In U.S. stock trading, small accounts face strict limits under the Pattern Day Trader rule. If you make too many trades in a short period, your account can get locked.

Forex trading works differently. By this, we mean that there are no day-trade restrictions, no limits on the number of trades, and the market is open 24 hours a day, five days a week. This flexibility comes from the decentralised global nature of Forex trading, where trades happen across multiple time zones and platforms rather than through a single exchange.

For traders, this means setups don’t disappear just because of arbitrary rules, and you can react to market opportunities whenever they appear during the week. Knowing how these rules differ from stocks helps you understand the Forex market’s pace and structure.

What is The Pattern Day Trading Rule? (And Why Forex Traders Can Ignore It)

| Characteristic | Pattern Day Trading (PDT) | Forex Trading |

| Regulatory Body | FINRA and SEC | CFTC and NFA |

| Account Type | Margin account | Any account |

| Day Trade Limit | 4+ trades in 5 days | No limit |

| Minimum Balance | $25,000 | No minimum |

| Restrictions | Limited trades if the balance drops | No restrictions |

| Example | $10k account, 3 trades allowed | $5k account, 500 trades allowed |

To understand why Forex trading is more flexible, it helps to know what the Pattern Day Trading (PDT) rule is.

Introduced in 2001 by FINRA and the SEC, the Pattern Day Trading rule applies to traders using a margin account who make frequent trades. If you execute four or more day trades within five business days and those trades represent a significant part of your total activity, you are considered a pattern day trader. Once you are flagged as a pattern day trader, you need to keep at least $25,000 in your account. If your balance drops below that, you are limited to just three day trades in any five-day period.

For example, if you have a $10,000 stock account and see four strong trading opportunities on Monday, the PDT rules allow you to take only three. The fourth setup must be skipped or held overnight, which can be a reason for extra risk.

Forex works differently. In the U.S., spot Forex is regulated by the CFTC and NFA, not FINRA. There is no minimum account balance, no limit on the number of trades, and no PDT restrictions. A $5,000 Forex account can make 5 trades, 50 trades, or even 500 trades in a single session. Traders can engage with the market throughout the week, without being restricted by PDT-style limitations.

At Taurex, traders of any account size benefit from this flexibility while trading under FCA and FSA regulation.

Around-the-Clock Access: How the 24/5 Market Structure Works

Unlike stock markets with fixed hours, Forex trading runs continuously during the week, from Sunday evening to Friday, because financial centres across the world take turns leading the market.

Trading sessions and characteristics:

| Session | Hours (UTC) | Key Features |

| Sydney | 10 PM – 7 AM | The market opens the week, generally quieter with smaller price moves |

| Tokyo | 12 AM – 9 AM | Moderate volume, steady price action often sets trends for the day |

| London | 8 AM – 5 PM | Highest volume in Europe, big moves around economic announcements |

| New York | 1 PM – 10 PM | Volatile, especially during the London overlap, the busiest trading window |

Why it matters:

- Traders can act at any time that fits their schedule.

- Traders can react instantly to news, economic reports, or central bank updates.

- Traders can respond to global events as soon as Sydney opens on Sunday.

At Taurex, clients in Asia can trade during the London-New York overlap at convenient times, supported by 24/7 multilingual assistance and fast withdrawal processing that often completes in under 15 minutes.

How Often Can You Trade Forex Without Limits?

In stock trading, the Pattern Day Trading (PDT) rule sets limits for smaller accounts. It restricts traders to three-day trades within five days, which can prevent frequent trading rather than support a strategy. Forex operates under a different framework, without any regulatory cap on how often trades can be executed.

Traders can place trades freely throughout the trading week. This applies whether a trader focuses on short-term moves, manages multiple positions across currency pairs, or responds to market developments as they occur. No regulation sets a maximum number of trades per day or week.

How this flexibility works in practice:

- Scalping and frequent trades: Traders can execute dozens or even hundreds of trades in a session without being restricted by a rule like PDT.

- Managing multiple positions: Traders can enter and exit several positions across different pairs, or adjust positions in steps, without worrying about hitting a trade limit.

- Reacting to news and data: Traders can act on economic announcements, central bank updates, or market developments as soon as they occur.

- Scaling in and out: Traders can increase or reduce positions in stages without depleting a limited number of allowable trades.

Some brokers may have technical limits on the number of positions a trader can hold or the size of individual orders. These limits are operational and platform-based, not regulatory. Many brokers support virtually unlimited positions for active trading.

At Taurex, traders have access to over 1,500 instruments and benefit from execution speeds as fast as 0.09 milliseconds. Taurex supports a broad range of activity levels, with execution infrastructure built for speed, reliability, and precision—suited for both occasional and frequent traders..

Key reminder: Traders still need careful management to operate effectively. The structure of Forex trading provides flexibility, but it also requires attention and consistency to use that flexibility responsibly.

How Forex is Actually Regulated

A common myth in trading communities is that Forex is unregulated, a lawless market where anything goes. In reality, Forex operates under strong regulatory frameworks designed to protect traders and ensure brokers follow strict rules.

The difference is that these regulations focus on broker conduct and client safety rather than restricting how often trades can occur.

Regulation by region:

- United States: The Commodity Futures Trading Commission (CFTC) provides oversight, while the National Futures Association (NFA) handles broker registration and compliance. Brokers must meet minimum capital requirements, maintain detailed records for five to seven years, and follow anti-money laundering (AML) and know-your-customer (KYC) procedures. Retail traders can access leverage limits set by regulators, but these focus on risk control rather than trade frequency.

- United Kingdom: The Financial Conduct Authority (FCA) regulates brokers with some of the strictest standards in the world. Retail leverage on major pairs is capped at 30:1, client funds must be kept separate from company assets, and brokers undergo regular audits to verify compliance.

- Other jurisdictions: Cyprus (CySEC), Australia (ASIC), and Seychelles (FSA) all maintain clear rules for capital adequacy, fund segregation, and transparent pricing.

Taurex operates under multiple regulatory jurisdictions to prioritise client protection. It holds FCA authorisation in the UK (Firm Reference 816055) and FSA licensing in Seychelles (License SD092). Client funds are kept in segregated accounts at top-tier banks, with protection coverage up to $1 million.

What proper regulation provides:

- Segregated funds: Client money is separated from broker operating capital, protecting it if the broker faces financial issues.

- Regular audits: Independent checks confirm brokers maintain capital and follow stated practices.

- Transparent pricing: Traders can clearly see spreads and fees without hidden charges.

- Dispute resolution: Mechanisms exist to address any issues that may arise.

The key takeaway is that regulated brokers prioritise trader protection. Forex oversight does not impose limits on how often trades occur. Instead, it ensures brokers act responsibly, keep client funds safe, and maintain transparent operations.

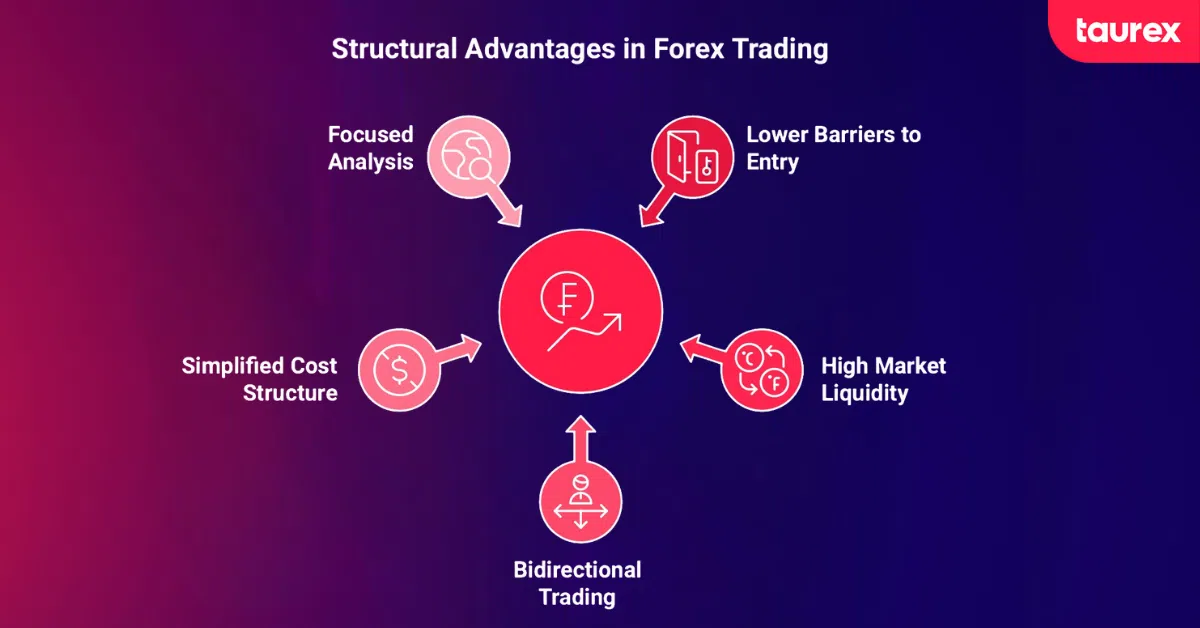

Structural Advantages: Why Forex Rules Favour Active Traders

Forex offers structural features that create a very different environment for traders who engage frequently. Understanding these advantages helps explain why Forex operates differently from stock markets.

-

Lower barriers to participation

Stock day trading often requires at least $25,000 to avoid restrictions. Forex does not impose a minimum account size. Traders can start with smaller amounts, such as $500 or $200, and still participate actively, adjusting position sizes as needed.

-

High market liquidity

Forex sees $6.6 to $7 trillion in daily trading volume, far exceeding the combined daily volume of global stock markets. This high liquidity results in tighter spreads, smoother order execution, and less price slippage. Traders managing multiple positions each day can benefit from these efficiencies.

-

Bidirectional trading is built-in

Currency trading is inherently two-way. When a trader buys one currency, they simultaneously sell another. Reversing a position direction is straightforward and does not require borrowing, special permissions, or extra fees, unlike shorting stocks.

-

Simplified cost structure

Many Forex brokers charge only spreads, with no additional commissions, exchange fees, or clearing costs. Frequent trading in this environment can be more efficient than navigating the multiple fees typical in stock trading.

-

Focused analysis requirements

Stock traders must research thousands of individual companies, considering earnings, management changes, and sector trends. Forex traders can focus on a smaller set of major currency pairs, primarily analysing macroeconomic factors such as interest rates, GDP growth, inflation, and central bank decisions. This concentrated focus allows for deeper insight into the currency market.

Taurex offers multi-asset access, including currency pairs, commodities, indices, and metals, allowing traders to diversify within a single platform. The platform also provides advanced risk management tools, real-time market news, and customizable alerts to help traders monitor multiple positions efficiently.

Comparison Table: Forex vs Stock Trading Rules

| Feature | Forex Market | Stock Market |

| PDT Rule Applies | No | Yes (accounts under $25k) |

| Minimum Capital for Day Trading | No regulatory minimum | $25,000 required |

| Daily Trade Limit | Unlimited | 3 per 5 days (under $25k) |

| Trading Hours | 24 hours/day, 5 days/week | ~6.5 hours/day |

| Leverage (US Retail) | Up to 50:1 | 2:1 to 5:1 |

| Short Selling | Unrestricted, inherent to pairs | Uptick rules, borrowing required |

| Daily Volume | $6.6-7 trillion | ~$17 billion combined |

| Primary US Regulator | CFTC/NFA | FINRA/SEC |

| Transaction Costs | Spread-based, typically no commissions | Spread + commission + fees |

| Asset Universe | ~7-8 major pairs (80+ total) | Thousands of stocks |

The structural differences are clear. Forex trading rules are designed for market access and liquidity. Stock trading rules emerged from protective regulations that, while well-intentioned, inadvertently restrict retail participation.

How to Get Started: Practical Steps to Begin

Understanding trading rules is one thing. Applying that knowledge is another. Here’s a clear path to move from learning to active participation:

Make sure the broker is licensed by official authorities. Check that client funds are kept separate from company money and that trading rules are clear. This helps protect your account and ensures the broker follows proper standards.

-

Complete account setup

You’ll usually need to provide an ID and proof of address. This verification usually takes one or two days and is part of standard regulations. It keeps your account safe and makes sure the broker operates correctly.

-

Practice with a demo account

A demo account lets you trade with fake money in real market conditions. Use it to get familiar with the platform, learn how Forex orders work, and test your ideas. Stay in demo mode until you feel confident about how the process works. If you need more information on how to open a Forex account, check out our guide.

-

Start small with real capital

When you open a live account, start with a small deposit that you are comfortable with. Trade small positions at first, focusing on following your process correctly rather than worrying about gains or losses. Increase your size gradually as you get used to real trading.

-

Document your trading rules

Keep a simple document with your trading plan. Include which hours you will trade, which currencies you will watch, and the steps to follow when entering or exiting positions. Use it as a guide so you stay consistent.

-

Use educational resources

Use tutorials, videos, guides, and community discussions to read charts, understand patterns, and market updates. Every new thing you learn builds your understanding and confidence.

-

Track performance and adjust

Record every session. Look back weekly to see what worked and what didn’t. Make small adjustments based on your observations, not guesses. Focus on following your plan carefully rather than judging yourself by individual trades.

Taking Charge of Your Trading

Forex trading works differently from stocks. There are no limits on how often you can trade, and markets stay open almost all week. Regulations focus on keeping brokers honest and protecting your funds, not restricting your activity.

These features create a flexible environment for those looking to develop their trading approach, learn market mechanics, and engage with strategies at their own pace. Starting small, practising, and staying organised helps you navigate the market safely while building experience.

Ready to trade on your terms? Open a Taurex demo account and access the tools, conditions, and support designed for traders who want to take charge. Start with a demo to test your strategy, or open a live account to begin building your trading discipline in a market that operates around your schedule.

Disclaimer: Trading involves significant risk, including potential loss of principal. Past performance does not indicate future results. The value of investments may fluctuate, and you may receive back less than your original investment. CFD trading involves leverage, which can magnify both gains and losses. Consider whether trading is appropriate for your financial situation and seek independent advice if necessary.

FAQ

1. Do Forex brokers limit how often I can trade?

No. Unlike stock accounts under PDT rules, regulated Forex brokers do not restrict the number of trades you can place in a day or week. You can open and close positions freely during market hours.

2. How does the 24/5 market affect trading opportunities?

The Forex market runs continuously from Sunday evening to Friday evening. Traders can react to news or price changes at almost any time during the week, across different global sessions.

3. Are there any account size requirements to trade Forex?

No minimum balance is required for active trading. You can start with smaller amounts and trade with the same freedom as someone with a larger account, though position sizes may vary.

4. Do regulatory rules affect trade frequency in Forex?

Regulations focus on broker behaviour, fund safety, and fair execution, not on limiting how often trades occur. Regulatory oversight ensures that brokers act responsibly while letting traders execute freely.

5. Can I trade both directions easily?

Yes. Currency pairs are inherently two-way. You can “buy” or “sell” a pair without borrowing or special permission, which is different from short-selling stocks.

6. Are there technical limits on trading?

Some brokers may set operational limits, such as maximum open positions or order sizes. These limits are platform-specific and not imposed by regulators.

7. How does liquidity affect active trading?

Forex markets are extremely liquid, meaning trades can usually be executed quickly without moving prices too much. This is important for traders who open and close positions frequently.

8. Can I practice trading before using real money?

Yes. Demo accounts allow you to trade in live market conditions without financial risk. This helps you understand the platform, test order types, and practice executing strategies.

9. What happens outside market hours, like weekends?

The Forex market closes from Friday evening to Sunday evening. During this time, no trades can be placed, but markets reopen continuously afterwards without PDT-like restrictions.

10. Are there fees or costs that affect active trading?

Most Forex brokers operate on spreads rather than commissions. While spreads exist, they do not restrict the number of trades you can execute, allowing active traders to operate freely.