By Samir Al Khoury,

The price of the US dollar against the Japanese yen continues its upward trend for the fourth day in a row, reaching 157.35 today. This marks an increase of about 12% since the beginning of the year. The next significant challenge is the 160.20 level, which was recorded on April 29, 2024.

Japan’s GDP index on an annual basis in the first quarter of this year recorded a contraction of 1.8%. The Manufacturing Purchasing Managers’ Index also declined, registering a growth of 50.4 points, which is lower than both expectations and the previous reading of 50.5.

The persistent difference between Japanese and US government bond yields exerts pressure on the yen. For example, the 10-year Japanese government bond yield is approximately 0.98%, while the 10-year US Treasury bond yield is around 4.41%, resulting in a gap of about 3.43%. This significant gap encourages interest trading or carry trade.

Additionally, several US economic indicators, particularly labor market data such as the non-farm payrolls report and average hourly wages, have surpassed analysts’ expectations, bolstering the dollar against all major currencies, especially the yen.

Today, markets are closely awaiting the Federal Reserve’s interest rate decision, with expectations that it will keep rates unchanged at 5.25% to 5.50%. Investors are also focused on the dot plot, which provides updated estimates from the Monetary Policy Committee members regarding the future path of interest rates, growth, and inflation. Furthermore, Federal Reserve Chairman Jerome Powell’s speech will be closely scrutinized for clues about the timing of the first rate cut. On Friday, markets will also be watching the Bank of Japan’s interest rate decision, with expectations that it will maintain rates at 0.1%.

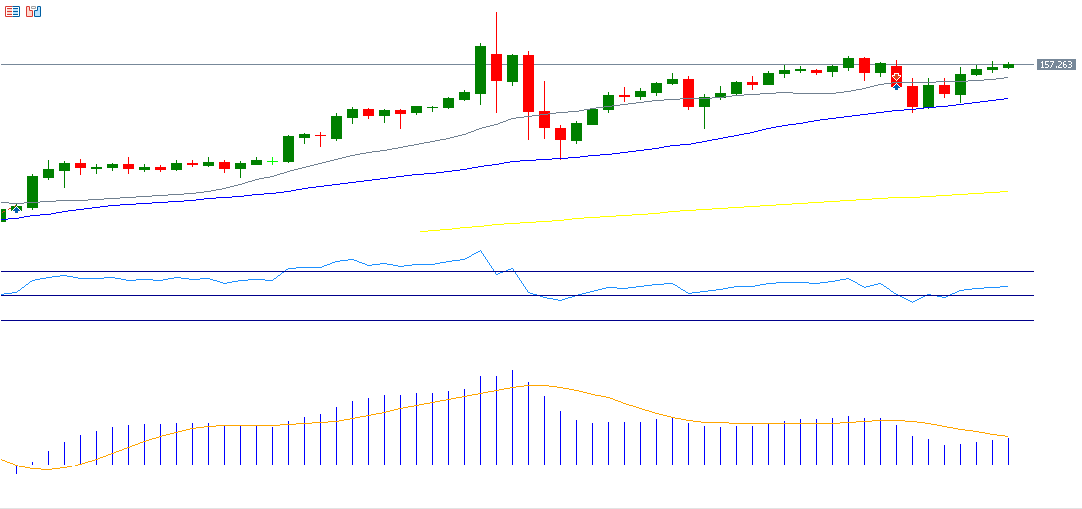

Technical indicators suggest the USD/JPY pair may continue its upward trend for several reasons:

-

The alignment and upward trend of the 20-, 50-, and 200-day moving averages, with the 20-day average above the 50-day average, and the 50-day average above the 200-day average.

-

The Relative Strength Index (RSI), currently at 58 points, indicates upward momentum for the USD/JPY pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.