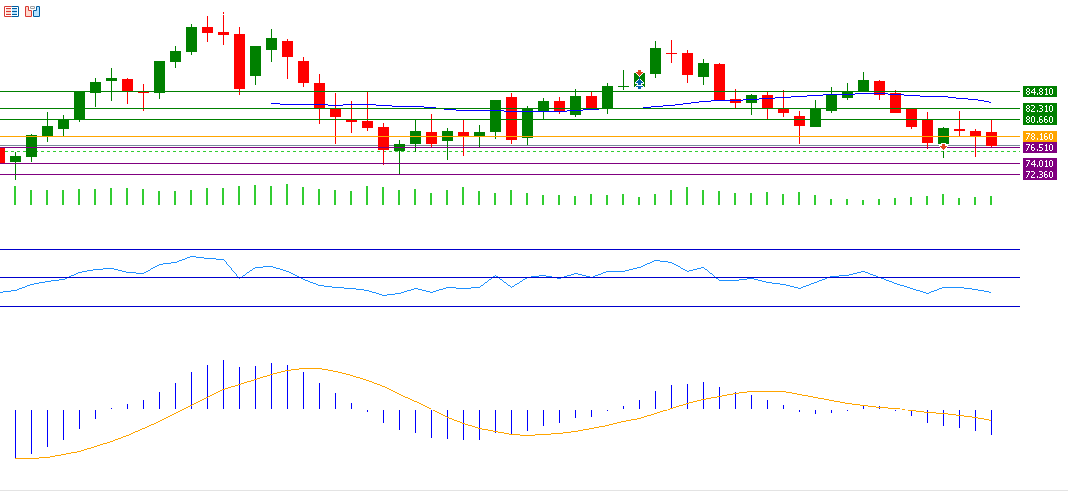

BRENT (Crude Oil)

If the pivot point at 78.16 for crude oil is broken, it may target support levels at 76.51, 74.01, and 72.36. Conversely, if the pivot point is surpassed, it could aim for resistance levels at 80.66, 82.31, and 84.81.

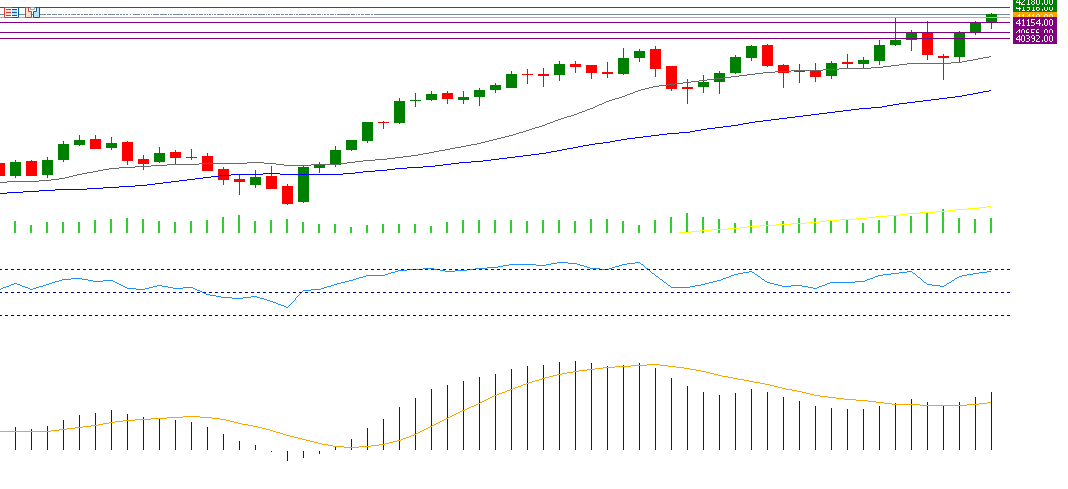

US30 (Dow Jones Index)

If the pivot point at 41418 for the Dow is broken, the index may target support levels at 41154, 40656, and 40392. Conversely, if the pivot point is surpassed, it could aim for resistance levels at 41916, 42180, and 42678.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.