Bitcoin prices kicked off October with strong performance — a month historically known as “Uptober” due to the positive momentum the cryptocurrency often sees during this period.

Yesterday, Bitcoin reached approximately $121,000, marking its highest level since August 14, when it hit a peak around $124,500. The price has risen by about 11% since the low recorded on September 25 near $108,600, climbing steadily to its recent high.

Year-to-date, Bitcoin is up approximately 29%, outperforming major U.S. equity indices. It is currently hovering above the $120,000 level.

Despite recent price volatility, Bitcoin remains attractive to investors, especially as it continues to trade above the psychological threshold of $100,000. The bullish momentum appears likely to persist in the near term.

Key factors supporting Bitcoin’s rise include:

- Increased demand for “digital gold” — investors are turning to Bitcoin amid growing uncertainty surrounding a potential U.S. government shutdown.

- Renewed inflows into Bitcoin ETFs — after outflows of $405 million last week, institutional investment has returned strongly this week.

- Net inflows into crypto-related exchange-traded products have exceeded $4.1 billion over the past four weeks.

- Market expectations of further interest rate cuts — markets anticipate an additional 50 basis points of Fed rate cuts by year-end.

- Rising risk appetite — both public and private companies, along with governments, investment funds, and individual investors, are increasingly adding Bitcoin to their portfolios as part of a diversification strategy, fueled by growing optimism around the future of the crypto industry.

It’s also worth noting that the Bloomberg Cryptocurrency Index has jumped over 106% in the past six months, with bullish momentum likely to continue in the coming period.

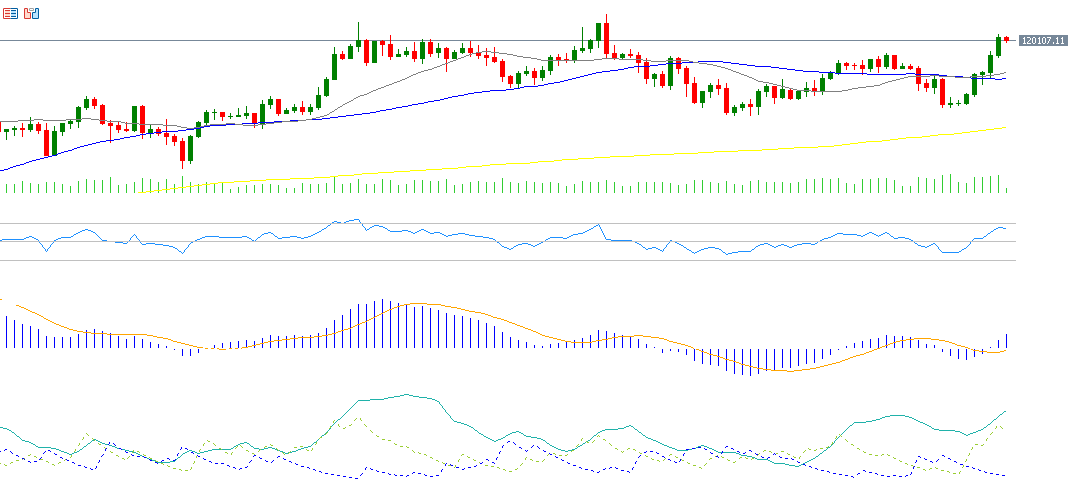

From a technical perspective, several indicators point to sustained upward momentum for Bitcoin:

- A bullish Golden Cross has occurred between the 20-day and 50-day moving averages — a classic sign of an ongoing uptrend.

- The Relative Strength Index (RSI) is currently at 65, indicating strong bullish momentum.

- The Positive Directional Movement Index (+DMI) is at approximately 35, while the Negative DMI (-DMI) is around 14 — reflecting strong buying pressure.

- A bullish crossover between the MACD and Signal Line has taken place in positive territory, reinforcing the upside trend.

Key resistance levels ahead:

The main challenge now for Bitcoin is to break through the strong resistance at $120,000 and then reclaim the previous high of $124,500. If it manages to do so and hold above it, this could pave the way for a rally toward $130,000 and potentially $140,000 in the near term — especially if the supporting fundamentals and investment flows continue.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.