By Samir Al Khoury,

The price of the US dollar against the Swiss franc fell by about 1% yesterday, recording 0.9031 and is currently hovering near the 0.9050 levels. However, it is still up by about 8% since the beginning of the year until today.

Recent Swiss economic data show that the Swiss economy is truly resilient, as:

-

The GDP index rose on a quarterly basis, registering a growth of 0.5%, a rate that exceeded expectations and the previous reading of 0.3%, marking its highest level in two years.

-

The trade balance rose to 4.316 billion Swiss francs, surpassing expectations of 3.980 billion and the previous reading of 3.767 billion.

-

Retail sales increased on an annual basis, registering a growth of 2.7%, which exceeded expectations of 0.2% and the previous reading of -0.2%.

The consumer price index rose on an annual basis in Switzerland, recording 1.4% in April, a rate that exceeded expectations of 1.1% and the previous reading of 1.0%. This indicates the possibility of the Swiss Central Bank maintaining interest rates at their current level of 1.50% at its meeting on June 20, 2024, after reducing them by 25 basis points at its meeting on March 21, 2024. Notably, the Swiss Central Bank was the first to start reducing interest rates this year.

Today, analysts are closely awaiting the release of the core personal consumption expenditures price index in the United States, which is a crucial indicator favored by the US Federal Reserve. They are also anticipating the release of the consumer price index in Switzerland next week, specifically on Tuesday, June 4, 2024.

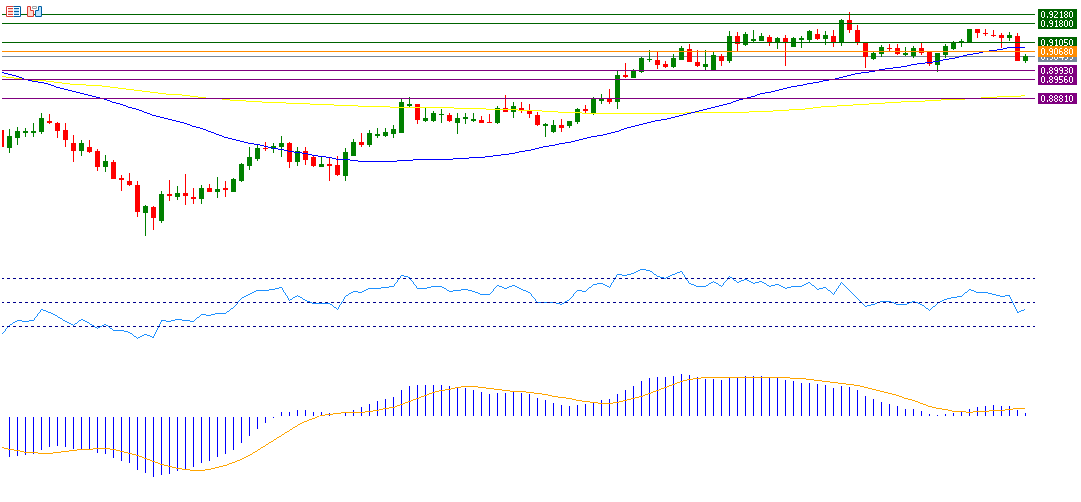

From a technical perspective, if the pivot point of 0.9068 for the US dollar against the Swiss franc is broken, it could target the support levels of 0.8993, 0.8956, and 0.8881. If it exceeds the pivot point, it is likely to target the resistance levels of 0.9105, 0.9180, and 0.9218. The Relative Strength Index (RSI), currently at 44 points, indicates negative momentum for the USD/CHF pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.