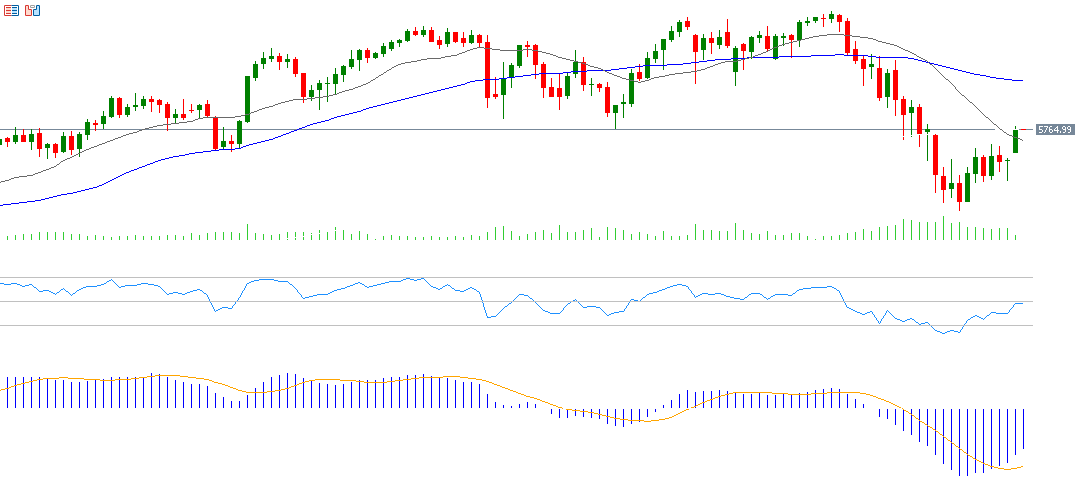

All major U.S. stock indices, including the S&P 500, Nasdaq 100, Dow, and Russell 2000 for small and mid-cap stocks, rose last week after four consecutive weeks of declines. The S&P 500 entered correction territory, having fallen about 10% from its peak of 6,147 points on February 19, 2025, to a low of 5,505 points on March 13, 2025, before bouncing back and closing yesterday at 5,768 points. Similarly, the Nasdaq 100 fell about 14% from its peak of 22,223 points on February 19, 2025, to a low of 19,153 points on March 13, 2025, before recovering and closing yesterday at 20,180 points.

There is no doubt that the U.S. markets are experiencing high volatility. If we look at the VIX (Volatility Index), it has dropped from 29.50 points to 17.50 points over the past two weeks, a decrease of about 40%. This indicates an improvement in investor sentiment, although uncertainty remains regarding the trade war between the Trump administration and other countries such as China, Canada, Mexico, and the European Union, as well as geopolitical tensions in the Middle East and concerns about the escalation of the war.

However, the question arises: Will these gains in U.S. stocks continue in the coming period?

Key factors supporting U.S. stocks:

- For example, last week, a meeting took place between President Trump and the UAE National Security Advisor, where the UAE pledged to invest $1.4 trillion in the United States over the next ten years in areas such as artificial intelligence, semiconductors, manufacturing, and energy.

- The U.S. economy compared to other economies: Despite the recent economic slowdown in the U.S., it remains better off than China, where both the consumer price index and producer price index are in contraction. Likewise, in the Eurozone and the UK, the manufacturing PMI remains in contraction, unlike in the U.S.

- Strong momentum in artificial intelligence, along with massive investments from U.S. companies and declining stock valuations, which may support the U.S. markets, particularly technology stocks tied to AI.

Main factors pressuring U.S. stocks:

- A shift of funds from U.S. stocks to Chinese stocks, with the Hang Seng index rising about 19% since the beginning of this year, along with the Hang Seng Technology index rising about 28% since the start of this year. There has also been a shift towards European stocks, particularly German stocks, where the DAX index has risen about 15% since the beginning of this year, especially with plans to stimulate the German economy through increased defense and infrastructure spending.

- Concerns about the U.S. economy entering a recession.

- The trade war between the Trump administration and several countries like Canada, Mexico, China, and the European Union, particularly regarding tariffs, which has led investors to exit high-risk assets like U.S. stocks and cryptocurrencies.

From a technical perspective, the S&P 500 broke above its 20-day moving average (gray line) at 5,736 points yesterday. The biggest challenge now is reaching the resistance level, which is the 50-day moving average (blue line) at 5,914 points.

The Relative Strength Index (RSI) is currently at 49 points, nearing the neutral level of 50 points. Any upward breakout above this level would indicate the beginning of positive momentum for the S&P 500.

The MACD shows a bullish crossover between the MACD line (blue) and the Signal Line (orange), which provides positive momentum for the S&P 500.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.