Last week showed mixed performance across global economic indicators. The US trade deficit widened to $78.3 billion, while initial jobless claims increased to 237,000. US crude oil inventories rose by 2.415 million barrels, and job openings declined to 7.181 million. Private sector nonfarm payrolls, according to ADP, fell to 54,000, and the official nonfarm payroll report showed an increase of only 22,000 jobs. The unemployment rate rose to 4.3%, and average hourly wages grew by 3.7% year-over-year. In purchasing managers’ indexes (PMIs), the US services PMI showed growth at 54.5 points, manufacturing PMI grew to 53.0 points, while the ISM manufacturing PMI contracted at 48.7 points versus growth in the non-manufacturing PMI at 52.0 points. In the Eurozone, the manufacturing PMI rose to 50.7 points, while the services PMI declined to 50.5 points. Consumer price inflation increased to 2.1% year-over-year, with core inflation (excluding food and energy) rising to 2.3%. Retail sales contracted by 0.5%, and GDP growth slowed to 0.1% quarter-on-quarter. In the UK, manufacturing PMI contracted at 47.0 points, services PMI grew to 54.2 points, and construction PMI contracted at 45.5 points, while retail sales rose by 0.6%. Switzerland saw retail sales decline by 0.7%, with consumer prices steady at 0.2%. Canada experienced a loss of 65.5 thousand jobs, an increase in the unemployment rate to 7.1%, and the Ivey PMI dropped to 50.1 points. In Australia, the manufacturing PMI grew to 53.0 points, services PMI to 55.8 points, and Q2 GDP expanded by 0.6%. Japan faced contraction in manufacturing PMI at 49.7 points, growth in services PMI at 53.1 points, and a 1.7% monthly increase in household spending. Finally, China’s Caixin manufacturing PMI grew to 50.5 points, and services PMI to 53.0 points, both exceeding expectations.

Market Analysis

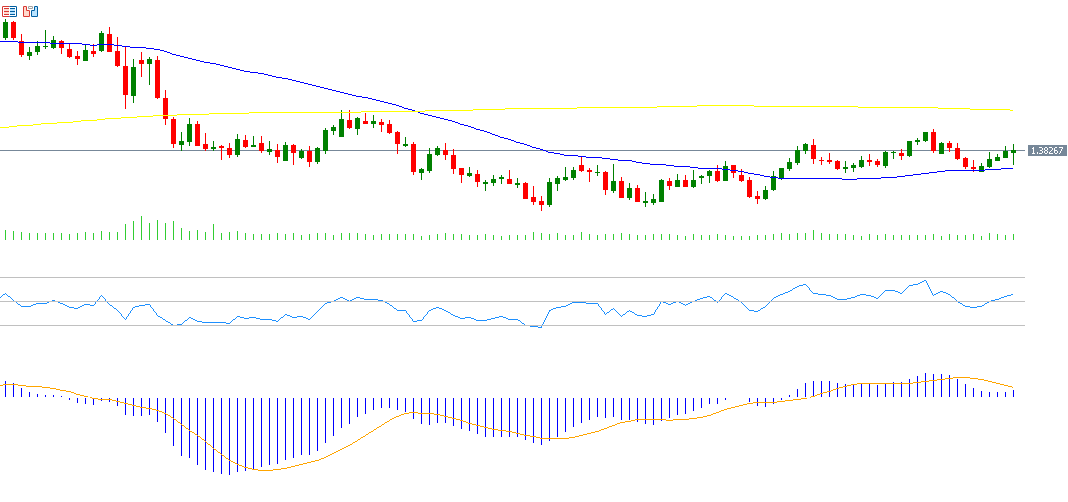

USD/CAD

The US dollar against the Canadian dollar reached 1.3854 on Friday, its highest level since August 27, 2025, closing at 1.3822. The pair has declined approximately 4% year-to-date. The Relative Strength Index (RSI) currently stands at 55, indicating positive momentum. The MACD indicator shows a convergence between the MACD line (blue) and the Signal line (orange), with any bullish crossover suggesting upward momentum.

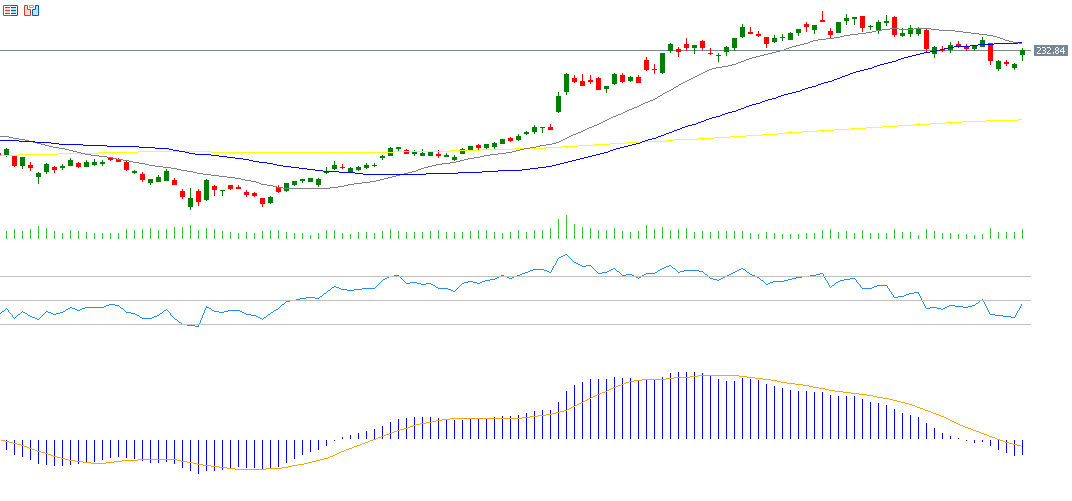

Oracle Corporation

Oracle’s stock has risen about 40% year-to-date. Markets are awaiting Oracle’s Q2 2025 earnings report on Tuesday, September 9. Earnings per share are expected at $1.48, up from $1.39 previously, while revenues are forecast at $15.04 billion compared to $13.3 billion in the prior quarter. The RSI is currently at 47, signaling negative momentum, and the MACD shows a bearish crossover, indicating downward pressure on the stock.

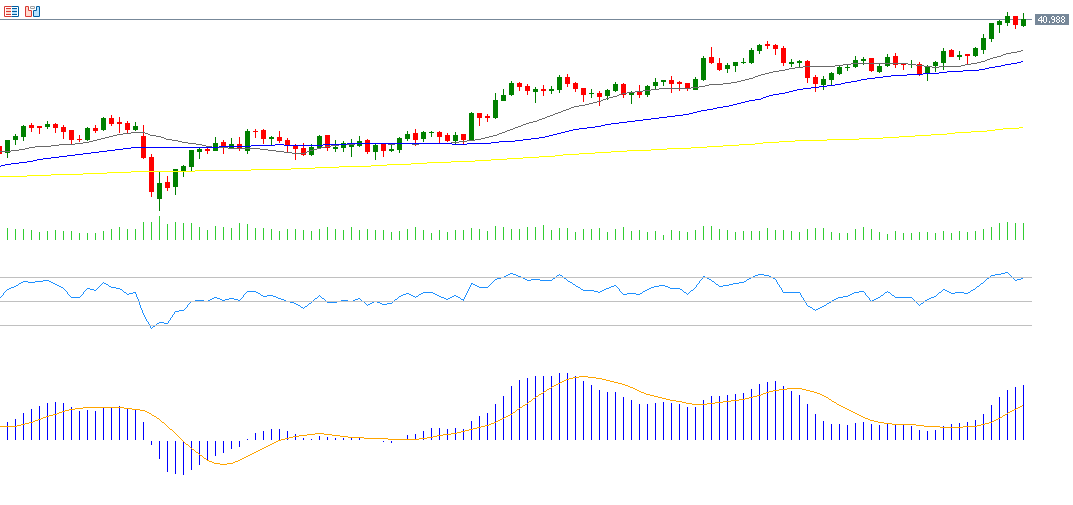

Silver

Silver prices rose approximately 3.23% last week, reaching $41.47 on Wednesday, September 3, the highest since September 9, 2011. Silver has surged about 42% year-to-date, outperforming risk assets such as Bitcoin and global stock indices, including US, European, Chinese, and Japanese markets, as well as gold, which rose 37%. Silver’s gains are supported by strong industrial demand across sectors like pharmaceuticals, medical supplies, and electronics, positive inflows into ETFs for the seventh consecutive month (the longest streak since 2020), record-high gold prices at $3,600 on Friday, and expectations that the US Federal Reserve will cut interest rates twice this year, benefiting silver as a non-yielding asset. The RSI currently stands at 59, reflecting ongoing bullish momentum, while the MACD shows a bullish crossover, indicating positive momentum.

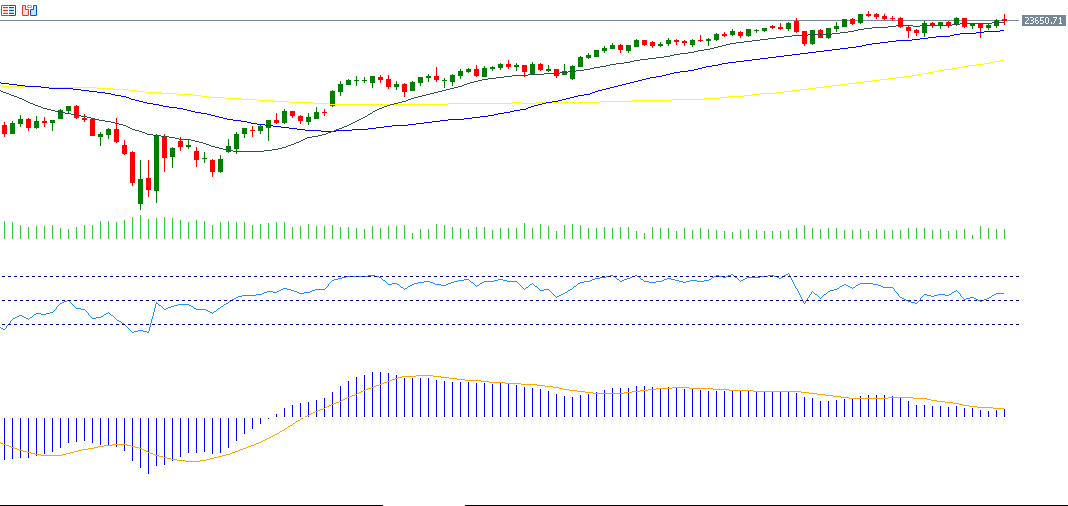

Nasdaq 100 Index

The Nasdaq 100 rose about 1% last week, closing at 23,652 points on Friday, and is up approximately 13% year-to-date. This performance reflects positive Q2 earnings reports from most US companies and continued strong momentum from the “Magnificent Seven” tech stocks, with the MAGS index hitting a new record on Friday. Additionally, market expectations of two US Federal Reserve rate cut this year support the rally. The RSI stands at 57, signaling bullish momentum.

Key Events This Week

Markets are awaiting several important economic indicators and data releases this week:

- On Monday, Japan’s GDP and China’s export and import data will be released.

- On Tuesday, the UK’s retail sales report is expected.

- On Wednesday, China will release consumer and producer price indexes, while the US will report producer prices and crude oil inventories.

- On Thursday, the European Central Bank is expected to keep interest rates steady at 2.00%, with markets closely watching ECB President Christine Lagarde’s comments on the future path of rates. The US will release consumer prices and jobless claims data, along with a 30-year US Treasury bond auction.

- On Friday, New Zealand’s business PMI, Japan’s industrial production, UK GDP and industrial production, and the University of Michigan consumer sentiment index in the US will be published.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.