The Reserve Bank of Australia (RBA) kept interest rates unchanged at 3.85% during its meeting on July 8, 2025, defying market expectations of a 25-basis point cut. The central bank cited a more balanced outlook for inflation risks and strength in the labor market as key reasons for maintaining its current policy stance.

Recent economic data from Australia reflects resilience in the country’s economic performance, including:

- Retail sales rose 0.2% month-on-month in May, up from the previous reading of 0.0%.

- Building permits increased 3.2% month-on-month, compared to a previous decline of -4.1%.

- Despite falling short of expectations, the Manufacturing PMI continued to indicate expansion, coming in at 50.6 points in June.

- The Services PMI rose to 51.8 in June, exceeding both expectations (51.3) and the previous reading (51.3).

Notably, Australia’s Consumer Price Index stands at 2.10%, within the RBA’s target range, suggesting that inflation is well-contained and balanced.

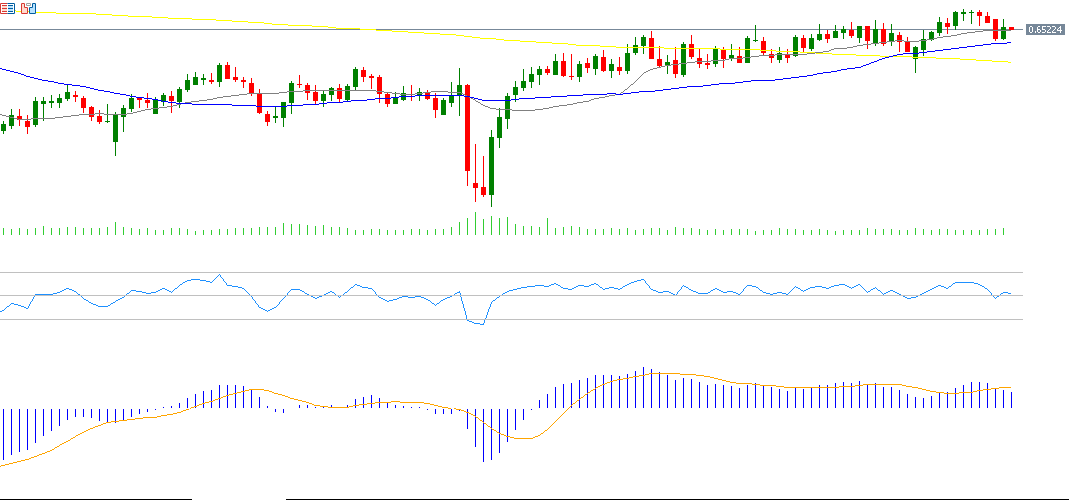

The Australian dollar (AUD) reached 0.6590 against the US dollar last week, marking its highest level since November 11, 2024. The AUD/USD pair has gained approximately 11% since bottoming out at 0.5913 on April 9, 2025, and is up around 6% year-to-date. The pair is currently trading near the 0.6525 level.

From a technical perspective, if the pivot point at 0.6515 is broken, the pair may target support levels at 0.6477, 0.6448, and 0.6410. On the upside, a break above the pivot could open the door to resistance levels at 0.6544, 0.6582, and 0.6611.

The Relative Strength Index (RSI) is currently at 52, indicating positive momentum for the AUD/USD pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.