Bitcoin prices reached a new all-time high of $123,279 on Monday, July 14, 2025. The cryptocurrency has surged 26% since its recent low of $98,000 recorded on June 22, signaling a clear entry into a bullish market phase. It has also gained approximately 26% year-to-date, outperforming Ethereum, Ripple, and Solana — as well as major U.S. equity indices. Currently, Bitcoin is trading near the $108,000 mark.

Key drivers supporting Bitcoin’s rally:

- Anticipation surrounding U.S. congressional decisions this week on regulatory frameworks for cryptocurrencies, aimed at protecting consumers and investors. This move supports President Donald Trump’s agenda to position the U.S. as a global hub for the digital assets industry.

- Continued inflows into Bitcoin-related exchange-traded funds (ETFs) for the fifth consecutive week.

- Bitcoin ETF assets surpassed $137 billion last week, marking a new record.

- Crypto investment products (ETPs) have seen 12 straight weeks of positive inflows, attracting more than $18.5 billion over that period.

- Rising risk appetite among investors, particularly large institutions — including pension funds — which have begun allocating Bitcoin into their diversified portfolios due to growing optimism surrounding the sector.

Technical indicators signal further upside for Bitcoin:

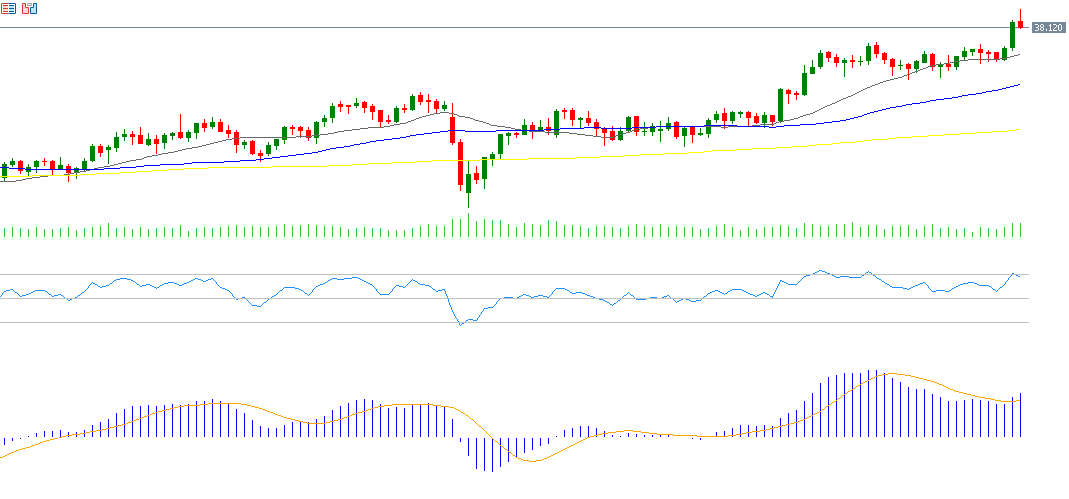

- A golden cross has formed, with the 20-day moving average (at $111,707) crossing above the 50-day moving average (at $108,022), reinforcing the bullish trend.

- The Relative Strength Index (RSI) currently stands at 68, indicating strong upward momentum.

- A bullish crossover in the MACD indicator, where the MACD line (blue) is above the signal line (orange), further confirms the positive trend.

Upcoming challenges:

The primary technical challenge for Bitcoin is to break and hold above the $123,000 level. If successful, this could pave the way for the cryptocurrency to target $130,000 and $140,000 in the near term — provided that market sentiment, institutional inflows, and regulatory clarity continue to support the rally.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.