It seems that the US dollar will continue to dominate in the coming period over most foreign currencies, for several reasons, including the following:

- First, the flexibility of the US economy and the outperformance of most economic data against market expectations, unlike the data from most advanced economies such as the Eurozone, the UK, and emerging markets.

- Second, the cautious and hawkish statements of Federal Reserve Chairman Jerome Powell, especially regarding inflation. He indicated that reaching the inflation target of 2% could take one or two years. Additionally, the Federal Reserve’s dot plot was published, which pointed to two interest rate cuts next year, after the September dot plot had forecasted four cuts. This reflects a slowdown in the pace of interest rate cuts, which has positively affected the US dollar and US Treasury yields across various maturities.

- Third, the trade policies and foreign relations of Donald Trump, where he vowed to impose significant tariffs on imported goods, particularly from China, Canada, the European Union, Mexico, and other countries, to support domestic industry and local manufacturing companies. It is worth noting that increased tariffs could reflect on the prices of goods and commodities, causing them to rise, which will burden US citizens and also affect inflation, pushing it higher. This will impact the Fed’s monetary policy, where it may keep interest rates stable for a longer period or even raise them. He also pledged to cut corporate tax rates, close borders with Mexico, and prevent illegal workers from entering the US, which could further fuel inflation, possibly leading to an upward momentum for the US dollar index.

On the other hand, there are some concerning figures within the US, such as the US Treasury debt surpassing $36 trillion, and the US debt-to-GDP ratio exceeding 120%.

Given these conditions, the question arises: Will this positive momentum for the dollar continue? And for how long?

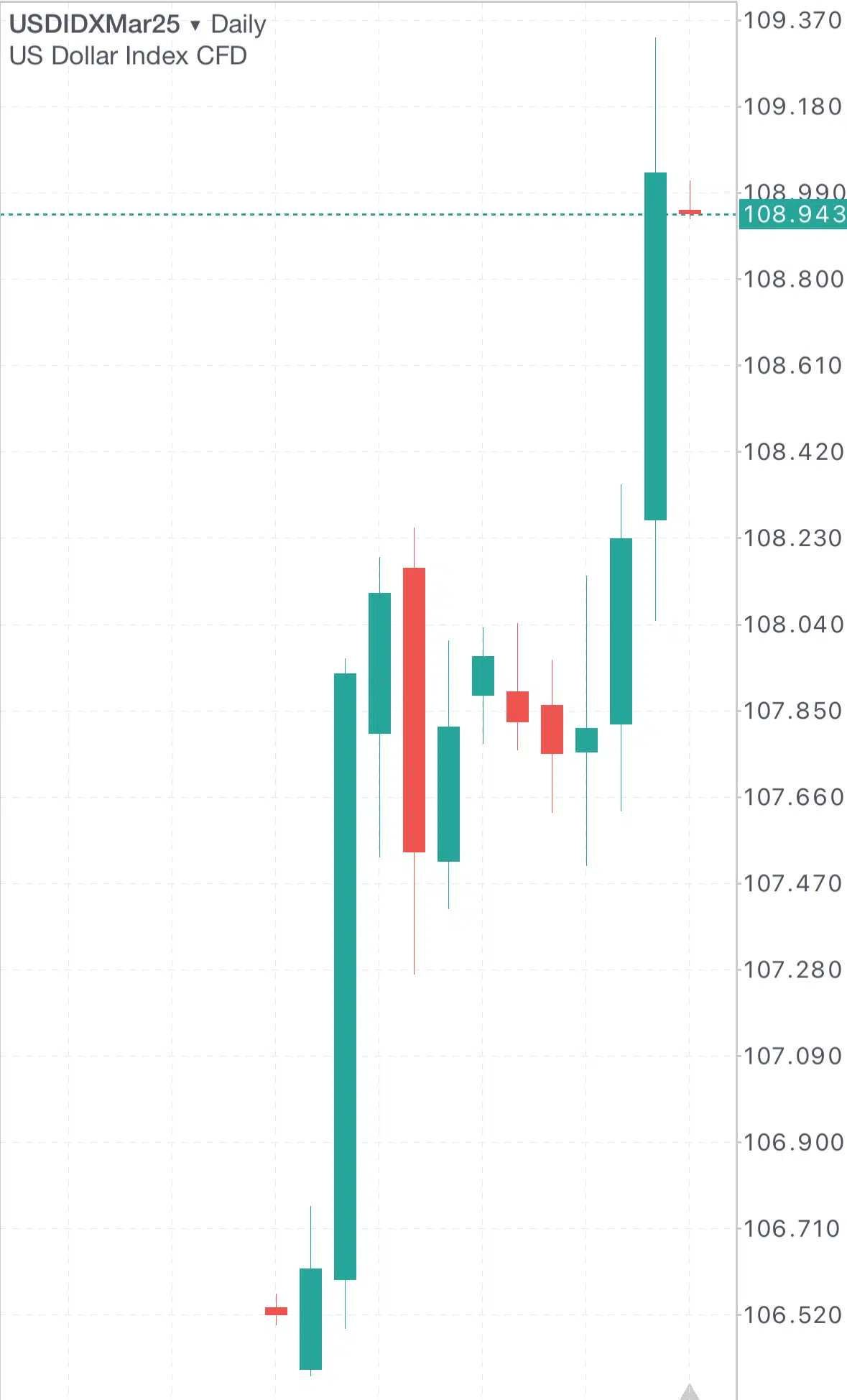

From a technical perspective, it appears that the start of 2025 for the US Dollar Index, which measures the dollar’s performance against a basket of six major currencies, is positive, having recorded 109.53 points yesterday, its highest level since November 10, 2022. It is currently hovering around the 109.00 level.

Technically, the indicators support the continuation of the US Dollar Index’s rise for the following reasons:

- The alignment of the 20-day, 50-day, and 200-day moving averages with an upward trend: The 20-day average exceeds the 50-day average, and the 50-day average exceeds the 200-day average.

- Relative Strength Index (RSI): Currently at 72 points, in the overbought zone, indicating an upward momentum for the US Dollar Index.

- Positive Directional Indicator (DMI+): It stands at around 32 points, compared to the Negative Directional Indicator (DMI-) which is at around 9 points. The significant gap between these two indicators indicates strong buying pressure on the US Dollar Index. More importantly, the Average Directional Index (ADX), shown in green, stands at around 40 points, exceeding the 25-point level, indicating strong momentum in this upward trend.

Markets expect further gains for the US Dollar Index, which could reach 115.00 points, along with an increase in US Treasury yields (a decline in Treasury bond prices) across various maturities. For instance, the 10-year Treasury yield is likely to exceed the 5.00% level

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.