The U.S. dollar recorded an exchange rate of 151.80 against the Japanese yen today, marking its lowest level since December 12, 2024. Currently, it is trading near 152.00, with negative momentum prevailing in the near term due to several fundamental and technical factors.

Fundamental Factors:

- Increase in the Consumer Price Index (CPI): The headline CPI grew 3.6% year-on-year in December, exceeding the previous reading of 2.9%. The core CPI (excluding food) also rose 3.0% year-on-year, in line with expectations but higher than the previous reading of 2.7%. However, inflation remains above the 2% target set by the Bank of Japan.

- Narrowing Yield Spread Between Japanese and U.S. Government Bonds: The 10-year Japanese government bond yield stands at approximately 1.284%, while the 10-year U.S. Treasury yield is around 4.480%, leading to a spread of approximately 3.196%. Although this spread remains significant, it still encourages carry trade strategies.

- Slight Weakness in the U.S. Dollar: U.S. labor market data fell short of analysts’ expectations, with the Job Openings Index dropping to 7.600 million, below the forecasted 8.010 million and the previous reading of 8.156 million.

- Interest Rate Expectations: Japan is likely to continue raising interest rates in the coming period, while uncertainty surrounds U.S. interest rates. Expectations suggest that U.S. rates will either remain unchanged or be cut, further narrowing the interest rate gap between the two countries.

Technical Factors:

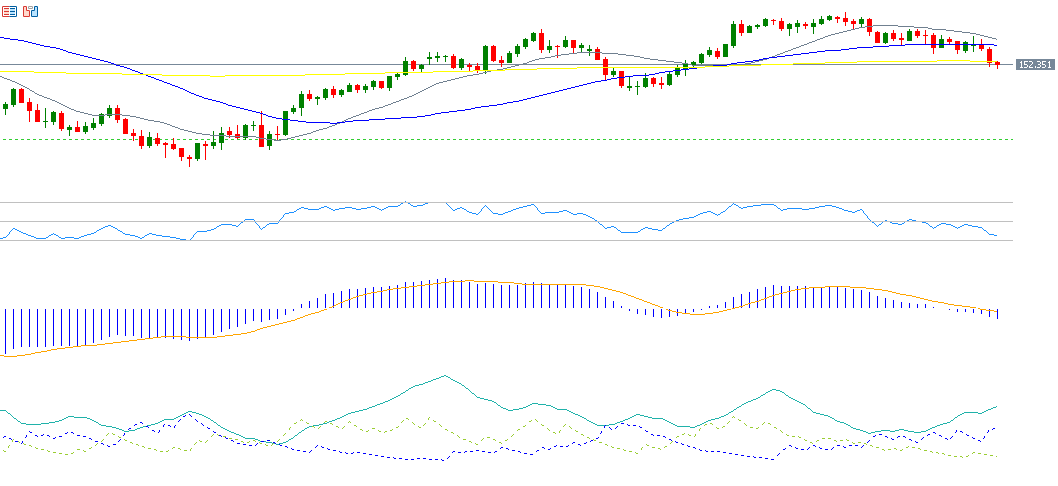

- MACD Indicator: The blue line is below the orange SIGNAL LINE, indicating continued negative momentum for the USD/JPY pair.

- Directional Movement Index (DMI): The DMI+ indicator is around 10 points, while the DMI- indicator is at 28 points, reflecting strong selling pressure on the dollar against the yen. The ADX (Average Directional Index) stands at 28 points, signaling strong bearish momentum.

- Relative Strength Index (RSI): Currently at 35 points, indicating the persistence of negative momentum.

Support and Resistance Levels:

- Support Levels: If the pivot point at 153.08 is breached, the pair may target 151.69, 150.72, and 149.33.

- Resistance Levels: If the pair surpasses the pivot point, it may aim for 154.05, 155.44 and 156.41.

Anticipation of U.S. Employment Data:

Market participants are closely watching the upcoming U.S. Non-Farm Payrolls (NFP), Unemployment Rate, and Average Hourly Earnings report, set to be released on Friday. These indicators are expected to have a direct impact on the USD/JPY pair.

Forecasts suggest that the U.S. economy will add 154,000 new jobs in January, following the addition of 256,000 jobs in December. The unemployment rate is expected to remain stable at 4.1%, in line with December’s figure.

Additionally, analysts predict that average hourly earnings will record a 0.3% month-over-month growth, matching December’s reading.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.