By Samir Al Khoury,

Yesterday, the Central Bank of Turkey kept interest rates unchanged at 50% for the fifth consecutive month, aligning with analysts’ expectations. Despite a decline in the consumer price index (CPI) on an annual basis in July—falling to 61.78%, below expectations of 62.10% and the previous reading of 71.60%—the index remains significantly above the Turkish central bank’s inflation target of 14%. Additionally, real interest rates are still negative, indicating a substantial gap between nominal interest rates and the inflation rate. This may compel the Turkish central bank to maintain its tight monetary policy, keeping interest rates unchanged for an extended period to curb inflation.

Recent Turkish economic data reveals ongoing weakness in the economy:

-

The unemployment rate rose to 9.2% in July, exceeding expectations of 8.2% and the previous reading of 8.5%.

-

The manufacturing PMI dropped to 47.2 in July, down from the previous reading of 47.9.

-

The industrial production index fell by 17.2% in June, compared to a previous decline of 22.9%.

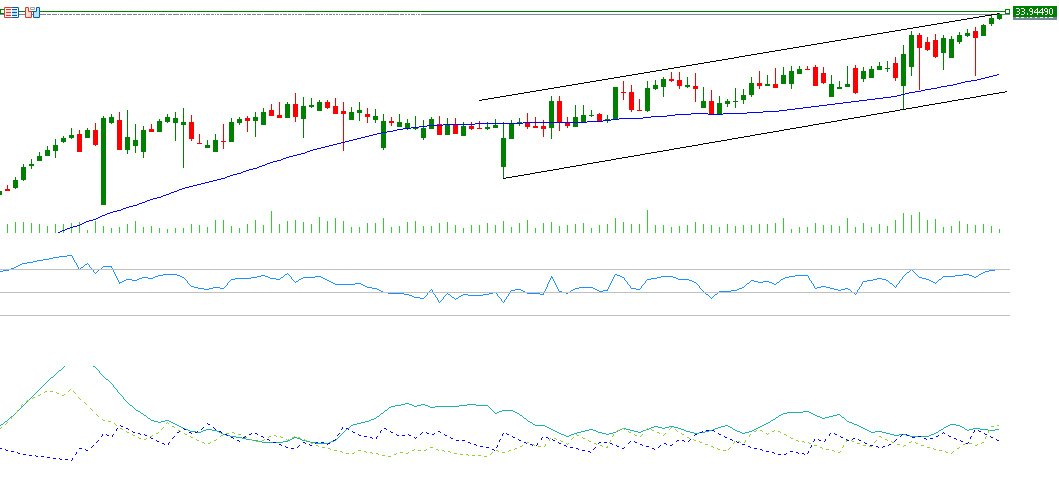

The USD/TRY pair continues its upward trajectory, reaching a new record high of 33.9449 today. This positive momentum appears likely to persist in the near term, with the USD/TRY having gained approximately 15% since the beginning of the year. The pair is currently hovering around 33.90.

From a technical standpoint, the USD/TRY pair seems poised to continue its uptrend in the coming period, supported by strong momentum. The Relative Strength Index (RSI) is currently at 80 points, indicating strong bullish momentum. The positive directional movement index (DMI+) is recording around 19 points, while the negative directional movement index (DMI-) stands at approximately 4 points, highlighting a significant gap between the two indicators. This suggests strong selling pressure on the Turkish lira against the dollar. Furthermore, the Average Directional Index (ADX) is at around 41 points—well above the threshold of 25 points—indicating that the upward momentum of the USD/TRY pair is robust.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.