By Samir El Khoury

Following a transition in Turkey’s monetary policy from unconventional to conventional, the Turkish Central Bank, under the leadership of Governor Hafiza Ghaya Arkan appointed in June 2023, implemented a substantial 31.50% interest rate hike, reaching a total interest rate of 40%.

A few days ago, Arkan stated that the monetary tightening cycle was nearing its end, calling on foreign investors to consider investing in government bonds denominated in Turkish lira. Additionally, Arkan pointed out that the tight monetary policy has started influencing consumer prices, with an expectation that inflation will not drop below 10% before 2026.

In November, the Consumer Price Index on an annual basis stood at 61.98%, slightly below expectations (63%) but higher than the previous reading (61.36%).

Market anticipation is building for the Turkish Central Bank’s upcoming interest rate decision, with expectations suggesting a 250 basis points increase, potentially raising the interest rate to 42.50%.

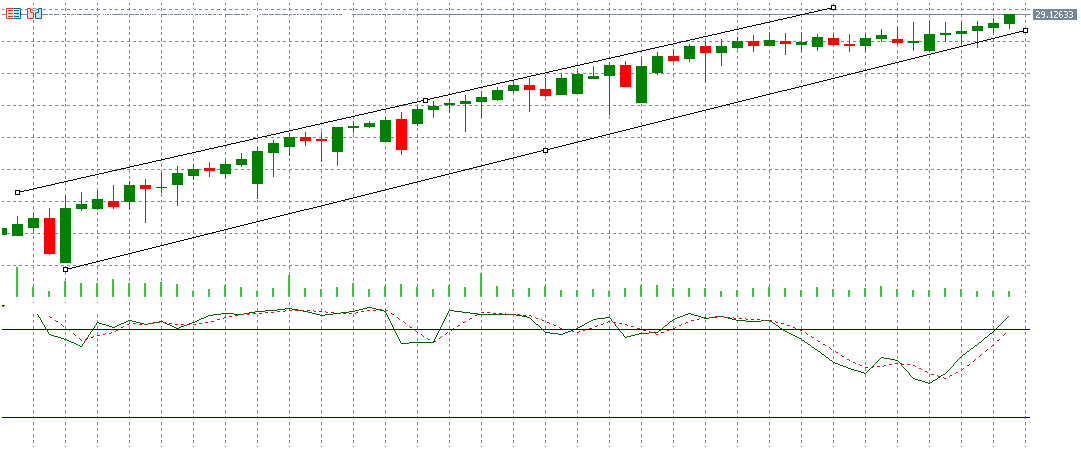

Technically, the US dollar against the Turkish lira pair is currently recording 29.1240, and the trend is still bullish for this pair.

The Positive Movement Index (DMI+) stands at around 14 points, contrasting with the Negative Movement Index (DMI-), which hovers around 6 points. The substantial gap between these indicators signifies robust purchasing pressures favouring the US dollar against the Turkish lira. Notably, the ADX trend strength index in green registers about 41 points, exceeding 25 points, indicating strong momentum in the upward trend.

Turning to the Stochastic indicator, it currently signals OVERBOUGHT levels, suggesting potential caution in the market.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.