The Forex market handles a daily trading volume of $9.6 trillion, but most activity happens during only a few key hours. This is why some sessions feel slow while others move quickly.

Understanding Forex market hours is about more than access. It helps you know when the market is active, spreads are tighter, and trades are easier to manage. Forex runs 24 hours a day, 5 days a week, moving between major financial centers. Knowing when these sessions overlap can help you trade with more confidence and better timing.

In this guide, we will explain how the Forex market hours work, why timing matters, and how different trading sessions can suit different trading styles.

How the Forex Market Operates 24 Hours a Day

Unlike stock markets, Forex does not open and close at one location. There is no single exchange. Trading moves between major financial centres around the world. When one market closes, another opens. This is how Forex runs all day during the week.

Trades are passed between banks, brokers, and institutions across time zones. This makes Forex easy to access. You can trade in the evening, early morning, or during the day, depending on where you are.

The Forex market is also very large. It trades trillions of dollars every day, and the US dollar is part of most trades. For traders, this means there is usually enough activity to enter and exit trades without major delays.

Why Forex Trading Hours Matter

Even though the market is open all the time, not every hour is the same. Some periods are active, with higher volume and tighter spreads, while other times are quiet, with slower price movement and wider spreads.

Trading during active hours often means better pricing and smoother execution. Trading during quiet hours can feel harder, as prices may move slowly or behave unevenly. Knowing when the market is busiest helps you choose better times to trade.

When the Forex Market Opens and Closes

The Forex market follows a weekly cycle. It opens on Sunday evening and closes on Friday evening, UK time differences aside.

The market opens when trading begins in Sydney and closes when New York finishes. It stays closed over the weekend. It is also fully closed on Christmas Day and New Year’s Day.

Main Trading Sessions

These are the usual session times in EST. They can shift slightly during daylight saving changes.

| Trading Session | Start Time (EST) | End Time (EST) |

| Sydney | 5:00 PM | 2:00 AM |

| Tokyo | 7:00 PM | 4:00 AM |

| London | 3:00 AM | 12:00 PM |

| New York | 8:00 AM | 5:00 PM |

Session overlaps, especially between London and New York, are often the most active parts of the trading day. Keeping track of time changes helps you avoid confusion and plan trades more clearly.

How Daylight Saving Time Affects The Forex Market Hours

Daylight saving time changes Forex session hours a few weeks each year, which can affect when markets are most active. The US, UK, Europe, and Australia switch clocks on different dates, while Japan does not change at all.

This creates short periods where key session overlaps, especially in London and New York, and shift by one hour. During these weeks, news releases also move in local time, spreads can change, and trade timing may feel slightly off. To avoid mistakes, note the DST change dates in advance and double-check session overlaps and economic news times before trading.

What Are The 4 Major Forex Trading Sessions?

The Forex market runs through four major trading sessions, each centred around a key financial hub. These sessions do not operate independently. They overlap, influence one another, and create specific windows of opportunity that many traders focus on.

Below is a breakdown of each session, what defines it, and how it is commonly approached.

Sydney session (Pacific session)

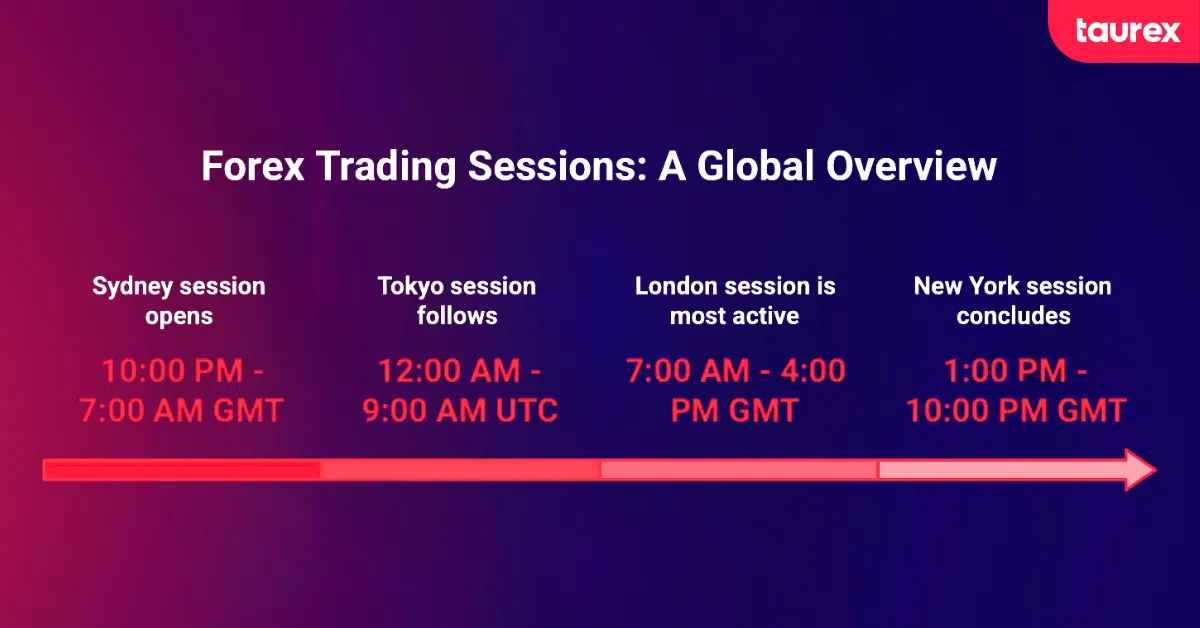

The Sydney session opens the trading week and runs from 10:00 PM to 7:00 AM GMT (5:00 PM to 2:00 AM EST). As the first session to open, it is usually the quietest, with lower volatility and narrower price ranges.

These calmer conditions often appeal to traders who prefer a slower pace. Currency pairs involving the Australian and New Zealand dollars, such as AUD/USD and NZD/USD, tend to see the most activity, although overall volume remains relatively low.

Tokyo session (Asian session)

The Tokyo session follows shortly after and runs from 12:00 AM to 9:00 AM UTC (7:00 PM to 4:00 AM EST). During this period, market activity begins to increase, but volatility generally stays lower than in the European and US sessions.

One advantage of trading this session is consistency. Tokyo does not observe daylight saving time, so its hours remain the same throughout the year. Pairs like USD/JPY, EUR/JPY, and AUD/JPY are more active here, and Japanese economic releases can still create noticeable price movements.

London session (European session)

The London session runs from 7:00 AM to 4:00 PM GMT (3:00 AM to 12:00 PM EST) and is widely considered the most active Forex session. As trading volume increases sharply, price movement tends to become faster and more decisive.

Major pairs such as EUR/USD and GBP/USD see high liquidity during this time. Tight spreads and strong momentum make the London session attractive for active trading strategies, though the faster pace also means risk needs to be managed carefully.

New York session (American session)

The New York session begins at 1:00 PM GMT (8:00 AM EST) and runs until 10:00 PM GMT (5:00 PM EST). It is the second-largest session and is heavily influenced by US economic data and policy decisions.

Because the US dollar is involved in most Forex trades, this session carries significant weight. Liquidity is highest during the overlap with London, after which trading activity typically slows as the day comes to an end.

What Times Should You Avoid Trading

Just as important as knowing when to trade is knowing when not to trade. There are periods when liquidity dries up, spreads widen, and price action becomes erratic. Trading during these times can feel like fighting the market.

- Sunday evening (first few hours after Sydney opens): Liquidity is low. Spreads are wide. The market is still waking up.

- Friday afternoon after 12:00 PM EST: Traders are closing positions ahead of the weekend. Volume drops off sharply, and spreads widen.

- Between New York close and Sydney open (7:00 PM to 10:00 PM GMT): This is the dead zone. Almost nothing happens during this gap.

- Major holidays (Christmas, New Year’s): The market is closed. No trading is possible.

- Single session periods without overlaps: When only one session is active, volume is lower, spreads are wider, and opportunities are limited.

If you’re seeing unusually wide spreads or choppy, directionless price action, there’s a good chance you’re trading during a low-liquidity period. Wait for a more active session.

What Are the Best Days of the Week for Forex Trading

There is no such thing as a guaranteed best day to trade Forex. Market behaviour can change from week to week, and what works well one week may look very different the next.

That said, some traders find that the middle of the week, usually Tuesday through Thursday, can offer slightly more stable conditions. These days may see wider pip ranges and clearer setups at times, although this is not always the case and depends heavily on market context.

Mondays can sometimes feel slower as the market settles after the weekend, which may result in less defined price action. Fridays can also be less predictable, particularly later in the day around 12:00 PM EST, when some traders begin scaling back or closing positions.

If you are planning your trading week, it may be worth paying closer attention to Tuesday, Wednesday, and Thursday. Market participation is often higher during this period, which can help create smoother price movement, but outcomes will always vary, and no pattern is guaranteed.

How to Use Economic Calendars to Time Your Trades

Economic calendars are one of the most important tools in a trader’s arsenal. They tell you when high-impact events are scheduled, what the market expects, and how previous data compares. If you’re not using an economic calendar, you’re trading blind.

What Are the Major Market-Moving Events

Different countries release different types of economic data, and some events carry more weight than others. Here are the major market-moving events by region:

United States (highest impact):

- Non-Farm Payrolls (NFP): First Friday of every month, 8:30 AM EST. One of the most anticipated releases. Can create 50-100+ pip moves.

- Federal Reserve interest rate decisions: 2:00 PM EST, eight times per year. Sets the tone for USD strength or weakness.

- CPI (Consumer Price Index): Monthly, 8:30 AM EST. Inflation data that directly impacts Fed policy.

- GDP (Gross Domestic Product): Quarterly. Measures the health of the US economy.

- Retail sales: Monthly. Tracks consumer spending, which drives a significant portion of US economic activity.

Europe:

- ECB interest rate decisions: Set by the European Central Bank. Major impact on EUR pairs.

- Eurozone CPI: Inflation data for the Eurozone.

- German ZEW Economic Sentiment: Leading indicator of economic expectations.

United Kingdom:

- Bank of England interest rate decisions: Key driver for GBP pairs.

- UK GDP: Quarterly measure of economic output.

- CPI and employment data: Both have a significant impact on GBP volatility.

Japan:

- Bank of Japan policy decisions: Major impact on JPY pairs.

- Japanese GDP and Tankan Survey: Key indicators of economic health.

Other high-impact events include central bank speeches, geopolitical tensions, trade data, and major earnings reports that can affect currency sentiment.

How to Use Economic Calendars

A good economic calendar includes several key features:

- Event importance rating (low, medium, high)

- Previous, forecast, and actual figures

- Deviation ratio (how much the actual figure differed from the forecast)

- Historical data comparison

- Real-time updates

You can use economic calendars in several ways:

- News trading: Navigate market movement during major releases.

- Risk avoidance: Close positions before high-impact events to avoid unexpected moves.

- Strategic planning: Schedule your trading around data releases to use timing insights to plan around major events.

- Volatility forecasting: Anticipate increased market movement based on upcoming events.

Combine this timing with Forex technical analysis to identify entry and exit points during high-volatility sessions.

High-impact times to watch:

- 8:30 AM EST (US economic data)

- 2:00 PM EST (FOMC decisions)

- 7:45 AM EST (ECB decisions)

- Various times for Asian data (typically evening EST)

Use multiple economic calendars to ensure you don’t miss important events. Tools like the FXStreet, TradingView, and Taurex economic calendars provide comprehensive, real-time data.

What Are The Essential Tools for Trading the Forex Market Hours?

Timing the Forex market is much easier with the right tools. Many platforms and apps can adjust for time zones, show which sessions are open, highlight overlaps, and alert you to important economic events. Using these tools helps reduce guesswork so you can spend more time focusing on your trades.

What Are The Must-Have Trading Tools

- Market hour converters

Market hour converters adjust trading sessions to your local time and account for daylight saving changes. They also show which sessions are currently open and when overlaps occur, making it easier to plan your trading day without confusion.

- Volatility meters

Volatility meters show how much different currency pairs are moving in real time. They can help you compare pairs, spot quieter or more active periods, and understand how price movement changes over time. This can be useful when deciding what to trade and when.

- Economic calendars

Economic calendars list upcoming news events and show their expected impact on the market. They often include past data, forecasts, and alerts for major releases. For traders who stay active during news-driven moves, this tool is especially important.

- Session indicators (for MT4 and MT5)

Session indicators display trading sessions directly on your charts. They adjust for time zones, highlight overlap periods, and mark session highs and lows. Understanding how to read charts with these session markers helps you identify patterns that emerge during specific trading hours.

What Are the Recommended Trading Platforms

Taurex platform

Taurex provides its own Forex trading app designed to make trading more straightforward. It includes access to market hours, economic updates, and execution tools within a single interface, which can be helpful for traders who prefer a simpler, all-in-one setup.

MetaTrader 4 and MetaTrader 5

MT4 and MT5 are among the most widely used trading platforms worldwide. They support custom session indicators, fast order execution, and built-in tools that help traders monitor market hours and key events.

TradingView

TradingView offers advanced charts, session-based tools, and an integrated economic calendar. It also supports multi-timeframe analysis and community features, which can be helpful for traders who rely heavily on charting.

Broker-specific platforms

Broker-specific platforms: Many brokers offer proprietary platforms that include session tools, integrated economic calendars, real-time news feeds, and mobile trading capabilities. Explore the best Forex trading platforms to find the right fit for your needs.

Also, when selecting tools and platforms, the broker you trade with matters just as much as the software itself. Learn how to choose a Forex broker that aligns with your trading schedule and provides reliable execution during peak market hours.

Conclusion

Understanding Forex market hours is less about finding perfect times to trade and more about knowing what kind of conditions you are stepping into. Each session has its own rhythm, and the tools you use can help you stay aware of changes in activity, volatility, and risk. Paying attention to timing can support better decisions and help avoid trading when the market is not offering clear setups.

Over time, many traders find that matching their strategy to specific sessions helps bring more structure to their routine.

Platforms like Taurex are made to support this approach by bringing market hours, economic updates, and execution tools together in one place. If you want a clearer view of when the market is active and how conditions are changing, exploring Taurex can be a useful next step.

Curious how timing affects your trades? Open a Taurex demo account to explore how timing affects trade conditions across sessions and how market conditions change throughout the day. Test your strategies during high-volatility overlaps in a real-time environment before you decide to trade with real capital.

FAQ

What time does the Forex market open?

The Forex market opens on Sunday at 5:00 PM Eastern Time (10:00 PM UTC) when the Sydney session begins trading. This marks the start of the Forex trading week. Depending on your local time zone, this may appear as Monday morning in some parts of the world since it’s already Monday in Australia. The market remains open continuously through Friday at 5:00 PM EST when the New York session closes. This 24-hour, 5-day operation makes Forex unique among financial markets, allowing traders worldwide to participate at times convenient to their schedules.

What time does the Forex market close?

The Forex market closes on Friday at 5:00 PM Eastern Time (10:00 PM UTC) when the New York session ends for the week. After this time, the market remains closed throughout Saturday and Sunday, with no trading activity. The market reopens Sunday evening at 5:00 PM EST. The Forex market also observes two major holidays when trading is completely closed: Christmas Day (December 25) and New Year’s Day (January 1). During these holidays, no trading can occur as all major financial centres are closed simultaneously.

What are the Forex trading hours?

Forex trading hours span 24 hours a day, five days a week, from Sunday 5:00 PM EST to Friday 5:00 PM EST. The market is divided into four major trading sessions: Sydney (5:00 PM to 2:00 AM EST), Tokyo (7:00 PM to 4:00 AM EST), London (3:00 AM to 12:00 PM EST), and New York (8:00 AM to 5:00 PM EST). These times are approximate and vary slightly depending on daylight saving time adjustments. The continuous nature of Forex trading means at least one session is always open during weekdays, though trading activity and liquidity vary significantly throughout the 24-hour cycle.

What are the 4 trading sessions?

The four major Forex trading sessions are: Sydney Session (Pacific), which operates from 5:00 PM to 2:00 AM EST and marks the start of the trading day with lower volatility; Tokyo Session (Asian), which runs from 7:00 PM to 4:00 AM EST and is driven primarily by Japanese market activity; London Session (European), which operates from 3:00 AM to 12:00 PM EST, accounts for 43% of global trading volume, and offers the highest liquidity; and New York Session (American), which runs from 8:00 AM to 5:00 PM EST and represents the second-largest market with significant USD activity. These four sessions collectively account for approximately 75% of all Forex trading volume.

What time does the Forex market open on Sunday?

The Forex market opens on Sunday at 5:00 PM Eastern Time (EST), which equals 10:00 PM Coordinated Universal Time (UTC). This opening time coincides with Monday morning in Sydney, Australia, where the Sydney/Pacific session begins the Forex trading week. For traders in different time zones, this translates to 2:00 PM Pacific Time (PST), 10:00 PM Greenwich Mean Time (GMT), and early Monday morning in Asia. The market opens with typically lower liquidity and trading volume during these first few hours, as only the Sydney and early Asian markets are active. Most experienced traders wait for increased activity when the Tokyo session begins a few hours later.

What time does the Forex market close on Friday?

The Forex market closes on Friday at 5:00 PM Eastern Time (EST) or 10:00 PM Coordinated Universal Time (UTC). This closing time marks the end of the New York trading session and the conclusion of the Forex trading week. Trading activity typically begins to decline significantly after 12:00 PM EST on Fridays as traders close their positions before the weekend. By Friday afternoon, liquidity drops substantially, spreads often widen, and many experienced traders have already exited the market. The market remains closed throughout Saturday and Sunday before reopening Sunday evening at 5:00 PM EST.

What time does the London session open?

The London session opens at 3:00 AM Eastern Time (EST) or 8:00 AM British Standard Time (GMT+0). During British Summer Time (BST), when the UK observes daylight saving time from late March to late October, the London session opens at 4:00 AM EST. The London session is the most important Forex trading session, accounting for approximately 43% of global trading volume. The first few hours after the London open typically see the highest volatility. This session offers the tightest spreads and highest liquidity, making it a favoured time for many traders, especially when it overlaps with the New York session from 8:00 AM to 12:00 PM EST.

What time does the Asian session open?

The Asian session, primarily represented by the Tokyo Forex market, opens at 7:00 PM Eastern Time (EST) or 12:00 AM Coordinated Universal Time (UTC). In Tokyo local time, this corresponds to 9:00 AM JST (Japan Standard Time). The Asian session actually begins earlier, with the Sydney market opening at 5:00 PM EST, but most traders refer to the Tokyo open when discussing the Asian session due to its higher volume and liquidity. Unlike other major financial centres, Tokyo does not observe daylight saving time, so these hours remain constant throughout the year. The Asian session is characterised by lower volatility compared to the London and New York sessions, making it suitable for range-trading strategies.

What time does the New York session open?

The New York session opens at 8:00 AM Eastern Time (EST) or 1:00 PM Greenwich Mean Time (GMT). This opening time coincides with the start of the US stock market and typically sees a significant increase in trading activity and volatility. The New York session is particularly important because the US dollar is involved in approximately 89% of all Forex trades. Major US economic data releases typically occur at 8:30 AM EST, just 30 minutes after the session opens, which can cause substantial market movements. The most active trading period occurs during the first four hours (8:00 AM to 12:00 PM EST) when the New York session overlaps with the London session, capturing approximately 37% of the day’s total Forex trading volume.

What is the best time to trade Forex?

The most active time to trade Forex is during the London-New York session overlap, which occurs from 8:00 AM to 12:00 PM Eastern Time (EST). During these four hours, approximately 37% of the entire day’s trading volume occurs, even though it represents only 19% of the 24-hour trading day. This overlap provides the tightest spreads (often 1-2 pips for major pairs), highest liquidity, and most significant price movements, with EUR/USD often moving 80-150 pips and GBP/USD exceeding 100 pips during this period. The overlap between the European and American sessions often creates higher liquidity and increased price movement, which many traders look for when planning their intraday strategies. That said, the best time also depends on your trading strategy. Swing traders may prefer different times, while news traders focus on economic release times regardless of the session.

Risk Disclaimer: Trading involves significant risk, including the potential loss of principal. Past performance does not indicate future results. The value of investments may fluctuate, and you may receive back less than your original investment. All content is for educational purposes and should not be considered financial advice.