By Samir Al Khoury

The most important events of the past week

United States of America

· In its meeting last Wednesday, the Federal Open Market Committee decided to maintain interest rates at 5.25% and 5.50% for the fourth consecutive time, aligning with the expectations of most analysts. However, of greater significance was the address delivered by US Federal Reserve Chairman Jerome Powell. Powell dismissed the likelihood of a sustained decrease in inflation leading up to the March meeting, thereby ruling out the possibility of a rate cut in March.

· The Consumer Confidence Index rose, recording 114.8 points, which exceeded expectations (114.2) and the previous reading (108.0).

· The job opportunities index rose, recording 9.026 million, which exceeded expectations (8.750M) and the previous reading (8.925M).

· The initial jobless claims index rose to 224K, which exceeded expectations (213K) and the previous reading (215K).

· US crude oil inventories rose by 1.23 million barrels, which exceeded expectations (-0.21M) and the previous reading (-9.23M).

· The ADP private sector non-farm jobs change index declined to 107K, which is lower than expectations (145K) and the previous reading (158K).

· The Manufacturing Purchasing Managers’ Index issued by the Institute for Supply Management (ISM) rose, recording a contraction of 49.1 points, which is higher than expectations (47.2) and the previous reading (47.1).

· The construction spending index recorded 0.9%, which was higher than expectations (0.5%) but in line with the previous reading.

· The Non-Farm Payrolls Report index rose, recording 353K new jobs, a percentage that exceeded expectations (187K) and the previous reading (333K).

· The average hourly wage index rose on an annual basis, recording 4.5%, which exceeded expectations (4.1%) and the previous reading (4.3%).

· The unemployment rate was 3.7%, which is lower than expectations (3.8%) but consistent with the previous reading.

· The Michigan Consumer Confidence Index rose to 79.0, which exceeded expectations (78.8) and the previous reading (69.7).

Eurozone

· The GDP index rose in the fourth quarter, recording 0%, a rate that exceeded expectations and the previous reading (-0.1%).

· The headline consumer price index recorded on an annual basis 2.8%, which was higher than expectations (2.7%) but lower than the previous reading (2.9%). The core consumer price index (which excludes food and energy) recorded on an annual basis 3.3%, which was higher than expectations (3.2%) but lower than the previous reading (3.4%).

United Kingdom

· The Monetary Policy Committee of the Bank of England decided to keep the interest rate of 5.25% unchanged, for the fifth meeting in a row, in line with market expectations.

Switzerland

· Retail sales recorded a contraction of -0.8%, which is lower than expectations (0.9%) but higher than the previous reading (-1.5%).

Australia

· Retail sales declined, recording a contraction of -2.7%, which is lower than expectations (-1.0) and the previous reading (1.6%).

· The building permits index declined, recording a contraction of -9.5%, which is lower than expectations (0.5%) and the previous reading (0.3%).

· The Consumer Price Index decreased year-on-year, recording 4.1%, which is lower than expectations (4.3%) and the previous reading (5.4%).

Canada

· The GDP index rose on a monthly basis, recording a growth of 0.2%, which exceeded expectations (0.1%) and the previous reading (0.0%).

China

· The Manufacturing PMI recorded a contraction of 49.2 points, which is in line with expectations but higher than the previous reading (49.0).

· The non-manufacturing PMI rose, recording a growth of 50.7 points, which exceeded expectations (50.6) and the previous reading (50.4).

· The Caixin Manufacturing PMI recorded a growth of 50.8 points, which is in line with expectations and the previous reading.

Japan

· Retail sales declined on an annual basis, registering a growth of 2.1%, which is lower than expectations (4.7%) and the previous reading (5.4%).

· The industrial production index recorded a monthly growth of 1.8%, which is lower than expectations (2.4%) but higher than the previous reading (-0.9%).

The most important events of this week

This week, financial markets are eagerly awaiting the release of several key economic indicators:

· Today, the Caixin Services PMI in China, the Services PMI in Australia, Japan, the Eurozone and Britain, the Producer Price Index in the Eurozone, and the Non-Manufacturing PMI issued by the Institute for Supply Management (ISM) in the United States of America will be released today.

· On Tuesday, the markets await the interest decision issued by the Australian Reserve Council, amid expectations that it will keep interest rates unchanged at the level of 4.35%. The Retail Sales Index is issued in Australia and the Eurozone, the Construction PMI in Britain, and the Building Permits and Ivey PMI in Canada.

· On Wednesday, the unemployment rate in Switzerland and China’s foreign exchange reserves will be released, in addition to the US crude oil inventories index.

· On Thursday, the building permits index in Australia, the consumer and producer price indices in China, and the initial jobless claims index in the United States of America will be released.

· Finally, the rates of change in employment and unemployment in Canada will be released on Friday.

Technical Analysis:

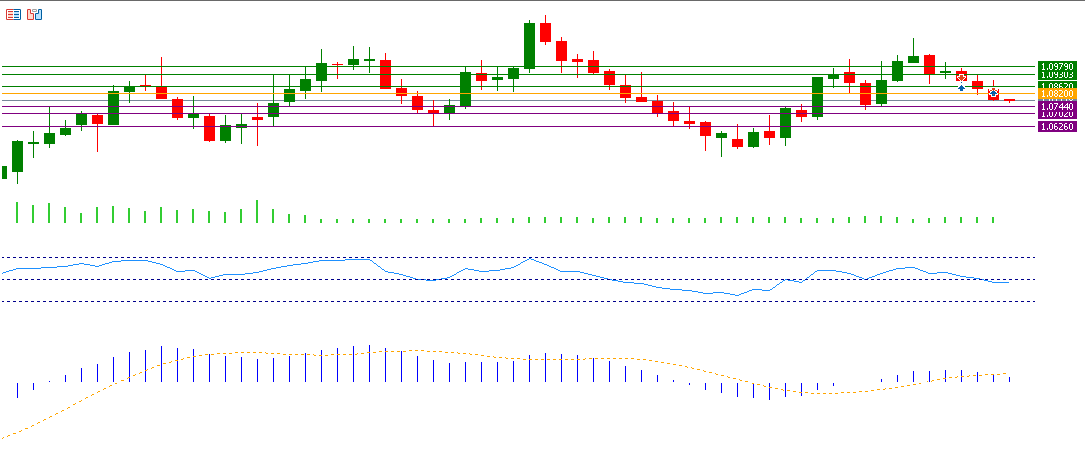

EUR/USD:

If the euro against the dollar breaks the pivot point of 1.0820, it may potentially target and test the support levels of 1.0744, 1.0702, and 1.0626. Conversely, if it surpasses the pivot point, it is likely to test resistance levels of 1.0862, 1.0938, and 1.0979.

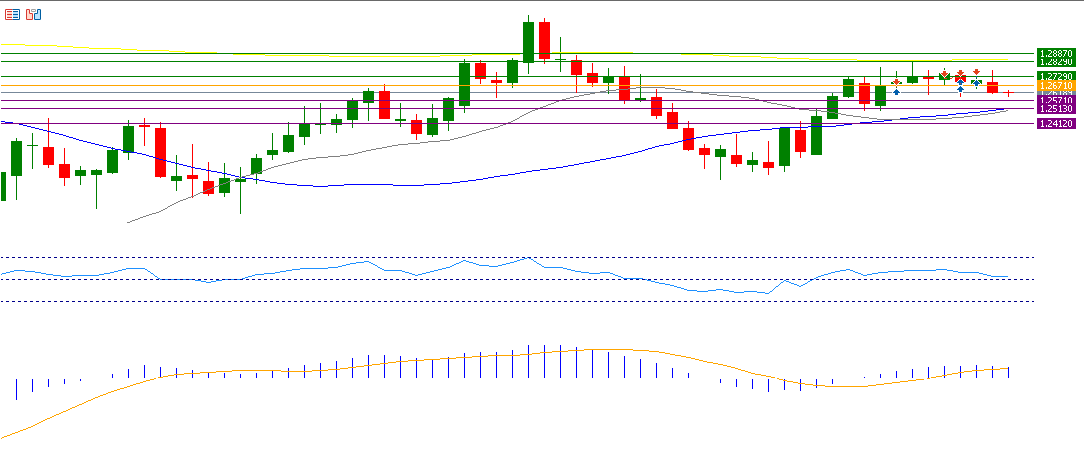

GBP/USD:

If the pound against the dollar breaks the pivot point of 1.2671, it has the potential to test the support levels of 1.2571, 1.2513, and 1.2412. However, if it exceeds the pivot point, it may test resistance levels of 1.2729, 1.2829, and 1.2887.

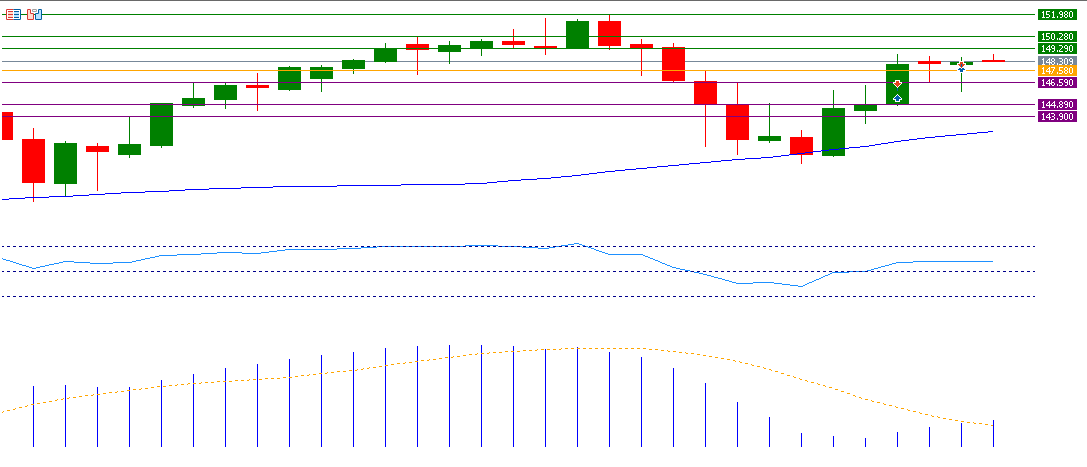

USD/JPY:

If the pivot point of 147.58 is broken for the dollar against the yen, there is a possibility that it will target the support levels 146.59, 144.89, and 143.90. But if it exceeds the pivot point, it is likely to target the resistance levels 149.29, 150.28, and 151.98.

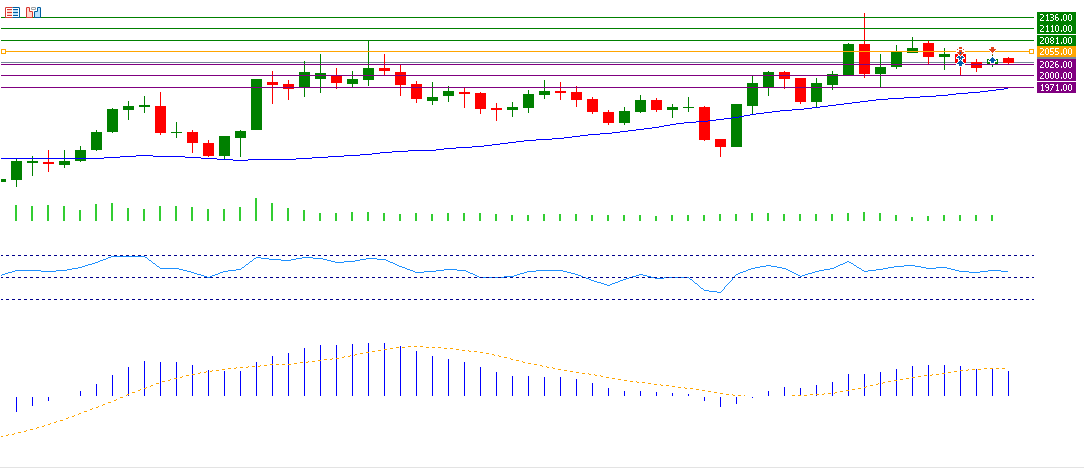

GOLD:

If the pivot point of 2055 is broken for gold, there is a possibility that it will target the support levels 2026, 2000, and 1971. But if it exceeds the pivot point, it is likely to target the resistance levels 2081, 2110, and 2136.

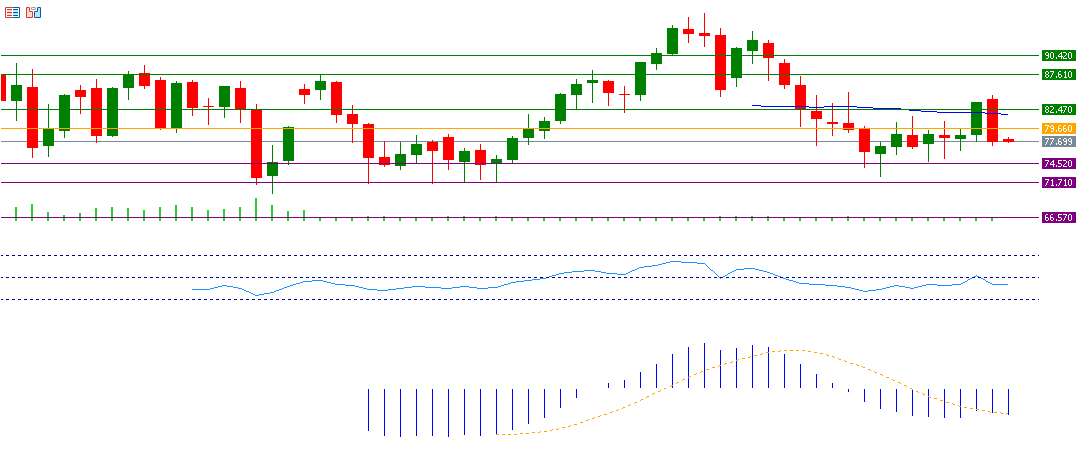

BRENT CRUDE OIL:

If the pivot point of 79.66 for crude oil is broken, there is a possibility that it will target the support levels of 74.52, 71.71 and 66.57. If it exceeds the pivot point, it is likely to target the resistance levels 82.47, 87.61, and 90.42.

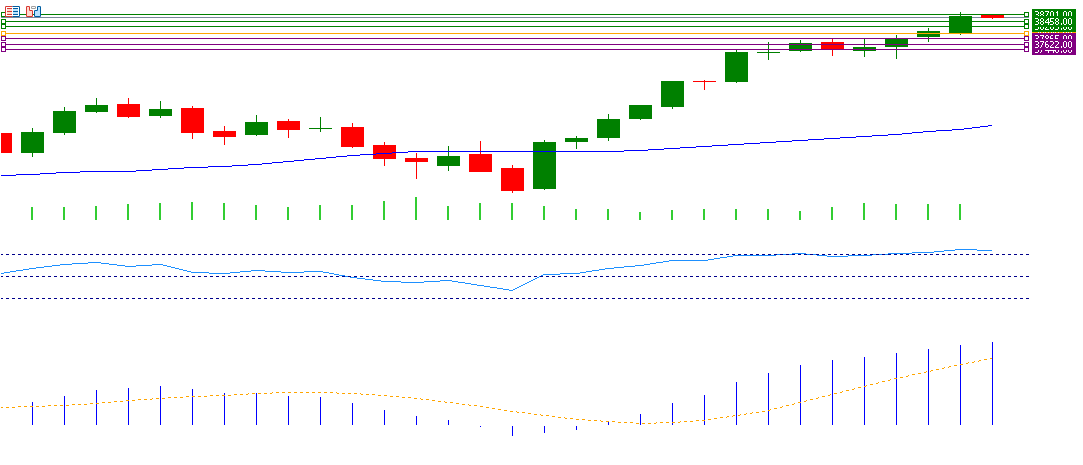

US30:

If the pivot point of 38,040 for the Dow is broken, there is a possibility that it will target the support levels 37,865, 37,622 and 37,448. If it exceeds the pivot point, it is likely to target the resistance levels 38,283, 38,458, and 38,701.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk