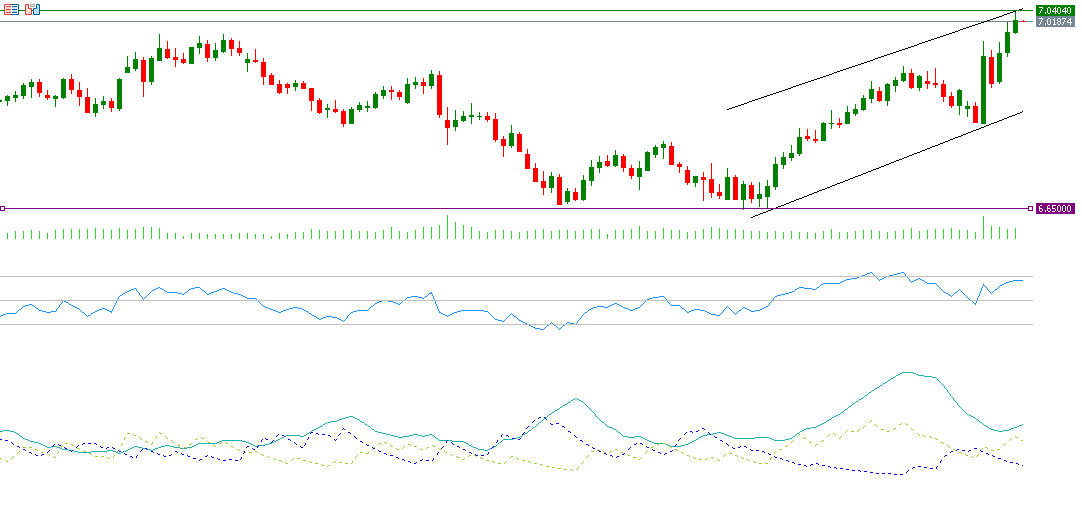

The US dollar continues its upward trend against the Danish krone, reaching 7.0404 yesterday, marking its highest level since November 2, 2024. The USD/DKK pair has risen by approximately 6% since the low of September 25, 2024, when it stood at 6.6500, up to the peak recorded yesterday at 7.0404. The pair has also risen by about 4% since the beginning of the year.

Recent Danish economic data shows that the Danish economy is struggling, as evidenced by:

- A decline in the industrial production index on a monthly basis for September, registering a contraction of 4.9%, which is lower than the previous reading of -4.8%.

- Retail sales declined year-on-year in September, showing a growth of 0.5%, which is lower than the previous reading of 2.9%.

- The consumer confidence index for October dropped by 8.9 points, lower than the previous reading of -6.8, marking its lowest level since December 2023.

It is worth noting that several factors have provided upward momentum for the USD/DKK pair, including the strength and resilience of the US economy, as well as the fact that the dollar is considered a safe haven amid ongoing geopolitical tensions in the Middle East. Additionally, the return of Donald Trump to the presidency, particularly his promise to reduce corporate taxes and impose tariffs on foreign imports, could further fuel US inflation.

From a technical perspective, if the pivot point of 6.9890 is broken for the USD/DKK pair, there is a possibility that it will target support levels at 6.9612, 6.9227, and 6.8949. If the pivot point is surpassed, the pair is likely to target resistance levels at 7.0275, 7.0553, and 7.0938.

The Relative Strength Index (RSI), which currently stands at 67, is approaching overbought territory, indicating positive momentum for the USD/DKK pair.

The Positive Directional Indicator (DMI+) is currently at around 32 points, compared to the Negative Directional Indicator (DMI-), which is at around 8 points. The significant gap between these two indicators suggests strong buying pressure on the USD/DKK pair. More importantly, the Average Directional Index (ADX) is at around 40 points, indicating that the upward trend momentum is strong.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.