The price of the US dollar against the Swedish krona continues its upward trend, reaching 10.6852 yesterday, the highest level since August 2, 2024. The USD/SEK pair has risen approximately 7% since the low on September 30, 2024, where it recorded 10.0274, up to the peak it reached yesterday at 10.6852. It has also increased by about 6% since the beginning of the year.

Recent Swedish economic data shows that the Swedish economy is experiencing weakness, as evidenced by:

- The GDP growth rate on a year-over-year basis for the third quarter of this year recorded a contraction of 0.1% yesterday, which is below expectations (0.7%) and the previous reading (0.5%).

- The Consumer Price Index (CPI) on a year-over-year basis in September registered 1.6%, matching expectations but lower than the previous reading (1.9%), and below the target rate set by the Swedish central bank of 2%.

- The Manufacturing Purchasing Managers’ Index (PMI) in September recorded a growth rate of 51.3, lower than the previous reading (52.6).

- The Services PMI in September recorded a contraction of 49.1, lower than the previous reading (52.4).

- The unemployment rate in September increased to 8.2%, higher than the previous reading (7.9%).

It is noteworthy that an important factor contributing to the upward momentum of the USD/SEK pair is the strength and resilience of the US economy, in addition to the dollar being considered a safe haven amid current geopolitical tensions in the Middle East.

The Swedish central bank has lowered interest rates by 75 basis points this year, from 4.00% to 3.25%, following three reductions of 25 basis points each.

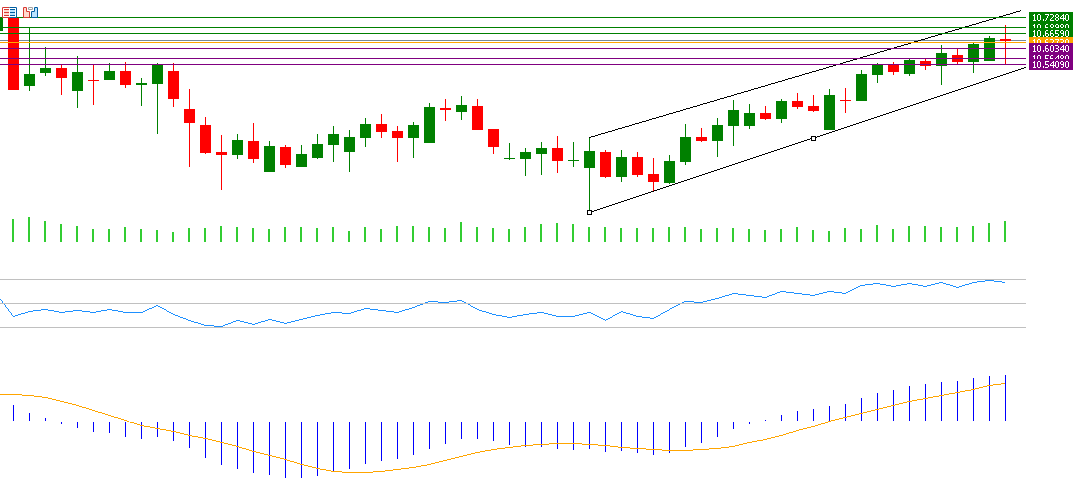

On the technical side, if the pivot point of 10.6273 for the USD/SEK pair is broken, there is a possibility of targeting support levels of 10.6034, 10.5648, and 10.5409. If the pivot point is exceeded, resistance levels of 10.6659, 10.6898, and 10.7284 may be targeted.

The Relative Strength Index (RSI), currently at 70, indicates that the pair is in the overbought zone, suggesting positive momentum for the USD/SEK pair. Meanwhile, the MACD indicator, in blue, is crossing above the signal line, in orange, indicating upward momentum for the USD/SEK pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.