Opening your first forex trading account may seem overwhelming, but it is a simple process once you understand the steps involved. It is similar to setting up a new bank account, but with the added benefit of gaining access to the world’s largest financial market, where more than $7.5 trillion is exchanged daily.

Whether you’re entirely new to currency trading or looking to switch brokers, this guide shows you exactly how to open a forex trading account: documents, verification, funding, platforms, and your first trade.

We will use Taurex’s own processes as a real-world example, giving you a clear understanding of what to expect from start to finish.

What is Forex Trading?

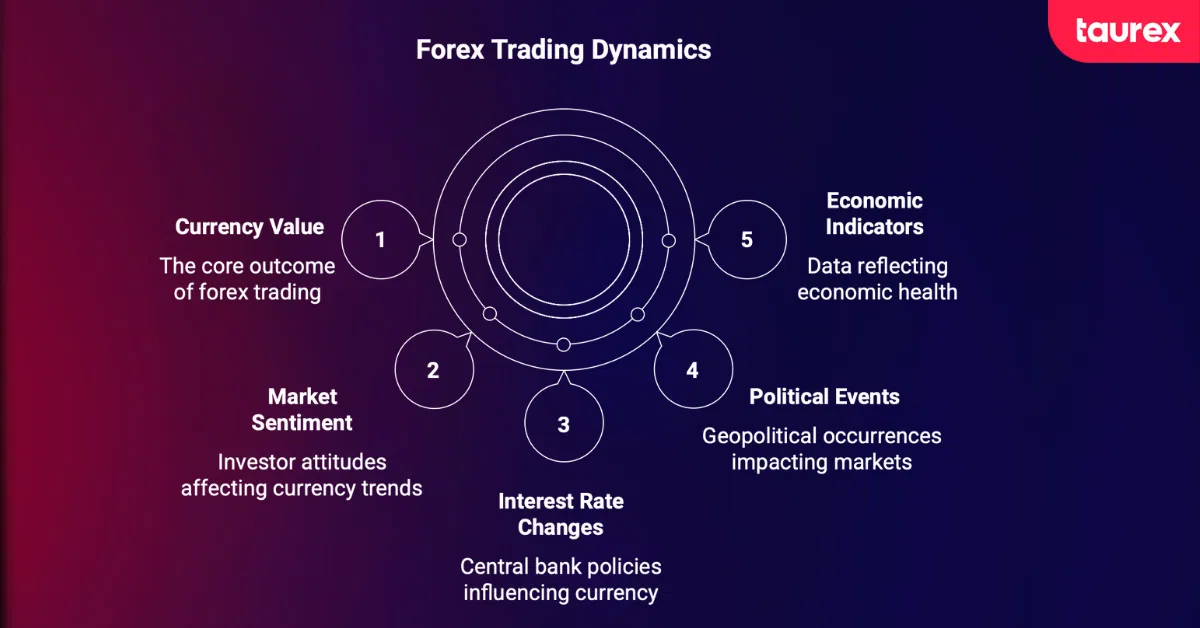

Forex trading involves trading currency pairs, where you speculate on whether the value of one currency will rise or fall against another. For example, when you see EUR/USD at 1.0850, it means one Euro is worth 1.0850 US dollars. If you believe the Euro will strengthen against the dollar, you would buy the pair. Conversely, if you think the Euro will weaken, you would sell.

Exchange rates fluctuate based on economic data, political events, interest rate changes, and mood. For example, if the European Central Bank raises interest rates but the Federal Reserve does not, the Euro could rise against the dollar as investors seek higher returns.

A regulated broker like Taurex provides the secure gateway to access this market, offering you the technology and infrastructure needed to execute trades safely and efficiently.

Why Open a Forex Trading Account?

The foreign exchange market operates 24 hours a day, five days a week, making it accessible for people with different schedules around the globe. Unlike stock markets, which close overnight, forex trading occurs continuously as markets open and close across different time zones, from Sydney to New York.

What makes forex particularly appealing is its accessibility. A significant amount of capital is not required to begin trading. Many brokers, including Taurex, allow you to start with relatively modest amounts while still giving you access to the same professional-grade tools used by institutional traders.

It is important to clarify from the outset that forex trading carries significant risks, including the possibility of losing your entire investment. The market can move quickly and unpredictably, creating both opportunities and risks.

Why Choosing the Right Forex Broker is Important

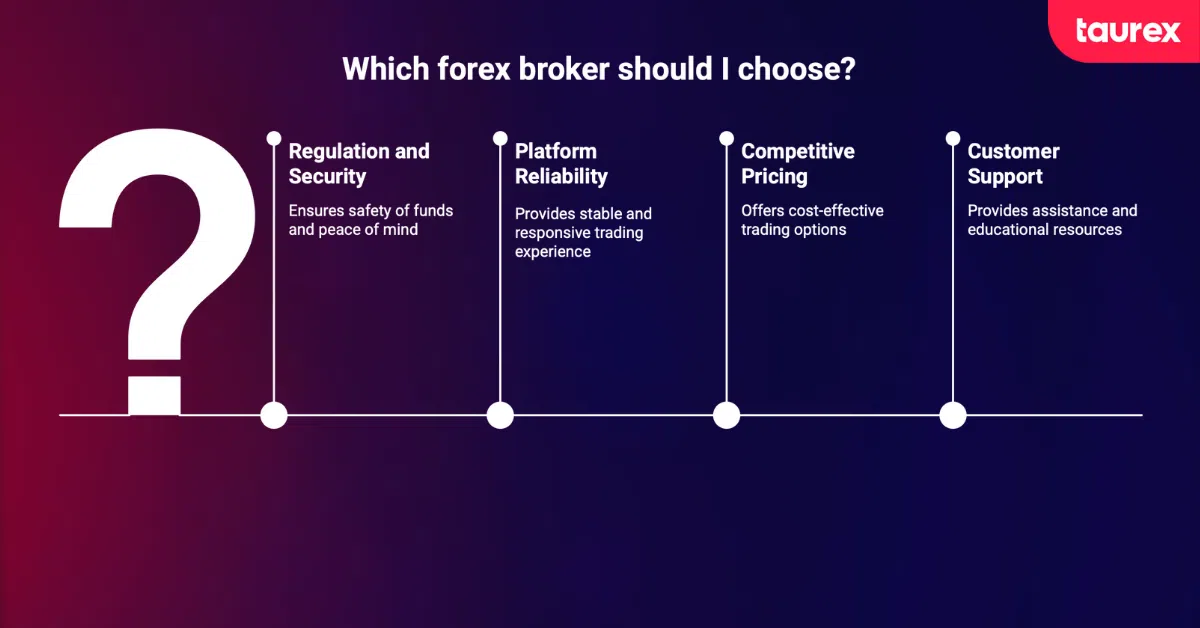

Selecting the right broker is one of the most critical steps when starting out as a forex trader. Your broker acts as your key partner in accessing the market, significantly influencing your trading experience. Their reliability, fees, and the range of services they offer will all play a crucial role in shaping your journey.

Regulation and Security

At Taurex, we prioritise regulation and client protection to ensure a secure and trustworthy trading environment. We operate under recognised financial authorities (including the Financial Services Authority in Seychelles), and we ensure your funds are kept separate from ours by maintaining them in segregated accounts. We also implement additional security measures and insurance to protect your assets further. You can verify our licenses directly with the regulators for added peace of mind.

Platform Reliability and Technology

When trading forex, it’s essential that your platform remains stable and responsive at all times. That’s why we provide you with MetaTrader 4, MetaTrader 5, and our proprietary Taurex mobile app. These platforms provide industry-standard execution and tools, along with the flexibility to trade from home or on the go, without worrying about downtime.

Competitive Pricing

Trading costs primarily come in two forms: spreads (the difference between buy and sell prices) and commissions. Taurex offers zero-commission accounts with competitive spreads, along with various account types, including Standard Zero, Pro Zero, and Raw accounts, to cater to different trading styles and budgets.

Customer Support and Education

You are never alone while trading the world’s biggest market. That’s why we offer 24/5 multilingual support to address your questions and resolve any issues. Additionally, we offer access to a comprehensive education center with webinars, tutorials, and market commentary to help you enhance your knowledge and skills.

In conclusion, traders looking for a regulated broker with access to multiple platforms and multilingual support may consider Taurex as one option.

How to Open a Forex Trading Account at Taurex: Step-by-Step

Step 1: Select a Trustworthy Forex Broker

The initial step is to select a regulated broker you can trust. Seek regulation, reasonable prices, robust platforms, and attentive support. At Taurex, we achieve this by providing you with transparent fees, international platforms such as MT4 and MT5, and a regulated environment that ensures the safety of your funds.

Step 2: Prepare the Necessary Documents

To open your account, you’ll need a few documents for verification:

- Proof of identity: A valid government ID such as a passport or driver’s license.

- Proof of address: A recent utility bill, bank statement, or government letter (within the last 3 months).

- Financial information: In some cases, documentation of income or origin of funds. You can speed up approval by uploading clear, high-quality scans or photos that match your application details.

Step 3: Create a Forex Account

Next, complete the application form on our website. You’ll need to enter personal details, your trading background, and financial information. Double-check that everything matches your documents exactly.

Then, choose your account type: we offer Standard Zero, Pro Zero, and Raw accounts, depending on your experience and style. Next, select your preferred platform: MT4, MT5, or our mobile app.

Step 4: Fund Your Forex Account

Once your application is in, you can fund your account using one of our supported methods: credit/debit card, bank transfer, or e-wallet. Processing times can vary; however, card transactions are typically instant, while bank transfers may take 1-3 business days.

Minimum deposits vary by account type, starting from as low as $100. Many traders begin with the minimum deposit to test their strategies. In some regions, you may deposit funds before completing full verification, but withdrawals will always require KYC to be completed.

Step 5: Verify Your Identity and Complete the Account Setup

Once you submit your documents, our compliance team reviews them, typically within one to two business days. The most common issues are blurry uploads or expired IDs, so please check everything carefully before submitting. Once approved, you’ll receive confirmation and be able to access your account fully. Then download MT4, MT5, or our app and start exploring the platform.

What Are The Different Types of Forex Accounts to Choose From?

Demo Accounts

Every new trader should start with a demo account, regardless of their previous experience in other financial markets. Demo accounts let you practice with virtual money in real market conditions, so you can learn how the platform works and test your strategies without financial risk.

Taurex provides demo accounts with the same features as live accounts, including access to real-time market data, all available currency pairs, and the full range of trading tools. Traders can practice placing trades, setting stop-losses and take-profits, and getting familiar with market movements.

Spend at least a few weeks on a demo account before moving to live trading. This helps you understand market volatility and develop discipline around your trading plan.

Mini and Micro Accounts

Mini and micro accounts are ideal for beginners who want to trade with real money but prefer smaller position sizes. These accounts enable you to trade smaller lot sizes, reducing the amount of money at risk per trade.

A standard lot in forex is 100,000 units of the base currency, but mini accounts let you trade 10,000 units, and micro accounts often allow 1,000 units or even smaller. This means you can participate in the market with much less capital while you’re learning.

These account types often have lower minimum deposit requirements and provide an excellent bridge between demo trading and full-scale live trading.

Standard Accounts

Our Standard Zero accounts are intended for traders who prefer spread-only pricing with no commission. With narrow spreads and a comprehensive feature set, this account is a good fit if you plan to trade frequently and prefer transparent costs.

Managed Accounts

Managed accounts enable professional traders or money managers to trade on your behalf. You supply the capital, and they make trading decisions based on their expertise and strategy.

This option appeals to individuals who want exposure to the forex markets but lack the time or expertise to trade on their own. However, managed accounts come with additional fees, and you give up control over individual trading decisions.

Make sure any money manager you consider has a verifiable track record and proper credentials. Even with managed accounts, it is essential to understand the strategy being used with your money.

Islamic Accounts

Islamic accounts, also known as swap-free accounts, cater to traders who adhere to Islamic finance principles that prohibit the earning or payment of interest. In regular forex accounts, positions held overnight incur swap charges or credits based on interest rate differentials between currencies.

Taurex offers Islamic accounts that eliminate these overnight charges, making them compliant with Sharia law. These accounts function identically to regular accounts except for the absence of swap charges.

To open an Islamic account, you typically need to request it specifically and may need to confirm your religious requirements.

Opening a Forex Trading Account: What to Expect

Account Verification Process

Verification typically takes one to two business days, but may take up to a week when things are busy or additional paperwork is required. The process involves verifying your identity, confirming your address, and conducting compliance screenings.

Delays typically occur when document photos are blurry, IDs are expired, or the information you entered doesn’t match the documents. To minimise delays, carefully review all details and ensure the images are clear.

Some brokers, like Taurex, allow you to deposit money before verification is complete, but you cannot withdraw funds until it’s fully completed.

Funding Your Account

Select the funding method that best suits your needs: cards for speed, bank transfers for larger amounts, or e-wallets for flexibility. We don’t charge deposit fees, but please note that your bank may impose charges.

Keep records of your deposits and withdrawals for personal tracking and tax purposes. Many clients start with a small deposit while they learn, then add more once they feel confident.

Starting with a Demo or Micro Account

Even if you’re eager to buy shares, a demo account can help you observe market movements without the pressure. Test different pairs, experiment with various orders, and develop a risk management routine.

Once you’re comfortable, consider starting with a micro account before moving to a full account. This allows you to experience real money risk with smaller stakes.

How Much to Deposit?

Only deposit money you can afford to lose. Your initial balance should cover the minimum for your chosen account type and still allow you to manage risk properly: for example, risking just 1–2% per trade. Some traders start small and grow steadily, focusing on consistency rather than large upfront deposits.

Risk Management

Before you place a trade, set clear rules: how much you’ll risk per trade, your maximum daily loss, and when to step back.

Use a stop-loss order every time and set take-profit levels to secure profits. Keep a trading journal to record each trade and review your decisions.

Over time, this habit helps you identify patterns and develop better discipline.

Advanced Trading Platforms and Software

As mentioned earlier, with us, you gain access to MetaTrader 4, MetaTrader 5, and third-party tools like Trading Central. These platforms provide charts, indicators, and automation options.

Start with the basics: placing trades, setting stop orders, and using fundamental indicators. As your skills develop, you can gradually explore more advanced features.

Common Mistakes to Avoid When Opening a Forex Account

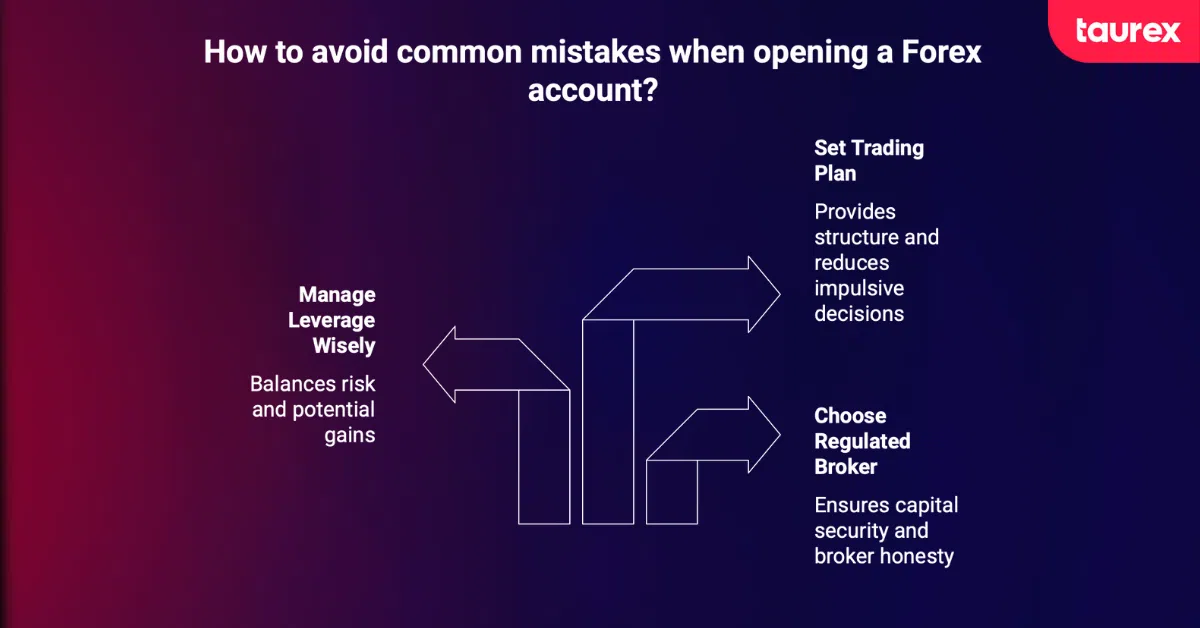

Choosing an Unregulated Broker

Unregulated brokers are a considerable risk to your capital. With no protection of a governing authority, you have no guarantee that your capital is secure or that the broker is honest. You may find it difficult to withdraw money, encounter rigged prices, or lose your entire deposit if the firm collapses.

Always verify a broker’s regulatory status on legitimate regulatory sites. Good brokers, such as Taurex, have openly displayed their license numbers and regulatory information on the site, making it easy to check their status.

Overleveraging

Leverage allows you to take larger positions with smaller capital, but it multiplies gains and losses equally. While 100:1 leverage may seem enticing, it can quickly drain your account if trades don’t go in your favor.

Start with smaller leverage ratios until you understand how they affect your risk. Most experienced traders use leverage ratios of 10:1 or 20:1, which are significantly lower than those offered by brokers, because they are concerned about conserving capital rather than maximising profit potential.

Remember, leverage is a tool, not a requirement. You can always trade a smaller size using less leverage as your ability and confidence build.

Not Setting a Trading Plan

Any unmanaged trade without a plan is essentially gambling. Your plan must be grounded in your risk tolerance, preferred currency pairs, entry points, exit points, and rules for position size.

Write down your plan and adhere to it. Spontaneous choices have a propensity for bad things to happen, but systematic approaches allow you to make sane choices even when markets start getting volatile.

Review and modify your plan based on performance, but avoid making spontaneous changes in real-time trades.

How to Start Trading After Your Account Has Been Opened

Placing Your First Forex Trade

Once your account is funded and verified, you’re ready to place your first trade.

- Choose a major pair such as EUR/USD.

- Decide whether to buy (go long) or sell (go short) based on your analysis.

- Select your position size in line with your risk plan.

- Set your stop-loss and take-profit levels.

- Place the order and monitor execution.

Start small; you aim to learn the process, not to chase large profits immediately.

Using Risk Management Tools

Use a stop-loss order to limit potential losses if the market moves against you, and a take-profit order to lock in profits once your target is reached.

Test these functions in a demo account first to understand how they behave in live trading conditions.

Managing Your Trades and Monitoring Progress

Maintain a trading journal that records each trade, including the reasons for entering, your emotional state during the trade, and the lessons learned from the outcome.. This helps you identify patterns and makes you a more effective decision-maker.

Check your performance periodically, but avoid making radical strategy changes based solely on short-term results. Instead, focus on following your trading plan repeatedly, rather than seeking quick gains or returning rapidly from losses.

Apply position sizing that can handle multiple trades, even when some of them turn against you. This will enable you to weather inevitable losing streaks while giving your winning trades sufficient time to develop.

Conclusion: Your Forex Trading Journey Begins Here

Opening a forex trading account is the first step on a potentially rewarding yet challenging journey in the world’s largest financial market. With the correct information, you can select a reputable broker, complete the necessary paperwork, and choose an account type that aligns with your goals.

Success in forex requires patience, discipline, and continuous learning, as the market is influenced by economic data, political events, and shifting sentiment. Starting with a demo account is an innovative approach, as it allows you to practice without risking real money. Afterward, you can try a small live position with proper risk management, and gradually increase your stakes as your skills and confidence grow.

A regulated broker like Taurex offers a secure platform, along with educational resources and 24/5 multilingual support to help newcomers navigate the market.

In conclusion, if you’re looking for a trusted, regulated partner for your trading journey, consider opening a forex account with Taurex.

Take your time and decide.

Risk Warning: Trading leveraged products involves significant risk and may not be suitable for all investors. Information provided is for educational purposes and does not constitute financial advice.