By Camilo Botia

The S&P 500 and Dow Jones Industrial Average soared to record highs on Thursday, fueled by a surge in growth and technology stocks. This rally was ignited by chipmaker Nvidia’s impressive earnings report and optimistic outlook, which calmed concerns about the recent tech rally’s sustainability and convinced investors that there’s still room for growth in the AI sector.

Nvidia’s shares skyrocketed after the company beat expectations for both fourth-quarter revenue and provided a bullish forecast for the coming quarter. This strong performance was a significant test for the AI-fueled rally that pushed the S&P 500 past the 5,000 mark earlier this month.

Beyond Nvidia, the positive sentiment spilled over to other growth stocks. Other AI-related companies like AMD, Super Micro Computer, and Arm Holdings also saw their shares jump, riding the wave of optimism surrounding the potential of artificial intelligence. This broad-based rally suggests that investors are confident in the overall health of the tech sector and believe that there’s more upside to come.

Meanwhile, investors are now leaning towards June as the starting point for the first rate cut from the Federal Reserve. The recent robust economic data and the tight labour market likely influence this expectation to shift. However, Fed Vice Chair Philip Jefferson emphasized the importance of evaluating all incoming economic data before making decisions about rate adjustments, suggesting that the Fed’s policy path remains uncertain.

Overall, Thursday’s market surge demonstrates the continued optimism surrounding AI technology and its potential to drive growth. While there are some concerns about potential rate changes from the Fed and the performance of specific sectors, the solid economic data and Nvidia’s performance suggest a bullish outlook for the near future, with investors eagerly awaiting the next chapter in the AI-fueled tech rally.

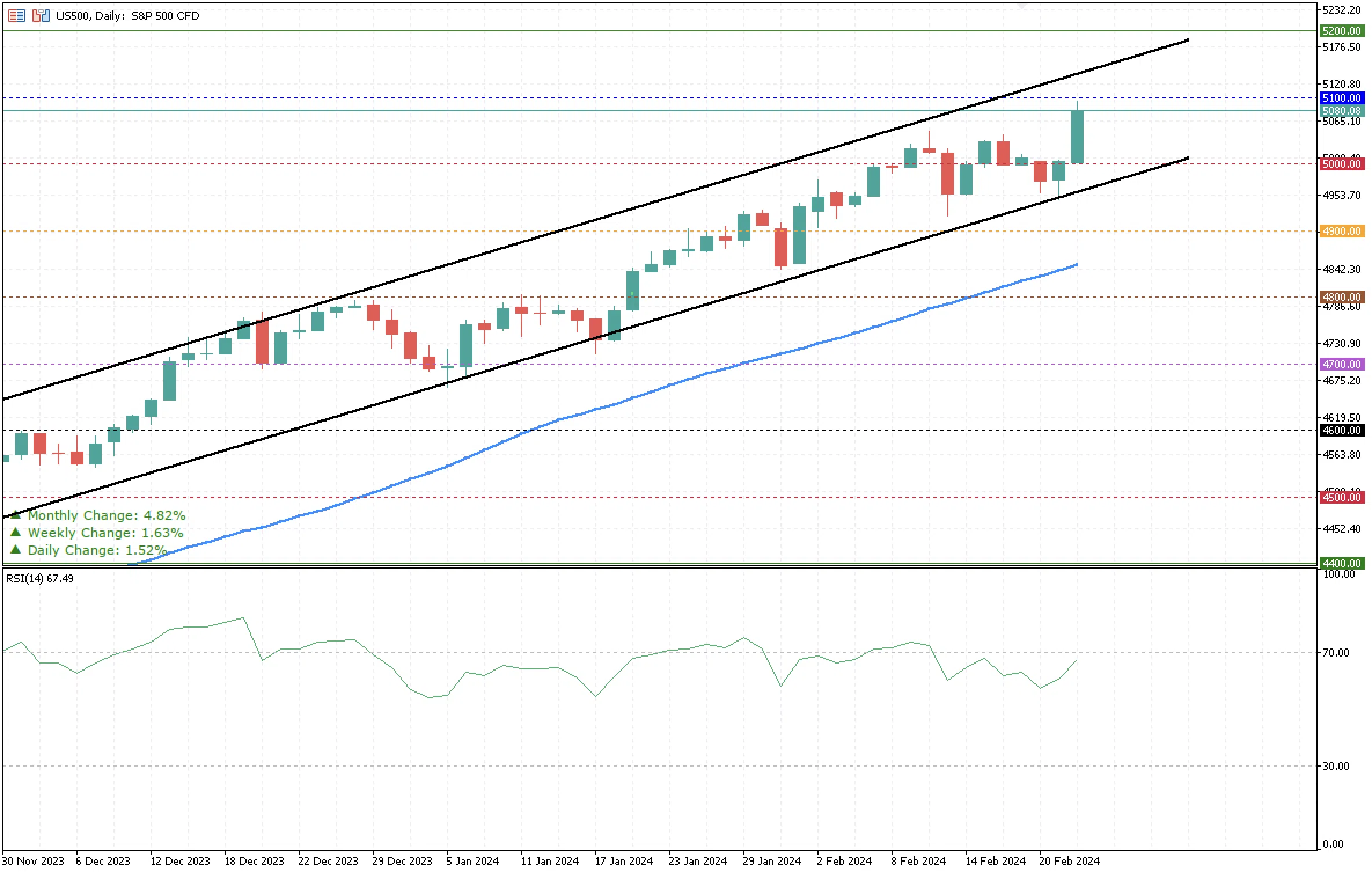

The S&P 500 has surpassed the $5,000 mark and reached an all-time high on Thursday at $5,095.19, just below the next resistance at $5,100. The AI rally has kept the Index bullish, and it’s getting closer to an overbought market, as shown in the RSI indicator, which is now at 67.7 and rising, leaving space for higher highs in the upcoming days. The S&P 500 is up 4.82% during the month and will likely close with gains next week. If the price were to break the $5,100 mark, the next potential level is at around $5,200. On the other hand, as a support, there is the $5,000 mark and the lower boundary of the bullish channel.