Yesterday, the Bank of Canada lowered interest rates by 50 basis points, from 5.25% to 4.75%, aligning with market expectations. This reduction is the fourth in a row this year, following three decreases of 25 basis points each.

The exchange rate of the US dollar against the Canadian dollar continues its upward trend, registering yesterday at 1.3862, the highest level since August 5, 2024. The price of the US dollar against the Canadian dollar has risen by about 3% since the low of September 25, 2024, where it was at 1.3419, to the peak recorded yesterday at 1.3862. It has risen by approximately 4% since the beginning of the year to date.

Recent economic data from Canada shows that the Canadian economy is experiencing weakness, as:

- The Consumer Price Index (CPI) declined year-on-year, registering 1.6%, which is lower than expectations (1.8%) and the previous reading (2.00%), and below the target rate set by the Bank of Canada of 2%.

- The trade balance index showed a deficit of CAD 1.10 billion, which is lower than expectations (-CAD 0.40 billion) and the previous reading (-CAD 0.29 billion).

It is noteworthy that an important factor has provided upward momentum for the US dollar against the Canadian dollar: the strength and resilience of the US economy, especially with labor market and inflation data outperforming analysts’ expectations, in addition to cautious statements from US monetary policymakers.

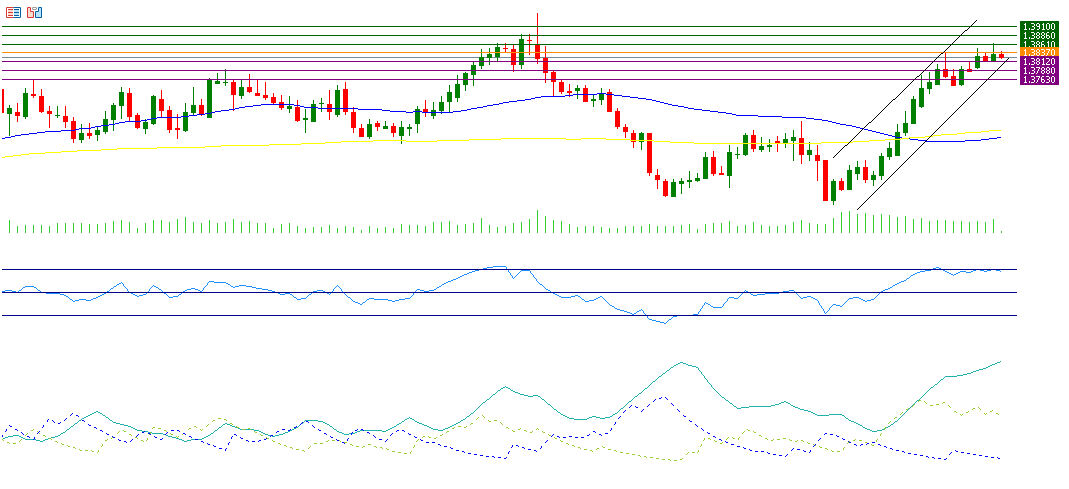

Regarding the technical side, if the pivot point of 1.3837 for the U.S. dollar against the Canadian dollar is broken, there is a possibility that it will target support levels of 1.3812, 1.3788, and 1.3763. On the other hand, if it surpasses the pivot point, it is likely to target resistance levels of 1.3861, 1.3886, and 1.3910.

Currently, the Relative Strength Index (RSI) registers at 68 points, suggesting positive momentum for the US dollar against the Canadian dollar.

The Positive Directional Indicator (DMI+) registers around 33 points, while the Negative Directional Indicator (DMI-) is at approximately 8 points. We observe a significant gap between these two indicators, indicating that buying pressure on the US dollar against the Canadian dollar is strong. Most importantly, the Average Directional Index (ADX) registers around 40 points, indicating that the momentum of this upward trend is strong.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.