Last week saw the release of several key economic indicators globally. In the United States, the data presented mixed signals. While jobless claims rose, and both the ADP private employment report and the manufacturing and non-manufacturing PMIs declined, the Non-Farm Payrolls report and the Job Openings and Labor Turnover Survey (JOLTS) showed relatively positive results. Markets remain focused on the Federal Reserve’s stance on interest rates.

In the Eurozone, the European Central Bank (ECB) cut interest rates as expected amid declining inflation indicators and relatively positive GDP and PMI data. In the UK, PMI readings improved across all three sectors, although industrial activity remained below the growth threshold.

In Canada, the central bank held interest rates steady, and employment data outperformed expectations. Meanwhile, in Switzerland, GDP figures showed healthy growth, and inflation remained at low levels.

In Australia, GDP growth slowed along with weaker manufacturing and services PMI data. Japan, on the other hand, saw improvement in industrial activity and continued expansion in the services sector.

China’s data showed a sharp drop in the Caixin Manufacturing PMI — the lowest reading since September 2022 — while the services sector continued to grow.

Market Analysis

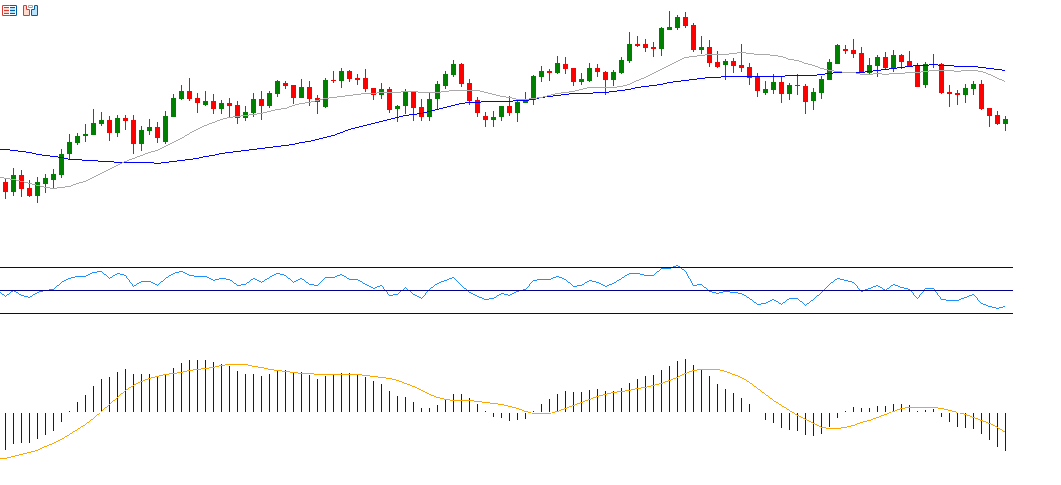

GBP/USD

The British pound has risen by approximately 8% year-to-date against the U.S. dollar. On Thursday, June 5, 2025, the pair reached 1.3616 — the highest level since February 23, 2022. This bullish momentum is driven by a weaker U.S. dollar and improved UK economic data. The Relative Strength Index (RSI) currently stands at 59, indicating positive momentum. The MACD also shows a bullish crossover between the MACD line (blue) and the signal line (orange), further supporting the bullish outlook.

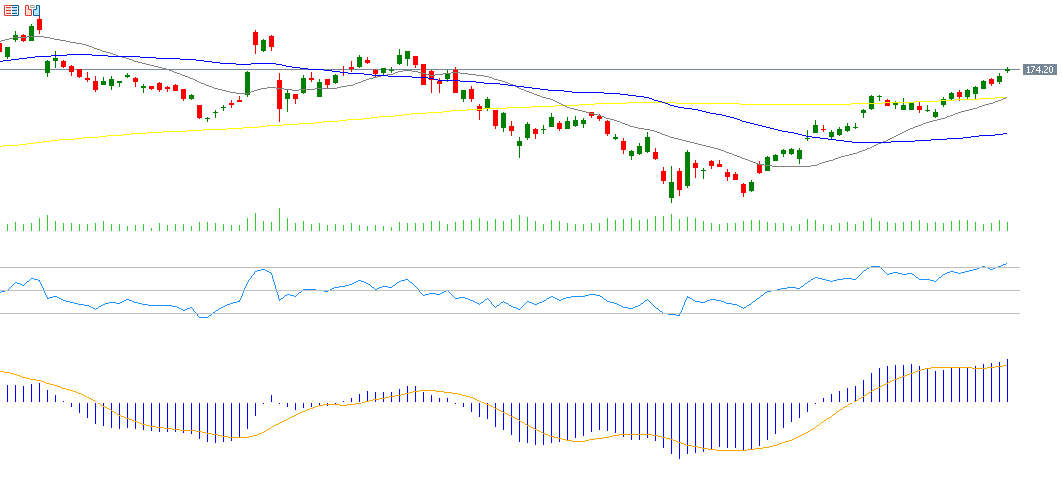

Oracle

Oracle’s share price has increased about 4% year-to-date. Markets are closely watching the company’s financial results scheduled for Wednesday, June 11, 2025. Analysts expect earnings of $1.64 per share, up from $1.63 previously, and revenues of $15.58 billion compared to $14.30 billion previously. The RSI currently sits at 74, indicating overbought territory and strong bullish momentum. The MACD also shows a bullish crossover, reinforcing the positive sentiment.

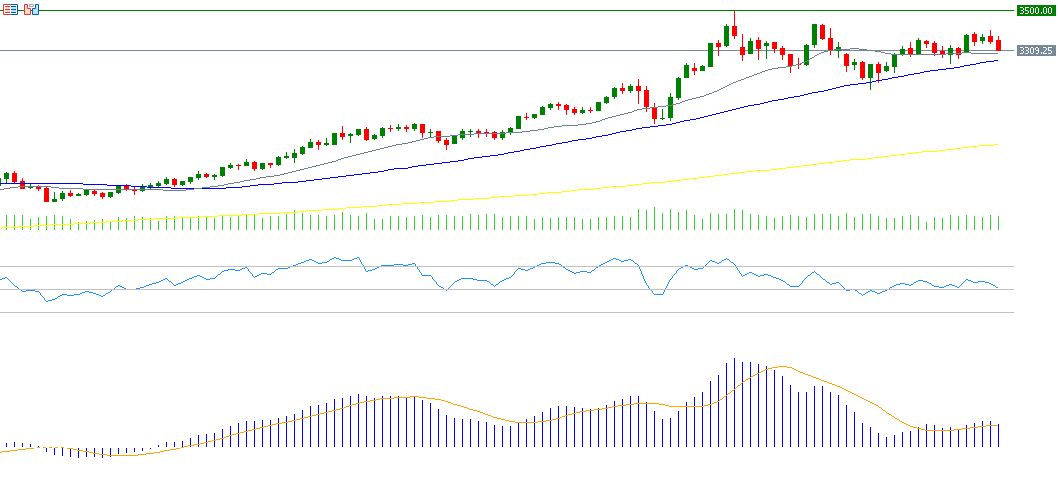

Gold

Gold prices reached an all-time high of $3,500 on April 22, before pulling back to $3,121 on May 15 — an 11% decline. However, prices rebounded to $3,404 on Thursday, June 5, marking a 9% gain from the recent bottom. Fundamental factors remain supportive of further upside, including geopolitical tensions between Russia and Ukraine, ongoing trade disputes, U.S. dollar weakness, and continued central bank gold purchases — particularly by the People’s Bank of China. Gold has surged about 26% year-to-date. The RSI currently stands at 51, signaling continued bullish momentum.

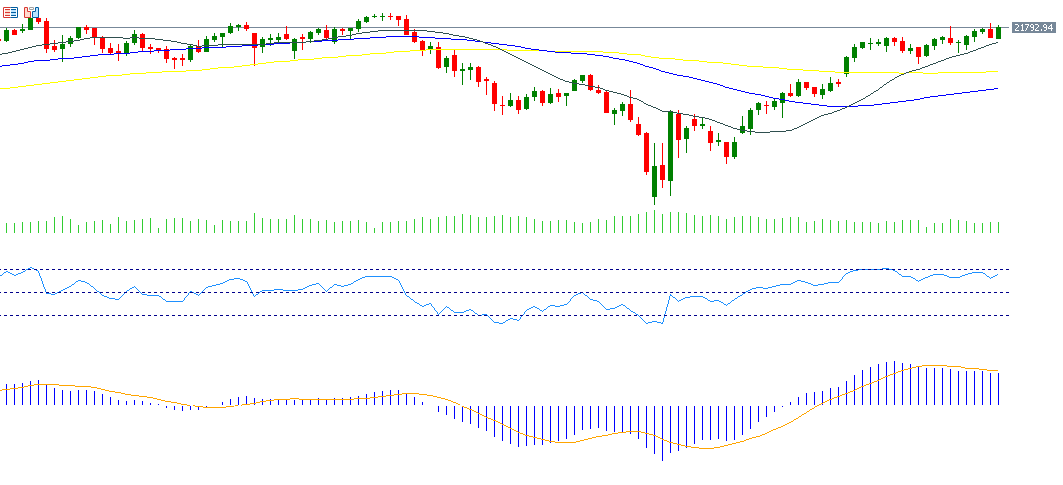

Nasdaq 100

The Nasdaq 100 hit a high of 21,892 on Thursday, June 5, 2025 — its highest since February 21, 2025. The rally is supported by a strong U.S. labor market, positive earnings from major U.S. companies — especially tech giants — and market expectations of two interest rate cuts this year. The RSI is currently at 67, indicating strong bullish momentum.

Key Events This Week

Markets are anticipating several important economic releases this week:

- Monday: Japan’s GDP and China’s CPI, PPI, exports, and imports.

- Tuesday: UK employment change and unemployment rate.

- Wednesday: U.S. CPI and crude oil inventories.

- Thursday: UK GDP and industrial production; U.S. jobless claims and PPI.

- Friday: Eurozone industrial production and U.S. University of Michigan Consumer Sentiment Index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.