The Forex market is the largest financial market in the world, with trillions of dollars traded every day. The market runs 24 hours a day, five days a week. Unlike the stock market, it does not operate from one central exchange. It runs through a global network of banks, institutions, companies, and individual traders.

When you place a trade, you are entering this global system. Each participant has a different reason for being there. Some manage risk, some exchange currencies for business, and others trade to make a profit.

Understanding who these participants are helps you see why prices move and where liquidity comes from. Let’s look at the main groups involved and the role each one plays.

Who Are The Major Institutional Players That Drive The Forex Market?

Most Forex trading is not done by individuals, it’is done by large institutions. These institutions provide the prices you see, the liquidity that allows your trades to go through, and much of the price movement on your charts.

There are three main groups to understand.

Commercial and Investment Banks Set The Prices You Trade

Large banks form the core of the Forex market. Banks such as JPMorgan, Citi, UBS, Barclays, Deutsche Bank, Goldman Sachs, HSBC, and Morgan Stanley handle a large share of global currency trading.

They serve corporate clients that need to exchange currencies for international business. They also trade for their own profit and manage currency risk across global investments.

Most of this activity happens in what is called the interbank market. This is a network where big banks trade directly with each other. The prices on your trading platform come from this system.

Why does this matter to you? Because when banks provide strong liquidity, spreads are tighter and execution is smoother. During major news events, banks may reduce liquidity, which can cause wider spreads and more volatility.

A broker like Taurex is regulated by the Financial Services Authority of Seychelles, which provides an added layer of oversight and accountability.

Central Banks and Governments Shape Currency Valuations

Central banks have a different goal, because they are not trading to make a profit. They manage interest rates, inflation, and economic stability.

When a central bank changes interest rates, it often moves the currency. For example, when rates rise, a currency may strengthen because investors seek higher returns. When rates fall, a currency may weaken.

Central banks can also directly buy or sell their own currency to influence its value. These actions can create large and lasting moves in the market.

For traders, central bank decisions are some of the most important events to watch. They can quickly shift trends in major pairs like EUR/USD or USD/JPY.

Non-Bank Liquidity Providers: The New Market Participants

Not all liquidity in the Forex market comes from large banks. There is a growing group of financial firms that also provide pricing and market access. These are known as non-bank liquidity providers.

They include specialised trading firms, asset managers, and other financial institutions that operate outside the traditional banking system.

These firms use advanced technology to quote, buy, and sell prices and help keep the market active. In some currency pairs, especially outside peak trading hours, they help fill gaps when large bank desks are less active. Their role has increased in recent years as electronic trading has expanded. More participants providing liquidity usually means tighter spreads and smoother execution.

For retail traders, this is generally positive. More competition between liquidity providers can improve pricing and overall trading conditions.

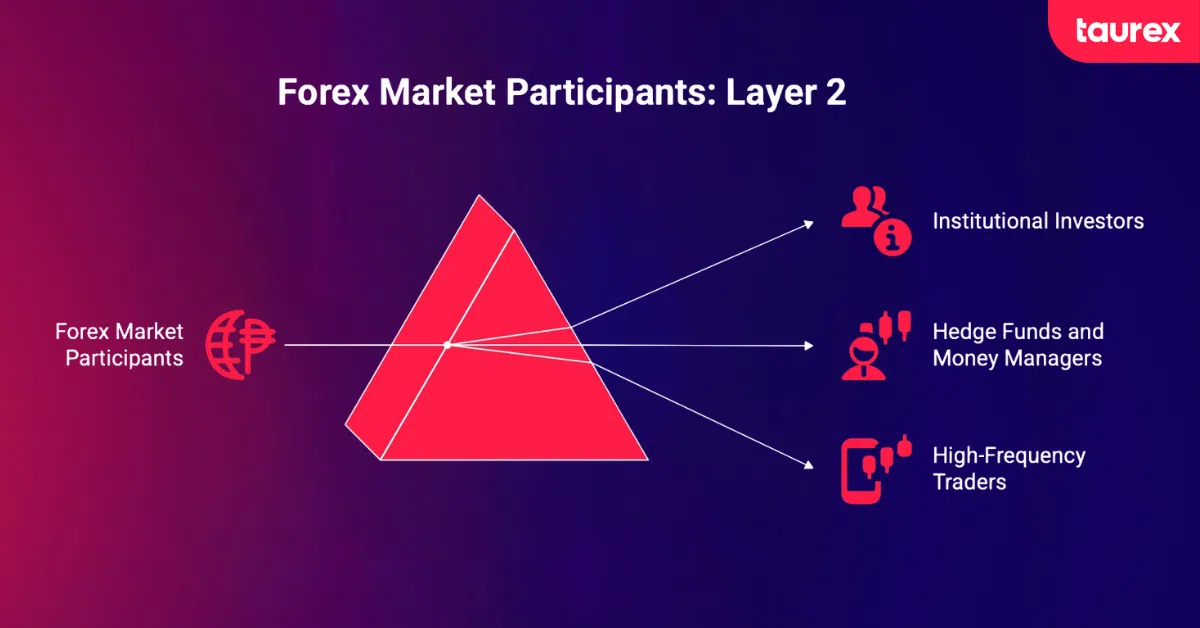

Which Professional Investors and Speculators are Key Participants in the Forex Market?

While banks and central banks focus on providing liquidity and managing monetary policy, another group participates mainly to generate investment returns.

These are professional investors and speculators. They manage large amounts of capital and trade primarily to profit from currency movements. Because of their size and resources, their positions can influence overall market direction.

Institutional Investors Hold Long-Term Positions

Large investors such as pension funds, insurance companies, mutual funds, and sovereign wealth funds are active in Forex.

They usually trade for long-term reasons. For example, they may invest in foreign stocks or bonds and need to manage currency risk. Their decisions are often based on economic data and global trends, not short-term chart patterns.

Because they move large amounts of money, their actions can create steady trends. If a big fund shifts billions from US assets into European assets, that flow can support a currency move that lasts weeks or even months.

Hedge Funds and Money Managers Pursue Speculative Strategies

Hedge funds are more aggressive, as their main goal is to profit from price changes.

Some focus on big economic trends, such as differences in interest rates between countries. Others use strategies like carry trades, momentum trading, or event-based trading around major news.

Large hedge funds can move markets when they build big positions. A well-known example is when George Soros bet against the British pound in 1992 and made a huge profit. While that was an extreme case, it shows how powerful large funds can be.

When major funds enter or exit a position, other traders often notice.

High-Frequency Traders Operate at Speeds You Cannot Match

High-frequency trading firms use computer programs to place thousands of trades in seconds. They profit from very small price differences.

They often act as market makers, meaning they provide buy and sell prices and earn money from the spread. Their systems are extremely fast and operate in milliseconds.

Retail traders cannot compete with them on speed. But that is not necessary. High-frequency firms help keep spreads tight and markets liquid. Retail traders can focus on longer-term analysis, patience, and risk management instead of trying to trade at high speed.

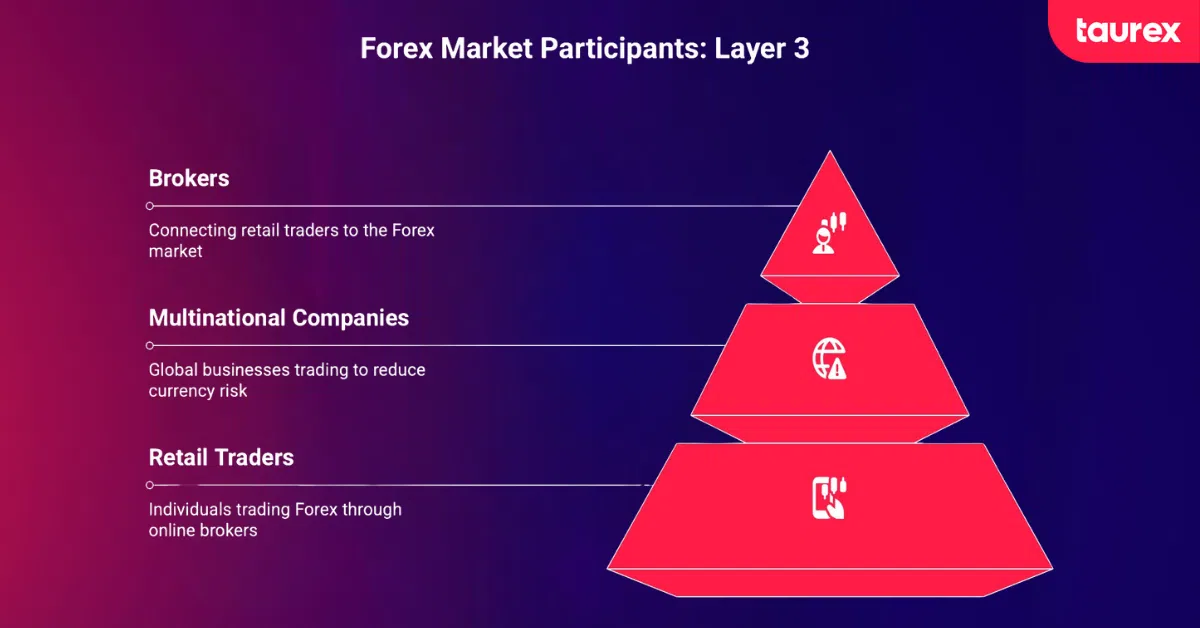

What Commercial and Retail Participants are there in the Forex Market?

Not everyone in the Forex market is trying to make quick profits. Many participants trade currencies because their business or financial situation requires it. This includes large global companies and individual retail traders.

Multinational Companies Trade to Reduce Risk

Large international companies operate in many countries. They earn money in different currencies but often report profits in one main currency.

For example, a US company may sell products in Europe and receive euros. If the euro weakens before the company converts it into dollars, the company earns less than expected. This is called currency risk.

To protect themselves, companies hedge. This means they use financial tools to lock in exchange rates or reduce uncertainty. They are not trying to profit from price moves. They are trying to protect their income.

Corporate activity can still affect the market. When many companies exchange currencies at the end of a quarter or during large mergers, it can create noticeable price movements.

Retail Traders Are a Small but Growing Group

Retail traders are individuals who trade Forex through online brokers. They represent a small share of total market volume compared to banks and large institutions, but their numbers have grown over the years.

People are attracted to Forex for different reasons. Some want to learn a new skill. Others like that they can start with a relatively small amount of money. Many are drawn to the flexibility of trading from anywhere.

However, trading is not easy. Many retail traders struggle to make consistent profits. This is why education, risk management, and discipline are so important.

Retail traders cannot access the interbank market directly. They trade through brokers, who connect them to larger pools of liquidity. This is why choosing the right broker matters. With Taurex, traders gain access to institutional-grade liquidity, advanced platforms, and transparent trading conditions.

Brokers Connect Retail Traders to the Market

Brokers act as the link between individual traders and the wider Forex market. They provide Forex trading platforms, access to liquidity, and tools such as leverage.

There are two common broker models. Some brokers act as market makers and set their own prices. Others pass client orders directly to external liquidity providers. Both models can be legitimate when properly regulated.

For any retail trader, choosing a regulated broker is essential. Regulation helps ensure that client funds are protected and that trading conditions are transparent.

Putting It All Together

The Forex market is made up of different groups, and each one plays a role. Banks provide liquidity. Central banks influence interest rates and overall direction. Large institutions move significant capital. Companies hedge risk. Retail traders participate through brokers.

All of these participants are connected. When a central bank changes policy, it can trigger reactions from funds and banks, which then affect the prices you see on your platform.

Understanding who is in the market helps you trade with better context. You may not control large capital, but you can control your strategy, discipline, and risk management.

If you are ready to trade in a market shaped by global institutions, choose a regulated broker that gives you reliable pricing, strong technology, and transparent conditions. Open a demo account with Taurex today.

Frequently Asked Questions

Who are the biggest players in the Forex market?

Large commercial and investment banks are the biggest players. They handle most of the trading and provide liquidity to the market. A few global banks control a large share of total volume.

Central banks are also major participants because they set interest rates and sometimes buy or sell their own currency. Hedge funds, investment firms, and high-speed trading companies are active as well. Retail traders are the smallest group by trading volume.

What percentage of Forex trading is retail?

Retail traders make up about 5.5% of total Forex trading volume. Most of the market is controlled by banks and large institutions. Even though retail traders are a small part of the volume, they benefit from the strong liquidity created by bigger players.

How do central banks affect the Forex market?

Central banks influence the Forex market in several important ways. First, they adjust interest rates. When rates rise, a currency often becomes stronger. When rates fall, it may weaken. Second, central banks can directly enter the market and buy or sell their currency. Finally, their public statements about future plans can move prices, since traders react to expectations even before policies change.

What is high-frequency trading in Forex?

High-frequency trading uses advanced computer programs to place a large number of trades in a very short time. These systems aim to profit from very small price differences. They operate at extremely high speeds and are mostly used by large firms. Because retail traders cannot compete on speed, it is usually more effective to focus on longer time frames and strong risk management.

Why do multinational corporations trade Forex?

Multinational companies trade Forex to manage currency risk. When a company earns money in one currency but reports profits in another, exchange rate changes can affect its results. To reduce this risk, companies use tools such as forward contracts and options. Their goal is to protect profits, not to speculate on short-term price moves.

How many retail Forex traders are there worldwide?

There are an estimated 9.6 to 15 million retail Forex traders worldwide. This number continues to grow as trading platforms become more accessible and more people gain interest in financial markets.

What is the difference between market makers and ECN brokers?

Market makers set their own buy and sell prices and may take the opposite side of your trade. They usually earn money from the spread. ECN brokers, on the other hand, send your Forex orders directly to external liquidity providers and typically charge a commission instead of widening the spread. Both models can work well if the broker is properly regulated. The right choice depends on your trading style and personal preference.