By Camilo Botia

The Japanese yen weakened against the dollar for a second consecutive day on Monday as doubts emerged regarding the Bank of Japan’s (BOJ) plan to phase out its negative interest rate policy. This comes despite a brief surge in the yen last week following new BOJ Governor Kazuo Ueda’s comments suggesting a potential policy shift.

Ueda’s statement on Thursday, which came after he met with Prime Minister Fumio Kishida, sparked hopes of a less dovish approach by the BOJ. He mentioned that the central bank possessed “several options” for targeting interest rates once it exits the negative rate territory.

However, a Bloomberg report on Monday threw cold water on these expectations. According to the report, BOJ officials need evidence that wage growth justifies ending the ultra-loose monetary policy this December. Analysts believe this cautious stance is the primary reason behind the yen’s recent decline. Ueda’s comments last week were not a concrete statement that they would end the negative interest rate.

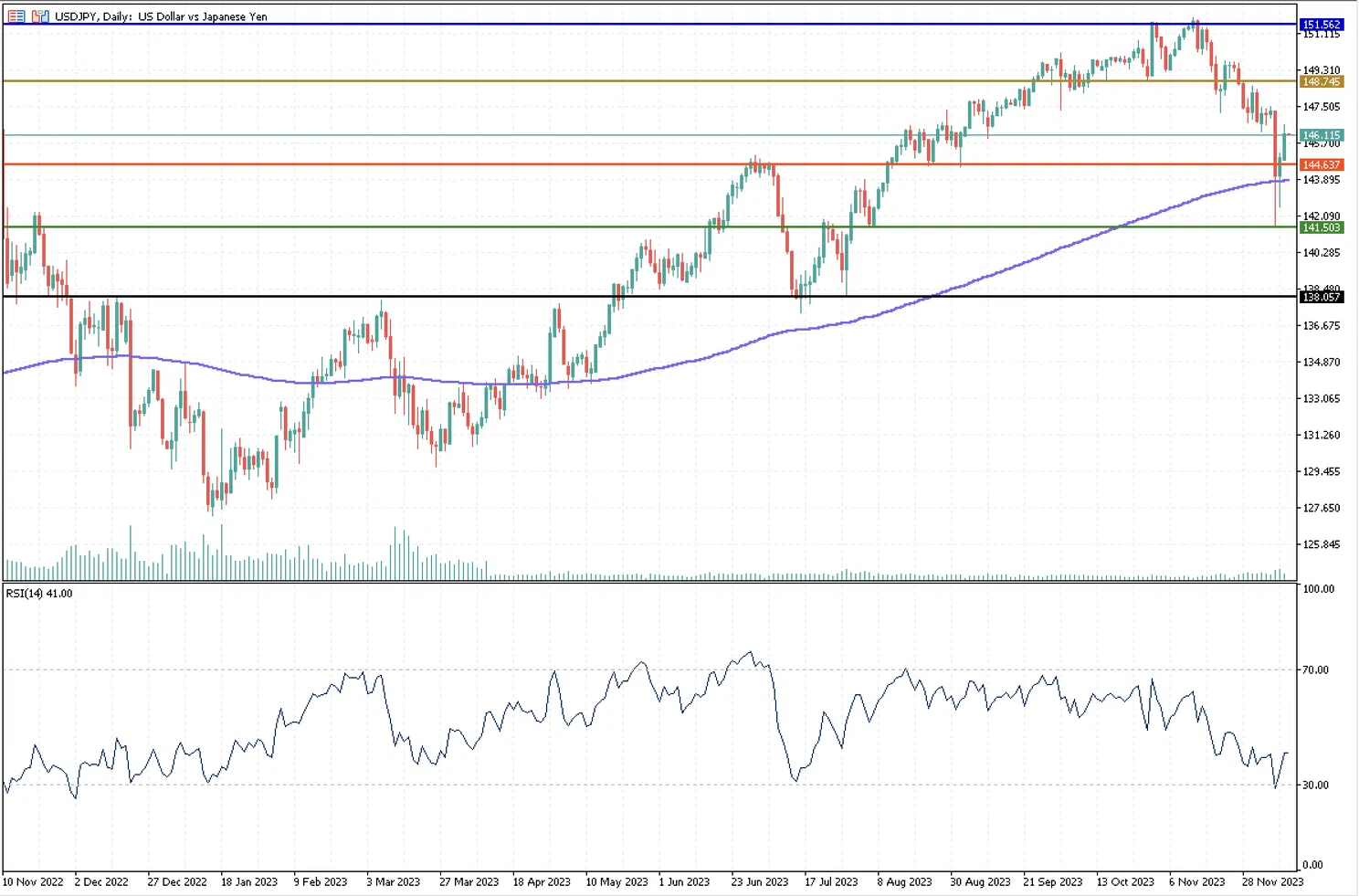

The USDJPY has climbed to $146.11, erasing almost all the yen’s gains from Thursday when it touched $141.50. The 200-day moving average coincided last Thursday with an oversold market, signalled by the RSI indicator, pushing the pair to trade above $144.63, now its closest support. Market attention now shifts to critical economic data releases and central bank meetings. Investors are keenly awaiting U.S. consumer price inflation data, which will influence the Federal Reserve’s future policy decisions. The next two resistances for the USDJPY are $148.74, significant monthly support, and $151.56, around the highest price for the USDJPY in 2023.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.