Chinese economic data has shown significant slowdown recently, prompting the need for additional stimulus measures to support growth, production, and consumption by Chinese authorities. Key developments include:

- Industrial production grew by 5.2% year-on-year in August, falling short of expectations and the previous reading of 5.7%.

- Unemployment rate rose to 5.3%, higher than both expectations and the previous figure of 5.2%.

- Retail sales grew by 3.4% year-on-year in August, below expectations (3.8%) and the previous reading (3.7%).

- Fixed asset investment declined to a growth rate of 0.5% year-on-year, underperforming both expectations (1.5%) and the prior reading (1.6%).

- Exports grew by 4.4% year-on-year in August, falling short of expectations (5.0%) and the previous figure (7.2%).

- Imports increased by 1.3% year-on-year in August, missing expectations (3.0%) and the previous reading (4.1%).

- Consumer Price Index (CPI) recorded a year-on-year deflation of -0.4%, below expectations (-0.2%) and the previous reading (0.0%).

- Producer Price Index (PPI) contracted by 2.9% year-on-year, in line with expectations but above the previous reading (-3.6%).

Despite the ongoing trade truce between China and the United States, uncertainty continues to loom over the future of bilateral trade relations. Meanwhile, competition between the two countries is intensifying in the fields of technology and artificial intelligence. China has accelerated efforts to develop and manufacture domestic semiconductor chips, gradually reducing reliance on American imports, which Chinese authorities consider a threat to national security.

Markets are closely watching the upcoming trade talks between China and the United States, scheduled to take place in Madrid from September 14 to 17.

On the currency front, the USD/CNH exchange rate reached 7.1153 on Friday, August 29 — its lowest level since November 6, 2024. The pair has declined by about 3% year-to-date and is currently trading around 7.1200. Despite ongoing challenges in the real estate sector, expectations of three U.S. interest rate cuts this year, combined with continued political pressure from President Donald Trump on the Federal Reserve, which raises questions about the central bank’s independence, have led to a weakening of the U.S. dollar against most major currencies, including the Chinese yuan.

As for equities, the Hang Seng Index has surged by approximately 32% year-to-date, outperforming U.S., European, and Japanese stock indices. The Hang Seng Tech Index has also climbed around 35% during the same period, outpacing the performance of the U.S. Nasdaq 100.

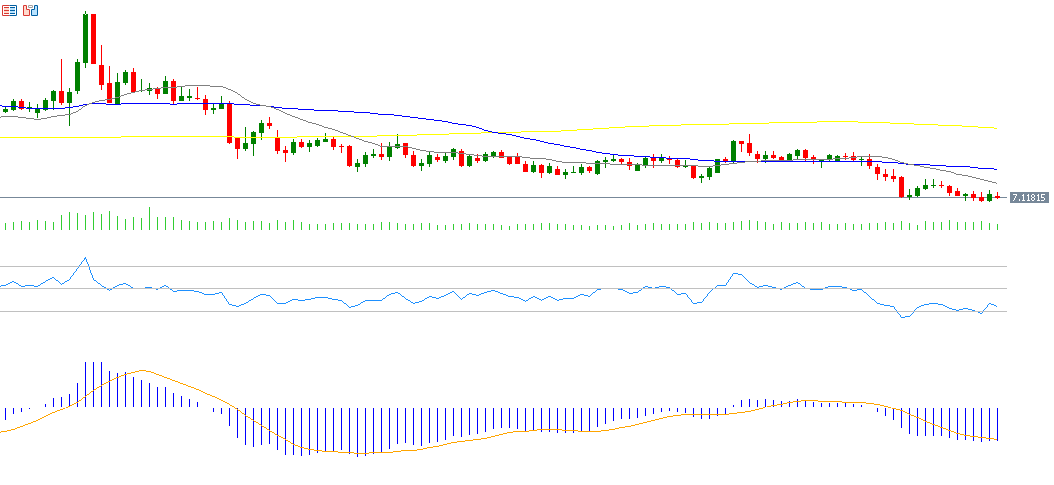

Technical Analysis of USD/CNH Suggests Possible Downtrend

Several technical indicators point to a potential further decline in the USD/CNH pair in the near term:

- Death Cross: A bearish crossover has occurred between the 20-day moving average (grey) and the 50-day moving average (blue), indicating downward momentum.

- Relative Strength Index (RSI) is currently around 36, signaling bearish momentum.

- MACD Indicator: The blue MACD line is below the orange signal line, suggesting continued negative momentum.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.