By Samir Al Khoury

How have Bitcoin and Ethereum performed since the beginning of this year until today?

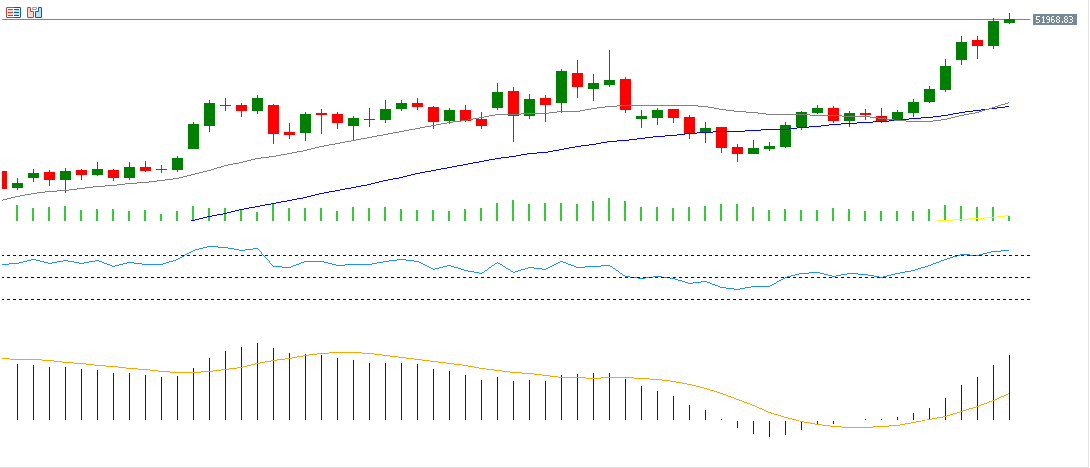

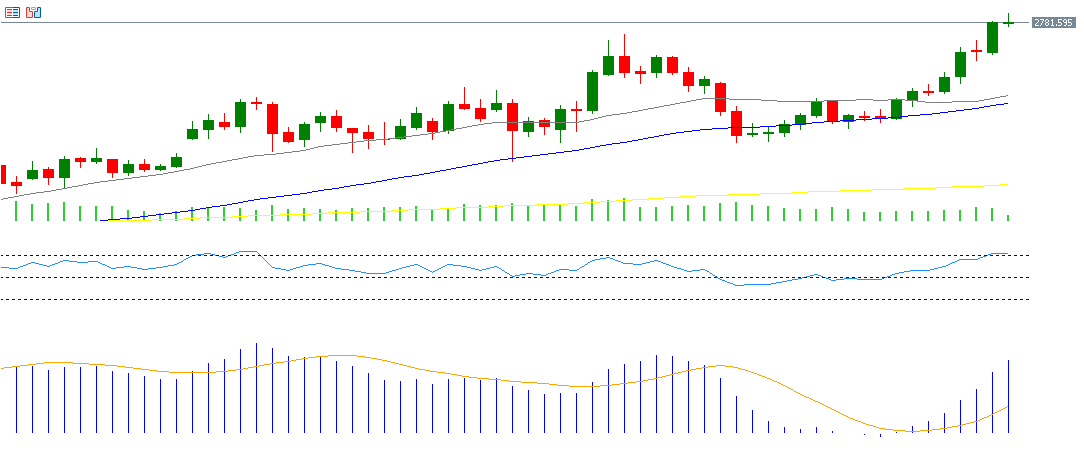

It appears that both Bitcoin and Ethereum have been on an upward trajectory since the beginning of this year until today, with their prices reaching $52,545 and $2,822 respectively. This marks the highest level for Bitcoin since December 4, 2021, and for Ethereum since May 5, 2022.

The price of both Bitcoin and Ethereum has increased by approximately 24% since the beginning of this year until today.

The next challenge for both Bitcoin and Ethereum is to reach the levels of $69,000 and $4,868, respectively, which represent their all-time highs recorded on November 10, 2021.

What are the most prominent factors that may support both Bitcoin and Ethereum to continue their upward momentum in the next stage?

- The potential approval by the US Securities and Exchange Commission to establish exchange-traded funds (ETFs) for direct investment in Ethereum, expected in May of this year, brings significant optimism to the market.

- The anticipated Bitcoin halving scheduled for April 2024 will reduce the rate of new currency issuance, effectively decreasing the supply, which historically has led to price increases.

- Speculation surrounding the possibility of the Federal Reserve initiating interest rate cuts in the middle of the second half of this year could stimulate investment in cryptocurrencies as alternative assets.

- Notably, large institutions are steadily incorporating Bitcoin into their portfolios, albeit in small proportions, driven by the need for diversification and growing confidence in the industry’s long-term potential.

What are the options market traders betting on regarding Bitcoin’s trajectory?

Options market traders are bullish on Bitcoin, betting that it will soon surpass its previous all-time high of $69,000 recorded in November 2021.

What is the technical outlook for Bitcoin and Ethereum?

The technical outlook for both Bitcoin and Ethereum appears promising, with several indicators suggesting potential support for their prices in the near term:

Firstly, there’s consistency and an upward trend in the moving averages for 20, 50, and 200 days.

Secondly, the Relative Strength Index (RSI) indicates entry into the overbought zone, suggesting strong upward momentum.

Thirdly, the Moving Average Convergence Divergence (MACD) indicator shows the blue line exceeding the orange SIGNAL LINE and residing in the positive zone, providing further bullish momentum for the leading cryptocurrency.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk