By Camilo Botia,

Wall Street began the week cautiously as investors prepared for crucial inflation data that could influence Federal Reserve policy and global markets. While stocks, bonds, and the dollar experienced minor fluctuations, the upcoming consumer price index (CPI) report is expected to moderate inflation, though still elevated.

Analysts are cautioning about a potential disruption in the recent calm of the stock market. Options traders are placing bets on a significant move in the S&P 500 after the CPI report, underscoring concerns about the potential impact of stronger-than-expected or weaker-than-expected growth.

Goldman Sachs indicates that US stocks and bonds are facing upside risk as traders continue to build long positions. This trend suggests that investors may keep buying into the market even if it declines. However, JPMorgan analysts express caution due to elevated interest rates, weakening growth, and limited potential returns. They believe the macro outlook is uncertain and that equities are entering a seasonally challenging period.

Despite high valuations, Goldman Sachs remains optimistic about the stock market due to strong corporate earnings and confidence in the disinflation path. Historical data also suggests that staying invested in the market, even after significant gains, can be beneficial in the long run.

This week will also see the release of retail sales data in addition to the CPI report. Guidance from major retailers like Walmart and Home Depot will offer insights into consumer sentiment amid signs of rising joblessness. Analysts are revising their earnings forecasts for the current quarter upwards, indicating that the worst corporate profit slump may be over.

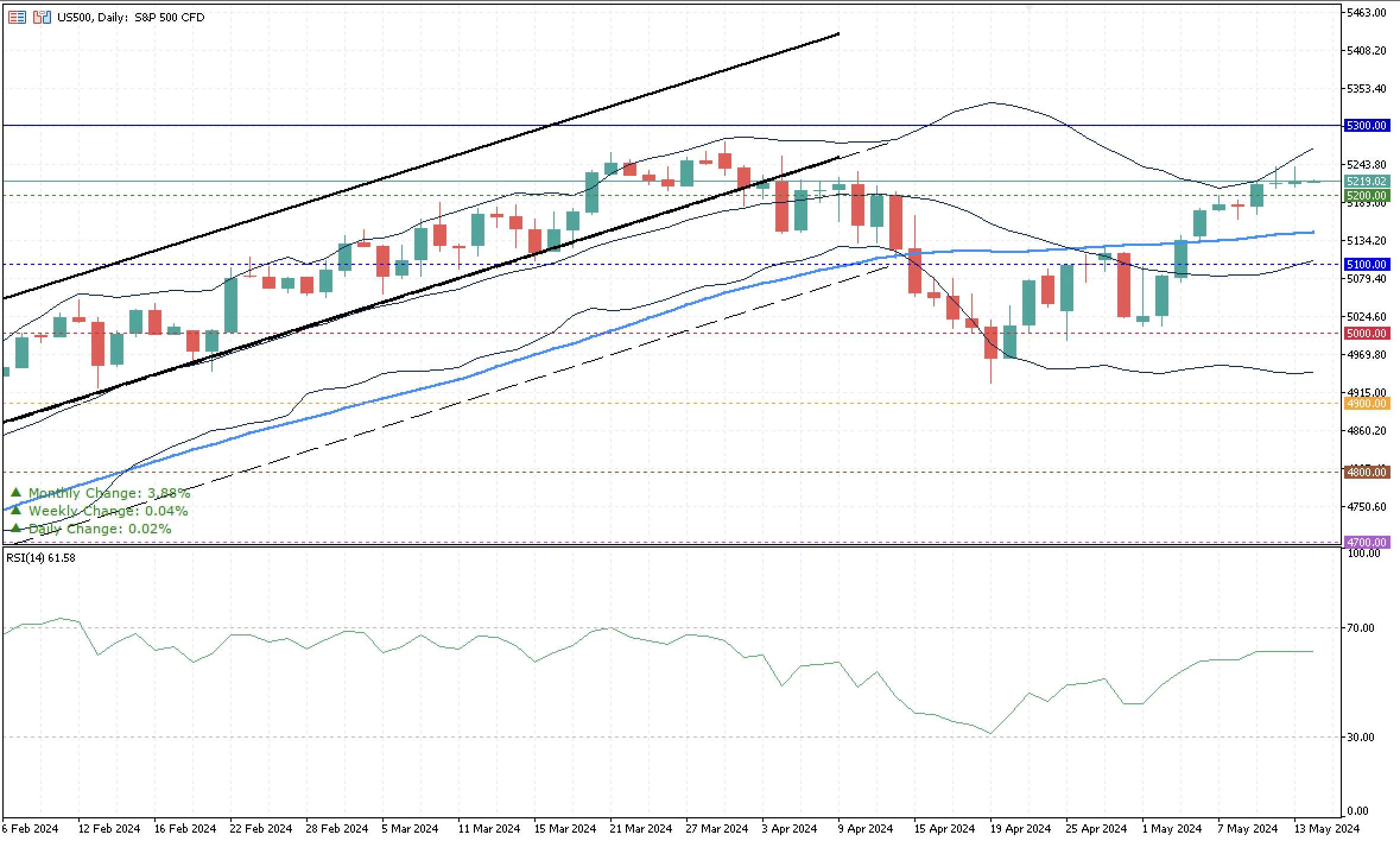

The week ahead is crucial for Wall Street as investors await critical inflation data and assess its potential impact on monetary policy and market performance. While there are differing opinions on the market outlook, the overall sentiment remains cautious, anticipating potential volatility. The S&P 500 has been hovering above 5,200, almost flat for the last two days. Bullish momentum on the stocks will cause the index to reach higher highs with its next significant resistance at 5,300. On the other hand, bearish momentum will cause the index to test the 5,200 level before reaching its 50-day moving average at 5,144.18.